Latest shots in the austerity debate: Krugman vs. Reinhart and Rogoff

The Excel spreadsheet error that rocked the world

That The Colbert Report spent more than seven minutes talking about a spreadsheet error in a seminal economics paper is a sign that the austerity debate has reached a whole new level. (Watch the video below.)

The error was in a study by Carmen Reinhart and Kenneth Rogoff that famously asserted that economic growth slowed after a country's public debt equaled 90 percent of its GDP — a so-called tipping point that conservative lawmakers around the world have used to justify austerity policies.

But three economists from the University of Massachusetts, Amherst, claimed that when the spreadsheet error was corrected, the study showed that countries that hit the 90 percent threshold saw economic growth of 2.2 percent — not a contraction of 0.1 percent, as Reinhart and Rogoff had initially stated.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

In an op-ed in The New York Times, Reinhart and Rogoff admitted that the Amherst researchers had "correctly identified a spreadsheet coding error that led us to miscalculate the growth rates of highly indebted countries since World War II."

They argued, however, that the fundamental conclusion of their report remains true, namely "that episodes of high debt (90 percent or more) were rare, long, and costly."

After reviewing their own work, they now say that countries that pass the 90 percent mark see 2.3 percent growth, down from 3.5 percent if they stay under that threshold. In other words, not negative growth, but still a significant drop. That's reason enough to consider austerity measures, albeit carefully considered ones, say Reinhart and Rogoff:

We agree that growth is an elusive goal at times of high debt. We know that cutting spending and raising taxes is tough in a slow-growth economy with persistent unemployment. Austerity seldom works without structural reforms — for example, changes in taxes, regulations, and labor market policies — and if poorly designed, can disproportionately hit the poor and middle class. Our consistent advice has been to avoid withdrawing fiscal stimulus too quickly, a position identical to that of most mainstream economists. [The New York Times]

Their op-ed also focuses on the political attacks they have received, which, in their view, are "a sad commentary on the politicization of social science research." They also balk at the suggestion that they ever posited that "90 percent was a magic threshold that transforms outcomes, as conservative politicians have suggested."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Paul Krugman, publishing an op-ed in the Times on the same day, doesn't buy Reinhart and Rogoff's latest conclusions. In fact, he claims he didn't believe them in the first place, arguing that "many economists raised fundamental questions about Reinhart-Rogoff long before we knew about the famous Excel error."

In Krugman's view, flawed research is dangerous because the wealthiest and most powerful Americans are so eager to embrace it:

The average American is somewhat worried about budget deficits, which is no surprise given the constant barrage of deficit scare stories in the news media, but the wealthy, by a large majority, regard deficits as the most important problem we face. And how should the budget deficit be brought down? The wealthy favor cutting federal spending on health care and Social Security — that is, "entitlements" — while the public at large actually wants to see spending on those programs rise.

You get the idea: The austerity agenda looks a lot like a simple expression of upper-class preferences, wrapped in a facade of academic rigor. What the top 1 percent wants becomes what economic science says we must do. [The New York Times]

Matthew Yglesias, weighing in at Slate, argues that Rogoff isn't an apolitical observer, but someone who has written op-eds and delivered testimony to Congress based on policy conclusions drawn from his own paper.

Whether you believe Reinhart and Rogoff or not, this whole brouhaha is a reminder that politics and economics are often inextricable, no matter how cold and impartial the numbers look.

Keith Wagstaff is a staff writer at TheWeek.com covering politics and current events. He has previously written for such publications as TIME, Details, VICE, and the Village Voice.

-

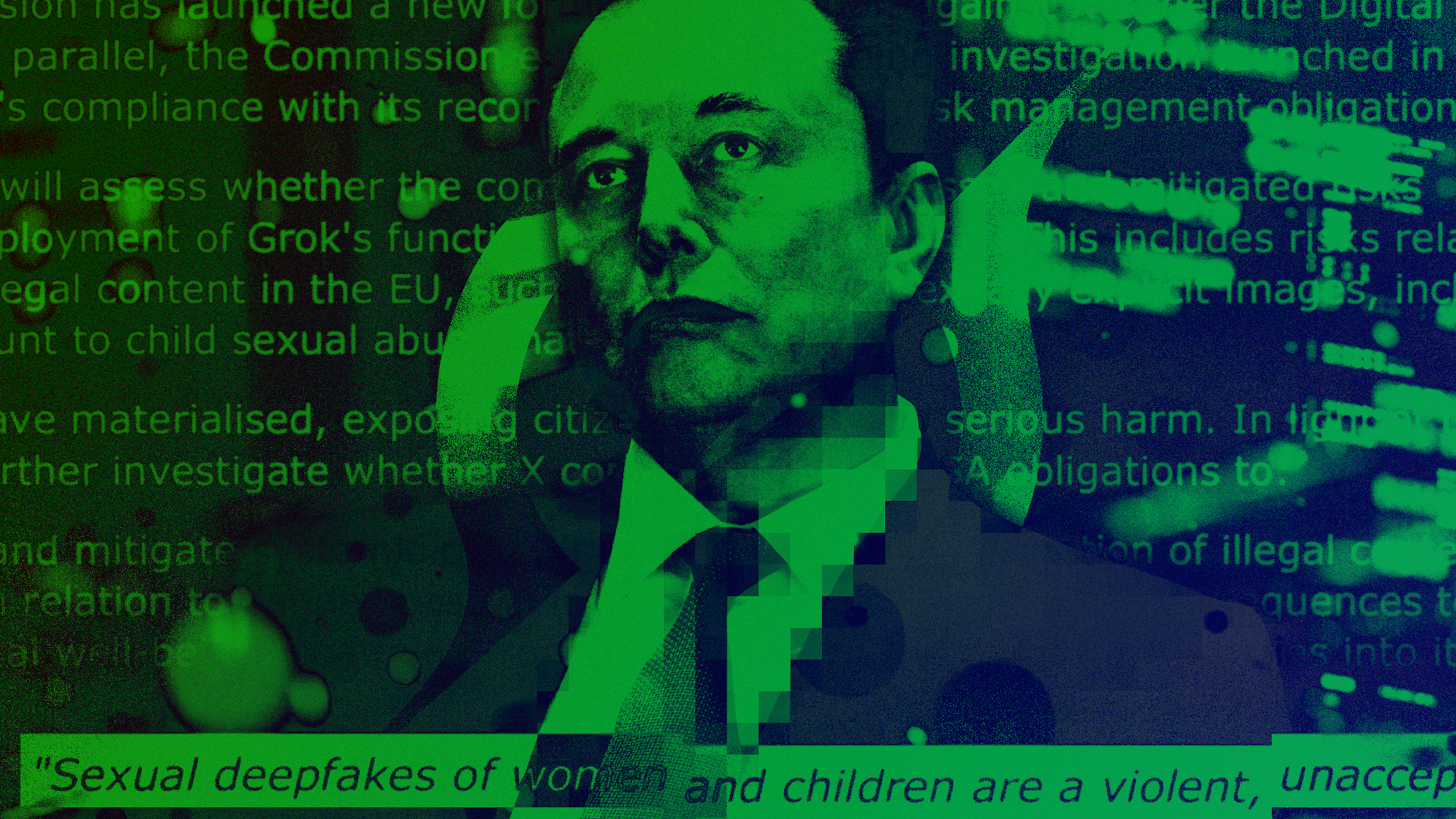

Grok in the crosshairs as EU launches deepfake porn probe

Grok in the crosshairs as EU launches deepfake porn probeIN THE SPOTLIGHT The European Union has officially begun investigating Elon Musk’s proprietary AI, as regulators zero in on Grok’s porn problem and its impact continent-wide

-

‘But being a “hot” country does not make you a good country’

‘But being a “hot” country does not make you a good country’Instant Opinion Opinion, comment and editorials of the day

-

Why have homicide rates reportedly plummeted in the last year?

Why have homicide rates reportedly plummeted in the last year?Today’s Big Question There could be more to the story than politics