How to avoid an economic bubble

Look no further than the flailing job market

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

President Barack Obama has stated his desire to prevent economic bubbles in the future, noting in his August 10 weekly radio address, "We have to turn the page on the bubble-and-bust mentality that created this mess."

He's right to be concerned about the historical danger of bubbles. But politicians too often end up fighting the last war, overlooking current threats.

The best example of that is the Maginot Line — France's heavy fortifications along its border with Germany built after World War I. The Maginot Line was thought to be impenetrable to German attack, and it took up most of France's defensive resources to build. When World War II broke out, however, Germany simply attacked France through France's less fortified border with Belgium, circumventing the Maginot Line altogether. It has been a cautionary tale ever since.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Similarly, Obama could be leaving the U.S. vulnerable to a kind of economic sneak attack.

It's certainly true that the bursting of the housing bubble in 2008 resulted in a financial collapse that had global repercussions. But some, like Hyman Minsky, would say that economic bubbles are unavoidable in a free-market economy.

And many, like Paul Krugman, would say that the real problem now is high unemployment and weak demand. This is a sound point. If millions of people are out of work and can't find employment, surely this is a more pressing situation than bubbles that might or might not occur in five or ten years time.

Indeed, the deepest challenges the economy faces, like wage stagnation and income inequality, are dangerous precisely because they could cause bubbles to grow. Obama actually recently touched on this while speaking at Knox College in July:

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Even though our businesses are creating new jobs and have broken record profits, nearly all the income gains of the past 10 years have continued to flow to the top 1 percent. The average CEO has gotten a raise of nearly 40 percent since 2009. The average American earns less than he or she did in 1999...

This growing inequality is not just a result, inequality of opportunity — this growing inequality is not just morally wrong, it's bad economics. Because when middle-class families have less to spend, guess what, businesses have fewer consumers. When wealth concentrates at the very top, it can inflate unstable bubbles that threaten the economy. When the rungs on the ladder of opportunity grow farther and farther apart, it undermines the very essence of America — that idea that if you work hard you can make it here. [WhiteHouse.gov]

Simply put, it's not sustainable to have an economy in which the incomes of the top 1 percent have skyrocketed while the typical working household has seen its income decline by nearly $2,000.

When incomes are stagnant and people need to spend more, there is only one route possible — taking on debt. The evidence shows that this is roughly what occurred in the run-up to the 2008 crisis.

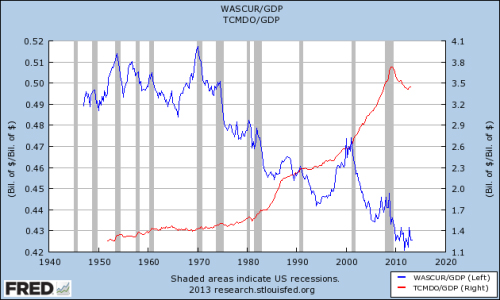

Wages and salaries as a proportion of economic output stagnated (the blue line), and so people took on lots and lots of debt (the red line). The bursting of the bubble in 2008 was very much connected to the private sector no longer being able to take on any more debt. The real question is how to reverse the trend.

And that is where it becomes possible to kill two birds with one stone. The period in the 1950s and 1960s, when wages and salaries were a higher proportion of the economy, was marked by low unemployment and full-employment policies involving heavy government investment. Focusing on reducing unemployment — and keeping it down — puts money in people's pockets, and supports income growth throughout the economy. The only price to pay may be slightly higher inflation, which has been running below the Federal Reserve's target for most of the last year.

Of course, some smaller economic bubbles could still occur in relation to the technology industry (like the dotcom bubble) or monetary factors. Bubbles happen, and that's been a fact of economic life throughout human history. But broader income growth could certainly have limited the seismic debt-fuelled bubble that burst in 2008.

While there are other policies which may be useful in limiting future financial sector bubbles — for instance, increased bank capital requirements — we should not overlook the potential of full-employment policies in creating more sustainable economic growth, and thus giving us a better chance of avoiding future economic bubbles.

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.