Is BlackBerry finally dead?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Is BlackBerry finally dead? asked Vauhini Vara at the New Yorker.

The Canadian smartphone-maker said this week that it had agreed to go private and sell itself to the investment firm Fairfax Financial Holdings for $4.7 billion. Vauhini says "Certainly, the new owners could potentially milk BlackBerry's existing customers for revenue as long as they can" (the company still has 72 million users). But the device's heyday is long gone, she notes, supplanted by iPhones and Android devices. It's only a matter of time before the once ubiquitous BlackBerry "gets relegated to some quiet corner of the Computer History Museum." The announcement of the buyout deal made no mention of the device's future or any growth plans — just corporate jargon about delivering "immediate value to shareholders" and "solutions" to customers, none of which bodes well for "the world's first beloved smartphone."

But let's not feel too bad for BlackBerry, said Sam Gustin at Time. Just a few years ago it was "the premier mobile gadget on the market." Then the company lost the plot. Between 2009 and 2012, BlackBerry's stock price collapsed "by a vertigo-inducing 90 percent to under $7." Those numbers tell a cautionary tale about "what happens when a tech giant fails to innovate." BlackBerry got blown away by its rivals because it ignored consumers and focused instead on the corporate market. It jumped far too late into the app economy, and failed to realize "that smartphones would evolve beyond mere communication devices to become full-fledged mobile entertainment hubs." And don't get me started on its stubborn attachment to physical keyboards.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

This deal could at least be good news for shareholders — if it ever comes off, said Rolfe Winkler at the Wall Street Journal. Fairfax's bid is still a long way from fruition, and financing it will be tough. Even if BlackBerry used all its cash to buy out the company's other shareholders, Fairfax would still need to scrounge up almost $1.6 billion to seal the deal. That's no easy task. "Lenders might balk, given the collapse of BlackBerry's handset business and diminished earning prospects." But there's one upside to Fairfax's offer: The buyout proposal has halted the slide in BlackBerry's shares, giving "current shareholders a window to get out of the stock."

Clearly BlackBerry needs to turn things around, and "a new owner might be able to help," said Stephen J. Lubben at The New York Times. But even if this deal falters, BlackBerry won't face bankruptcy anytime soon. Under Canadian law a company must be insolvent before filing, and the phone-maker's balance sheet shows $13 billion in assets and only $3.7 billion in liabilities. "That sure doesn't look like insolvency." BlackBerry's real challenge will be to scale back its operations to match its shrinking customer base. Last week's announcement that the company will slash 4,500 jobs — about 40 percent of its workforce — suggests it's on the right track. BlackBerry should be able to avoid bankruptcy — even if it is "burning shareholder value like a fire on a drought-stricken hillside."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Sergio Hernandez is business editor of The Week's print edition. He has previously worked for The Daily, ProPublica, the Village Voice, and Gawker.

-

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in Iraq

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in IraqThe Week Recommends Charming debut from Hasan Hadi is filled with ‘vivid characters’

-

Kia EV4: a ‘terrifically comfy’ electric car

Kia EV4: a ‘terrifically comfy’ electric carThe Week Recommends The family-friendly vehicle has ‘plush seats’ and generous space

-

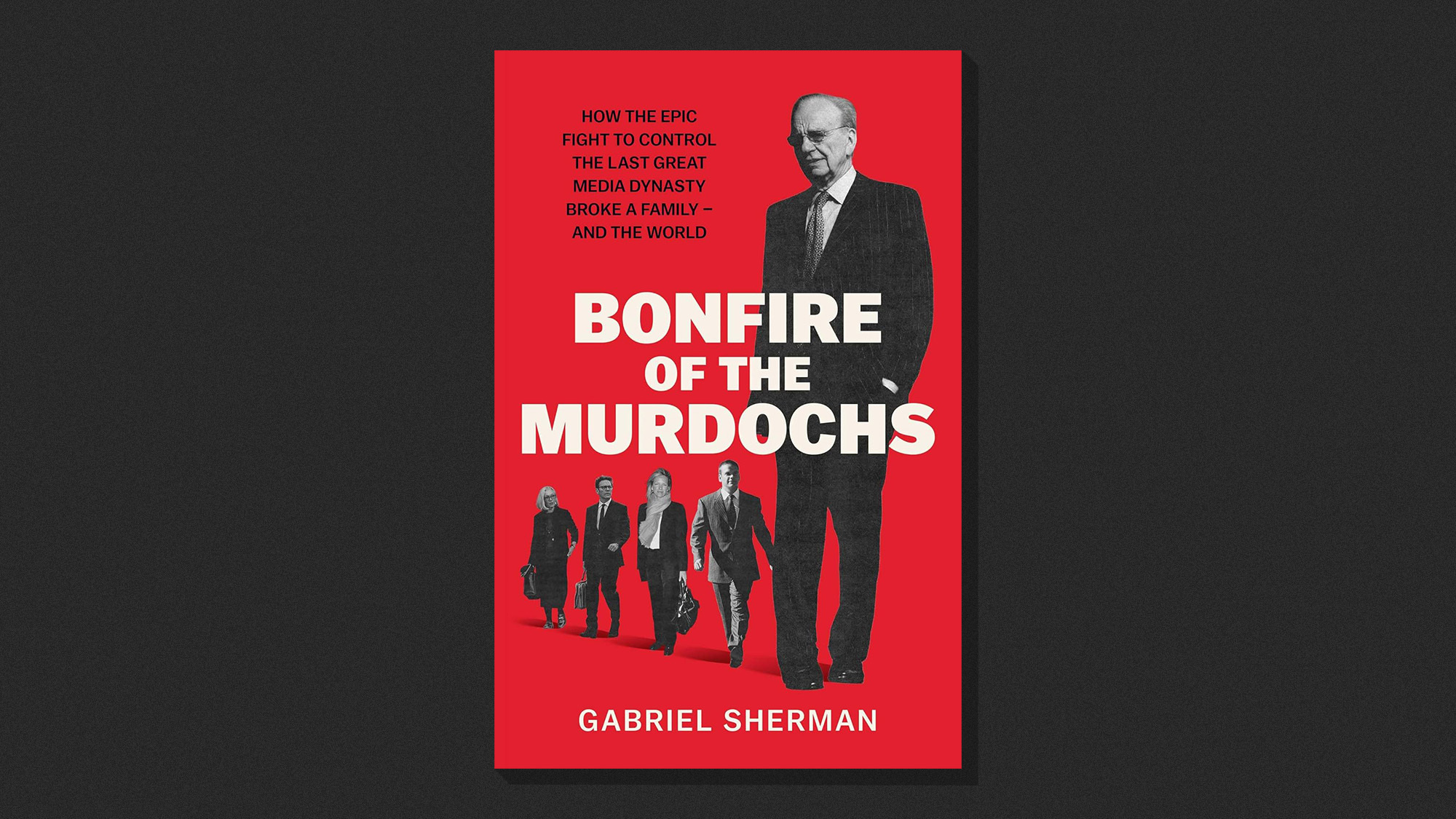

Bonfire of the Murdochs: an ‘utterly gripping’ book

Bonfire of the Murdochs: an ‘utterly gripping’ bookThe Week Recommends Gabriel Sherman examines Rupert Murdoch’s ‘war of succession’ over his media empire