Could ending Mexico's beer duopoly bring the craft beer revolution south of the border?

An eagerly awaited court decision could shake up Big Beer in Mexico

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

South African beer company SABMiller and several small Mexican beer companies are awaiting an antitrust decision this week that could open a crack in Anheuser-Busch InBev and Heineken International's Mexican beer fortress, which could help competitors establish a larger presence in one of the world's most lucrative beer markets.

The beer world for the most part is dominated by six global giants. In June, Anheuser-Busch InBev, the largest beer company on Earth, completed its takeover of the Mexican brewery Grupo Modelo, which owns the Corona, Modelo, and Pacifico brands. Meanwhile, the Dutch beer company Heineken, the third-largest brewer in the world, owns the classic Mexican brewer Cerveceria Cuauhtémoc Moctezuma, which encompasses a batch of other Latin American brands like Dos Equis and Tecate.

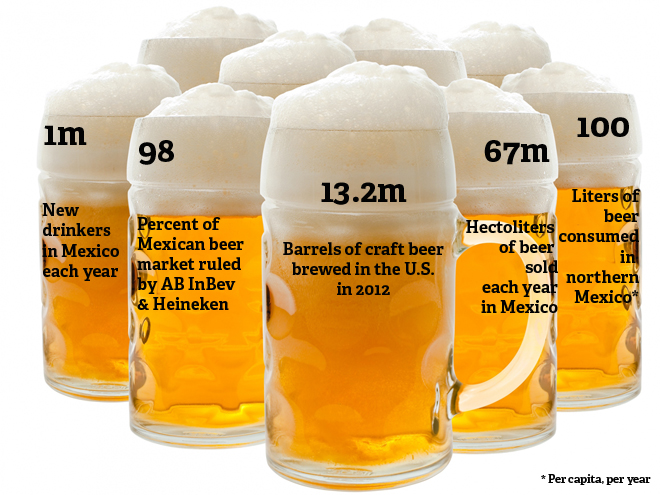

Together, AB InBev and Heineken have an iron grip on Mexican beer market, selling an estimated 55 percent and 43 percent of the country's beer volume, respectively.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

SABMiller, the second-largest beer company in the world, has a pinkie-toehold in Mexico with a 1 percent share of the market, leaving another measly 1 percent for small brands and craft brewers.

So how did two companies come to rule an entire nation of beer drinkers? It took more than just vacuuming up smaller brands. For one, both Modelo and Heineken control large convenience store chains throughout Mexico, where they sell their own beer exclusively. Furthermore, they have formulated exclusivity deals with the majority of mom-and-pop stores, which provide about half the beer sold in Mexico. The two giants will often lend money to a small store to help pay for a beer license, demand exclusivity in exchange, and thereby lock out competitors.

The stakes for SABMiller, which filed the lawsuit, are high. Mexico consumes the fifth-most amount of beer in the world. In the north, annual beer consumption averages 100 liters (about 26.5 gallons) per capita, and one million people turn the drinking age each year.

While SABMiller, with its huge resources for advertising and distribution, seems to have the most to gain, craft breweries, which are already booming in the U.S., could benefit as well. In 2012, when the U.S.'s beer market grew by just 1 percent, craft brewers saw 15 percent growth in volume and 17 percent growth in dollar sales, reaching 6.5 percent of the total U.S. beer market. We're "undoubtedly living through a beer renaissance," says TIME's Brad Tuttle. And if the Mexican market opens up, there's plenty of reason to think the renaissance could spread.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

"Craft beers — so beloved of Americans just across the border and now made by more than 30 Mexican microbrewers — could gain more traction," say Bloomberg's Clementine Fletcher and Brendan Case.

Fernando López, the manager of the Mi Tienda corner store in Mexico City agrees. "I think consumers like the variety," he tells the Wall Street Journal.

Carmel Lobello is the business editor at TheWeek.com. Previously, she was an editor at DeathandTaxesMag.com.