Why President Obama has Wall Street worried

The industry's new top cop has a stellar record as a prosecutor

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

This week, President Obama nominated Mary Jo White, the former U.S. attorney for the Southern District of New York, to head the Securities and Exchange Commission, an agency whose reputation as a watchdog was badly battered in the wake of the financial crisis and the Bernie Madoff Ponzi scheme. Obama signaled that White's appointment would mark a new era of reinvigorated government oversight of the financial industry. "You don't want to mess with Mary Jo," Obama said. "As one former SEC chairman said, Mary Jo 'does not intimidate easily.'"

The response to White's appointment has been largely positive among those who would prefer to see stricter regulation of Wall Street. She has developed a reputation as a tough prosecutor — in fact, she would become the first prosecutor ever to lead the SEC. According to Dylan Matthews at The Washington Post:

Among those she's locked up, both as U.S. attorney for the Southern District of New York (which covers Manhattan) and as an assistant U.S. attorney in the Eastern District (which covers Brooklyn), are mob boss John Gotti, six al Qaeda members involved in the 1998 Kenyan embassy bombings, and Omar Abdel-Rahman, the "Blind Sheikh" whose followers bombed the World Trade Center in 1993. [The Washington Post]

She also has a fairly solid record prosecuting white-collar crimes, such as a "pump and dump" financial scheme in the 1990s that involved members of the Mafia. However, some critics have taken issue with other parts of White's resume, particularly the years she spent at the blue-chip law firm Debevoise and Plimpton, where she defended corporate clients like former Bank of America CEO Kenneth Lewis and Morgan Stanley CEO John Mack. For some, the mere fact that she has worked on both sides is a count against her. According to David Sirota at Salon:

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

In moving through that revolving door, she has been a part of a corrupt culture that has weakened the power of the very law enforcement agency President Obama is now nominating her to run…

Simply put, if you know your next lucrative job is on Wall Street, you aren't all that interested in prosecuting Wall Street, because that might limit your private-sector career prospects. [Salon]

Others argue that the head of the SEC should have experience in both government and Wall Street, particularly after a crisis that showed just how clueless officials were about exotic financial instruments and the like. "Sure, the revolving door can lead to regulatory capture," says Massimo Calabresi at TIME. "But the mismatch between private industry and government in skills, knowledge and capacity is much more likely to produce that problem. Hiring someone who has seen the ugliest of the big banks is a smart choice."

It's important to remember, too, that White's responsibilities would be broader than merely punishing wrongdoing. As Michael Bobelian at Forbes explains:

The SEC acts simultaneously as an enforcement body and a regulator designed to enforce securities laws while working hand-in-hand with companies to ensure their compliance. It's a collaborative relationship that will require White to temper and redirect her prosecutorial instincts. If she's able to balance the agency's two missions as a tough enforcer and cooperative adviser, then she may lead the SEC completely back from its darkest days. [Forbes]

The hope, then, is that White will not only prosecute crimes, but take actions to prevent them. "It's absolutely the case that better-informed and more active regulators, particularly when they have the resources and the presidential support they need, can limit and mitigate bad behavior," says James Surowiecki at The New Yorker, "rather than simply punishing it after the fact.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Ryu Spaeth is deputy editor at TheWeek.com. Follow him on Twitter.

-

The broken water companies failing England and Wales

The broken water companies failing England and WalesExplainer With rising bills, deteriorating river health and a lack of investment, regulators face an uphill battle to stabilise the industry

-

A thrilling foodie city in northern Japan

A thrilling foodie city in northern JapanThe Week Recommends The food scene here is ‘unspoilt’ and ‘fun’

-

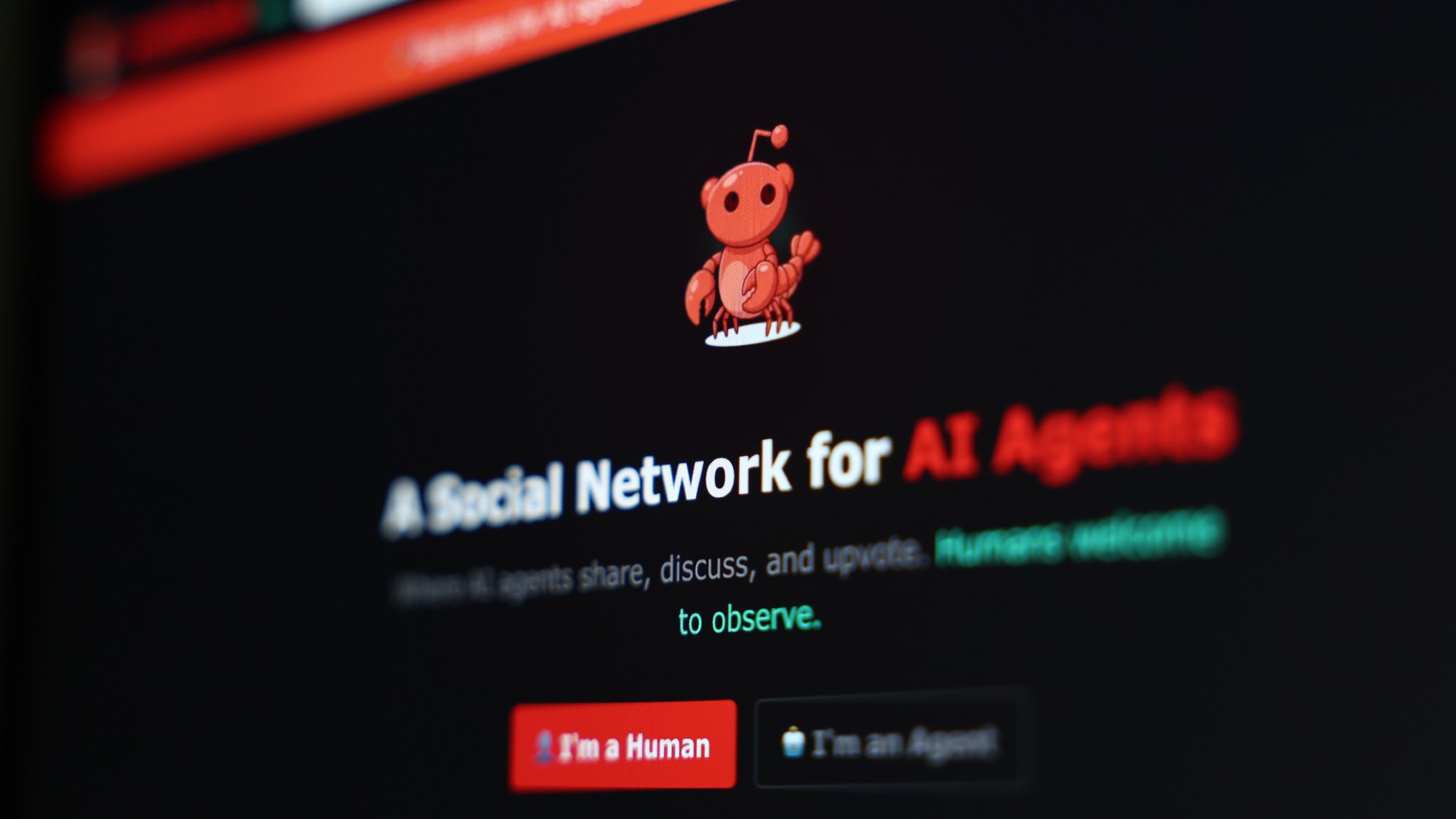

Are AI bots conspiring against us?

Are AI bots conspiring against us?Talking Point Moltbook, the AI social network where humans are banned, may be the tip of the iceberg