5 commercials for subprime mortgage loans from before the financial crisis

Those were the good old days...

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

On September 15, it will have been 5 years since investment bank Lehman Brothers filed for bankruptcy — a kind of unofficial anniversary of the subprime mortgage crisis, when billions of dollars worth of bad home loans led to the collapse of the global financial system.

So it's a fitting week to look back at the years leading up to that date, a period of irrational exuberance that saw lenders across the U.S. inventing exotic new types of loans that extended credit to borrowers who couldn't afford it. Companies then sold those loans to financial institutions to be packaged into AAA-rated mortgage-backed assets and other derivatives.

These mortgages included no-money-down loans that featured exorbitant interest rates; negatively amortizing loans, in which the monthly payments were too small to cover the interest, so over time the balance grew instead of shrinking; and "liar loans," in which banks didn't require pay stubs, W-2 forms, or other records to back up a borrower's stated income. Many of these loans were hawked through slick — and sometimes not so slick — ad campaigns.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Here are a few such commercials from lenders both big and small:

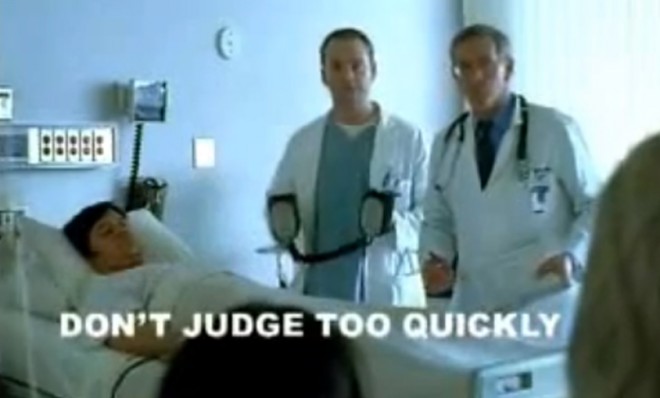

Ameriquest Mortgage

"Don't judge too quickly...We won't!" That was the slogan for Ameriquest, one of the country's biggest subprime lenders. Ameriquest is credited with coming up with the so-called liar loan.

The company, part of ACC Capital Holdings, stopped originating loans in 2007, and was shut down in 2008.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Countrywide Financial

Once one of the biggest mortgage lenders in the nation, Countrywide was sold to Bank of America in 2008 for about $4 billion, eventually resulting in massive losses for BofA. After the financial crisis, ex-employees accused Countrywide of predatory lending practices, including encouraging borrowers to lie about their income on applications.

(Via: Business Insider)

Lending Street

"Home of the zero-down home loan." Yikes.

One Percent Realty Loans

These guys offered "100 percent financing [meaning, no money down] even with a 575 credit score." For context: The average American credit score in 2008 was 692 according to Experian. And you were good to go even if you were "one day out of bankruptcy," or had "no credit history at all."

Low Kal Mortgage

We don't have much information about Low Kal First Discount Mortgage, which is what this commercial (?) is for. But, if you google Kal Wayman — the man whose little head that purportedly is — it takes you here.

Carmel Lobello is the business editor at TheWeek.com. Previously, she was an editor at DeathandTaxesMag.com.