Is Jamie Dimon headed for a demotion?

Warren Buffett is "100 percent for Jamie" — but JPMorgan Chase's shareholders may beg to differ

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

On May 21, JPMorgan Chase's shareholders will vote on whether to oust Jamie Dimon as chairman of the board, thereby leaving the outspoken banker with just one title, that of CEO.

Call it a trend. Many publicly traded companies have abolished the arrangement in which the chief executive also runs the committee that makes all the hiring and firing decisions. The idea is that the split allows the board more independence.

But Dimon has held both roles since 2006, shepherding the bank through a crisis that saw JPMorgan emerge stronger than ever while its rivals flailed. The possible demotion, in other words, would stem from some very recent — and very real — failures.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

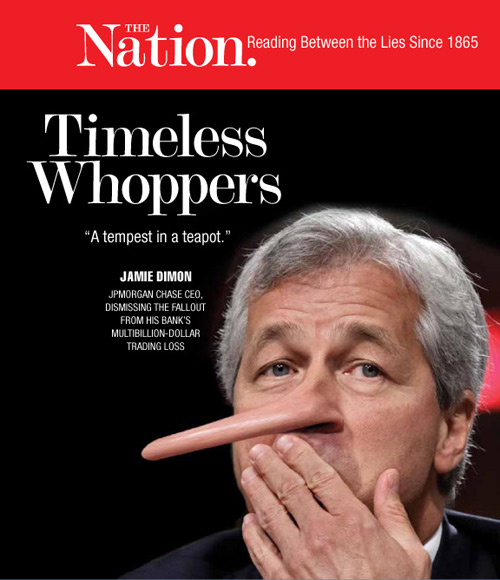

The most high-profile controversy would be last spring's "London Whale" fiasco, in which risky bets involving credit default swaps led to $6 billion in losses for the bank. Dimon came under heavy criticism (see below) for initially claiming the controversy was nothing more than "a tempest in a teapot."

But there are others: JP Morgan's legal woes have added up to billions in settlements and fines. These cases involve "dealings with mortgage borrowers and mortgage investors; foreclosing on active-duty military personnel; rigging bids in the municipal bond market; financial dealing with countries covered by U.S. sanctions; and overcharging for checking overdrafts," says Daniel Gross at The Daily Beast

Three of the bank’s largest shareholders — BlackRock, Vanguard, and Fidelity, which together own more than 12 percent of the company — have yet to disclose their position on the vote. Last year, the three did not join the 40 percent of shareholders that opposed Dimon occupying both roles. But if they do this year, they could swing the vote against Dimon. Though the vote is nonbinding, a majority vote could force the board to act, says the Wall Street Journal.

And shareholders may be feeling pressure as well. A proxy-advisory firm, Institutional Shareholder Services, has been lobbying shareholders to split the positions. The Wall Street Journal says, "ISS also recommended that shareholders vote against the re-election of the directors on the board's risk committee for failing to exercise oversight as traders at the bank took on massive risks."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

But Dimon still has his supporters, including Berkshire Hathaway CEO Warren Buffett, who thinks Dimon should keep both jobs. "I’m 100 percent for Jamie," he told Bloomberg. "I couldn't think of a better chairman."

CNN’s Paul R. La Monica agrees that JPMorgan's missteps are not all Dimon's fault.

The problem may not be Dimon, but that JPMorgan has simply proven to be fallible. Investors got too used to the bank outshining its brethren and steering clear of the industry's worst sins.

"JPMorgan Chase is akin to an A student that is now getting B grades. The fallout from last year's London Whale loss seems to increase risk with management, reporting, consistency and brand," wrote CSLA analyst Mike Mayo in a recent report. "In short, we feel that other banks provide greater potential at this time." [CNN]

Despite all the hype, Daniel Gross at The Daily Beast thinks Dimon will get to keep both his jobs. In his article, "Jamie Dimon Pushed Out at JPMorgan Chase? Fat Chance," he writes:

Dimon shouldn’t worry too much. Sure, the age of the imperial CEO may be coming to an end, in corporate America as a whole and in Wall Street in particular; many CEOs are on short leashes, battling declining tenures and increasingly aggressive boards and outsider shareholders. But Dimon, 57, who has been running JPMorgan Chase since the beginning of 2006, is an exception in many ways.

Duff McDonald’s excellent biography of Dimon was aptly titled Last Man Standing, in part because Dimon was one of the few Wall Street executives to emerge through the 2008 financial crisis with his job, fortune, and reputation intact. JPMorgan Chase, like every other bank, made plenty of poor, ultimately costly decisions in the credit boom years. But under Dimon, the bank made less of them than all of its peers, and it had more capital going into the bust. [The Daily Beast]

Carmel Lobello is the business editor at TheWeek.com. Previously, she was an editor at DeathandTaxesMag.com.

-

Crisis in Cuba: a ‘golden opportunity’ for Washington?

Crisis in Cuba: a ‘golden opportunity’ for Washington?Talking Point The Trump administration is applying the pressure, and with Latin America swinging to the right, Havana is becoming more ‘politically isolated’

-

5 thoroughly redacted cartoons about Pam Bondi protecting predators

5 thoroughly redacted cartoons about Pam Bondi protecting predatorsCartoons Artists take on the real victim, types of protection, and more

-

Palestine Action and the trouble with defining terrorism

Palestine Action and the trouble with defining terrorismIn the Spotlight The issues with proscribing the group ‘became apparent as soon as the police began putting it into practice’