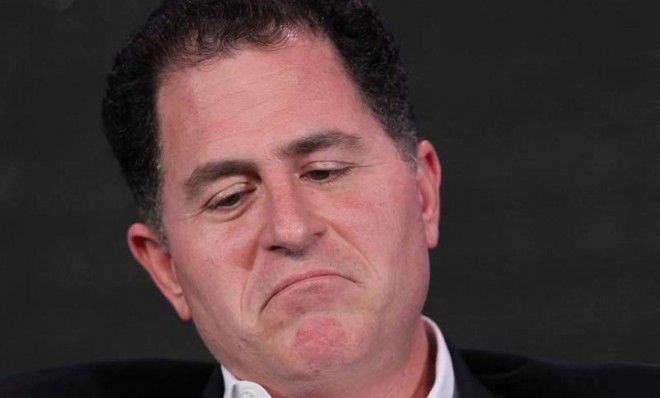

Can Michael Dell save his struggling PC empire?

The one-time leading global computer retailer has hit hard times. Now, Dell's founder reportedly wants to take his company private

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Dell has seen brighter days. The world's one-time No. 1 computer company is now No. 3, behind HP and Lenovo, and its 10.2 percent share of the PC market is down from 12.2 percent a year ago. On top of that, the overall market for PCs, laptops, and netbooks — about two-thirds of Dell's business — is shrinking as consumers and businesses shift toward smartphones and tablets like Apple's iPad. Dell's computer shipments dipped 21 percent in the fourth quarter, and its third quarter profits were down a hefty 47 percent. So perhaps it's not surprising that Dell's stock jumped Monday on a report by Bloomberg that two private equity firms are considering a leveraged buyout of Dell, led by founder and CEO Michael Dell, who owns more than 15 percent of the company's stock.

Dell has considered taking his company private before, he told investors in 2010 — when Dell was worth about $27.5 billion. Now that it's worth about $19 billion, a buyout "makes a lot of sense," Topeka Capital Markets analyst Brian White tells Bloomberg. "The valuation on this stock is absolutely insulted." Michael Dell is easing his company away from a PC-dependent model, and he "wants to change the focus of Dell without having the microscope of a public stock." That sounds about right, says Therese Poletti at MarketWatch. "As Dell seeks to transition to other business areas such as storage, software, and services, it might be helpful to get out of the limelight."

Investors may like Dell's plan to take the company private, but "my gut take is that this would be very, very difficult," says Dan Primack at Fortune. First, Dell and his partners need to raise, in a best-case scenario, $8 billion, or $5 billion after Dell cashes in his stock. That "sounds reasonable in 2007, but not in 2013." Next, they'd need at least $15 billion in leveraged financing — and keep in mind that "bankers aren't being asked to bet on shale gas here; they're being asked to commit billions to the personal computer market. There's a reason this thing trades pretty cheap." That's the biggest hurdle to this deal: "Who wants a declining PC business?" says Bob Pisani at CNBC. "Splitting the company in two — a PC and an enterprise business — seems more feasible than an outright sale."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Don't forget that along with Michael Dell's shares, "the firm itself has $5.15 billion on hand," says Matthew Yglesias at Slate. "So it's natural that he's at least exploring leveraged buyout options that would take the company private and let Dell and whatever co-investors he finds fully extract the considerable cash flows that are still associated with the company." But if he does, there will be "a certain irony," given his advice to Apple's management 15 years ago, right after founder Steve Jobs rejoined the then-struggling company: "What would I do? I'd shut it down and give the money back to the shareholders."

For all of Dell's recent troubles, shares in the firm are up 686 percent since he said that in the fall of 1997. The company's price is well below where it was in the recent past and way below its tech bubble peak, but it's still worth a lot more than it was in 1997. On the other hand, Apple's stock is up 37,761 percent since that time, so any shareholders who got their money back would be none too pleased with the outcome. [Slate]

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.