Why a war in Syria probably won't hit you at the pump

Hint: It has to do with a little thing called fracking

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Historically, when turmoil hits the Middle East, Americans tend to feel it at the gas pump.

And right on cue, as President Obama builds support for a military strike against Syrian President Bashar al-Assad's forces, gas prices in the U.S. have started getting jumpy. This week, the average price for a gallon of gas in the U.S. is up to $3.61, says GasBuddy.com, a nearly 4 cent increase from late August.

But despite recent jitters, analysts say this time may be different: The conflict in Syria probably won't totally batter Americans at the pump.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

There are a couple reasons for this.

First, the U.S. is enjoying its own boom in oil and natural gas, driven largely by the proliferation of fracking. U.S. production of oil is up 2 million barrels a day from the first quarter of 2011, shortly after the Arab Spring plunged the Middle East and North Africa into political turmoil. And the U.S.'s gasoline inventories are up almost 10 percent from a year ago.

Meanwhile, demand has risen only 1 percent. Record gas prices in 2008 helped steer Americans toward electric and more fuel-efficient vehicles, while the lackluster economic recovery has tamped down spending on goods like gas.

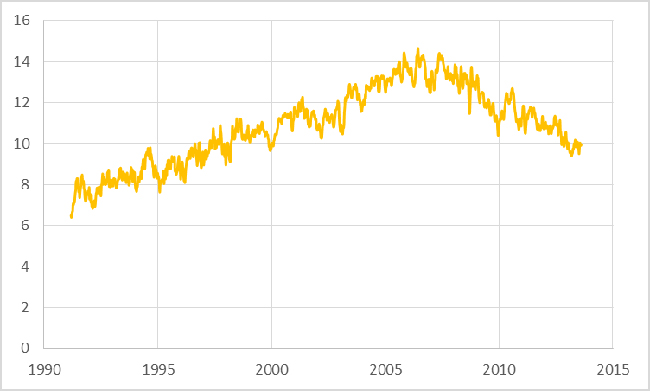

Add that all up and you get declining imports (measured here in millions of barrels of gas per day).

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Josh Boak from The Fiscal Times puts it like this:

For all the concerns caused by a lukewarm economic recovery, the United States has — since the 2008 oil price spike — benefited from its waning reliance on petroleum. The change from last year — when Americans spent a record percentage of their paychecks on gasoline — could not be more pronounced. It just might be the most underappreciated shift in the economy, one that insulates the country from geopolitical shocks such as the potential military intervention Syria that Obama is putting before Congress. [The Fiscal Times]

But all of this doesn't mean we're immune, especially not in the short term. As Clifford Kraus at The New York Times reports:

Still, some energy experts are expressing concerns. "This kind of unrest will lead to higher prices in the short term," Tim Dodson, executive vice president for exploration at Statoil, the Norwegian oil giant, said in an interview this week. "It should be a concern for everyone."

Oil prices are set globally, and there are several weak links in the global supply chain that could cause prices to spike in the coming weeks. [The New York Times]

Carmel Lobello is the business editor at TheWeek.com. Previously, she was an editor at DeathandTaxesMag.com.

-

What to know before filing your own taxes for the first time

What to know before filing your own taxes for the first timethe explainer Tackle this financial milestone with confidence

-

The biggest box office flops of the 21st century

The biggest box office flops of the 21st centuryin depth Unnecessary remakes and turgid, expensive CGI-fests highlight this list of these most notorious box-office losers

-

What are the best investments for beginners?

What are the best investments for beginners?The Explainer Stocks and ETFs and bonds, oh my