Americans are wealthier than ever*

*Except for the poor and much of the middle class

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

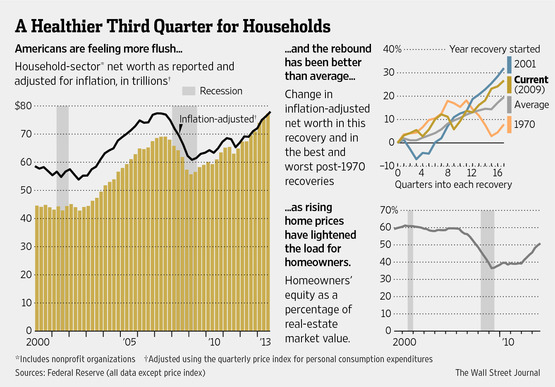

It took five years, but American households have collectively regained all the wealth they lost when the Great Recession hit, sending stock markets and housing prices sharply lower and putting hundreds of thousands of people out of work. In the third quarter of 2013, from July through September, U.S. household net income rose by $1.9 trillion, or 2.6 percent, to a nominal record of $77.3 trillion, according to a new report from the Federal Reserve.

Adjusted for inflation, that's still about 1 percent below the peak, hit in 2007. But the two biggest drivers of the latest jump in wealth were stock prices, adding $917 billion, and rising home values, adding another $428 billion. Since September, stocks have continued their rise — the S&P 500 is up nearly 8 percent — and housing prices have generally gone up, too. So total U.S. household wealth is at an all-time high, no matter how you look at it. (Net worth is the value of homes, stocks, bank accounts, and other assets minus mortgages, credit cards, and other debts.)

Here's what the curve looks like adjusted for inflation, from The Wall Street Journal:

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

This is promising news for the U.S. economy, building on strong recent employment and GDP figures. Typically, the more wealth Americans have — or even feel that they have — the more they spend, which leads to stronger growth. For this virtuous cycle to kick into gear, people have to be willing to spend and probably even borrow.

Unfortunately, the rising tide isn't lifting all boats. The wealthiest Americans have done far better at the end of the Great Recession than their lower- and middle-class compatriots. "The recovery of wealth has not been uniform," Credit Suisse's Dana Saporta tells Bloomberg News. "It still looks like wealth is concentrated in financial assets, which in turn are concentrated in a relatively small portion of all households."

The top 10 percent of U.S. household own about 80 percent of the stocks, and lower-income Americans especially are still recovering from the big hit they took in the housing crash. The rise in housing prices will help the roughly two-thirds of households that own their homes, but homeownership is still lower, post-recession, and renters won't directly benefit from the housing recovery.

Still, green shoots are green shoots. "We seem to be gaining momentum in a more significant way, and more areas of the economy are improving," Mark Vitner, senior economist at Wells Fargo Securities, tells The Wall Street Journal. So maybe, finally, after five pretty bad years, Americans "have a real recovery ahead of us."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

Local elections 2026: where are they and who is expected to win?

Local elections 2026: where are they and who is expected to win?The Explainer Labour is braced for heavy losses and U-turn on postponing some council elections hasn’t helped the party’s prospects

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict