The news at a glance

Settling the mortgage crisis bill; Steady but unspectacular growth; Problems with Boeing’s Dreamliner; Target vows to match Amazon; AIG considers suing government

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Banks: Settling the mortgage crisis bill

U.S. banks agreed in two separate deals this week to pay out more than $20 billion to settle claims from the mortgage foreclosure crisis, said Tom Braithwaite and Shahien Nasiripour in the Financial Times. Bank of America will pay $11.6 billion to government-controlled Fannie Mae to end a dispute over loans sold to Fannie Mae by mortgage lender Countrywide, which BofA bought in 2008. BofA is also one of the 10 major banks, including Wells Fargo, JPMorgan Chase, and Citigroup, that agreed to pay regulators $8.5 billion to settle claims “that they were guilty of widespread abuse of the foreclosure system.”

The 10-bank deal puts an end to a case-by-case review of foreclosures that “had proven too cumbersome and expensive,” said Aruna Viswanatha in Reuters.com. Under the agreement, the banks will pay $5.2 billion in loan modifications and forgiveness, and another $3.3 billion in direct payments to wronged borrowers. Comptroller of the Currency Thomas Curry said the deal would get “more money to more people more quickly, and it will speed recovery in the nation’s housing markets.” But Rep. Elijah Cummings (D-Md.) said it “may allow banks to skirt what they owe and sweep past abuses under the rug.”

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Jobs: Steady but unspectacular growth

The U.S. economy added 155,000 jobs in December, said Catherine Rampell in The New York Times, “despite concerns about looming tax increases and government spending cuts.” The Department of Labor’s figures put last month’s job growth squarely at the average for the last two years, leaving the unemployment rate unchanged at 7.8 percent. Hiring was strongest in health care, food services, construction, and manufacturing. “It’s still looking nothing like the typical recovery year we’ve had in deep recessions in the past,” said economist John Ryding. “We’re a long way short of the 300,000 job growth that we need.”

Airlines: Problems with Boeing’s Dreamliner

Air-safety officials this week launched a probe into Boeing’s flagship Dreamliner 787 airliner, said Jon Ostrower and Jack Nicas in The Wall Street Journal, after a fire broke out in an empty plane at Boston’s Logan International Airport. Another Dreamliner had to return to the gate in Boston after a fuel leak, and a day later a flight in Japan was canceled because of brake problems. “We’re not talking about the seats not being comfortable,” said former regulator Mark Rosenker. “These are safety issues which need to be addressed.”

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Retail: Target vows to match Amazon

Discount retailer Target this week promised to meet Amazon’s prices for all its products year round, said Quentin Fottrell in MarketWatch.com. It’s a bid to undercut the practice of “showrooming,” in which customers inspect products on retailers’ shelves only to purchase them online at lower prices. Target will match any price its customers find on Amazon.com, BestBuy.com, ToysRUs.com, or Walmart.com. Some analysts expected Target’s competitors to follow suit. “Price match guarantees are the only way to survive the Amazon onslaught,” said Odysseas Papadimitriou of the financial services site WalletHub.com.

Insurance: AIG considers suing government

Insurance giant AIG, bailed out in 2008 with $85 billion in taxpayer money, came under withering criticism this week for even thinking about suing the government for more, said Christopher Matthews in Time.com. The company’s former chairman, Hank Greenberg, claims that the government “exploited AIG’s near-bankrupt position to extract unfair concessions,” and sought this week to have the AIG board join his suit. “AIG should thank American taxpayers for their help,” said newly elected Sen. Elizabeth Warren, “not bite the hand that fed them.”

-

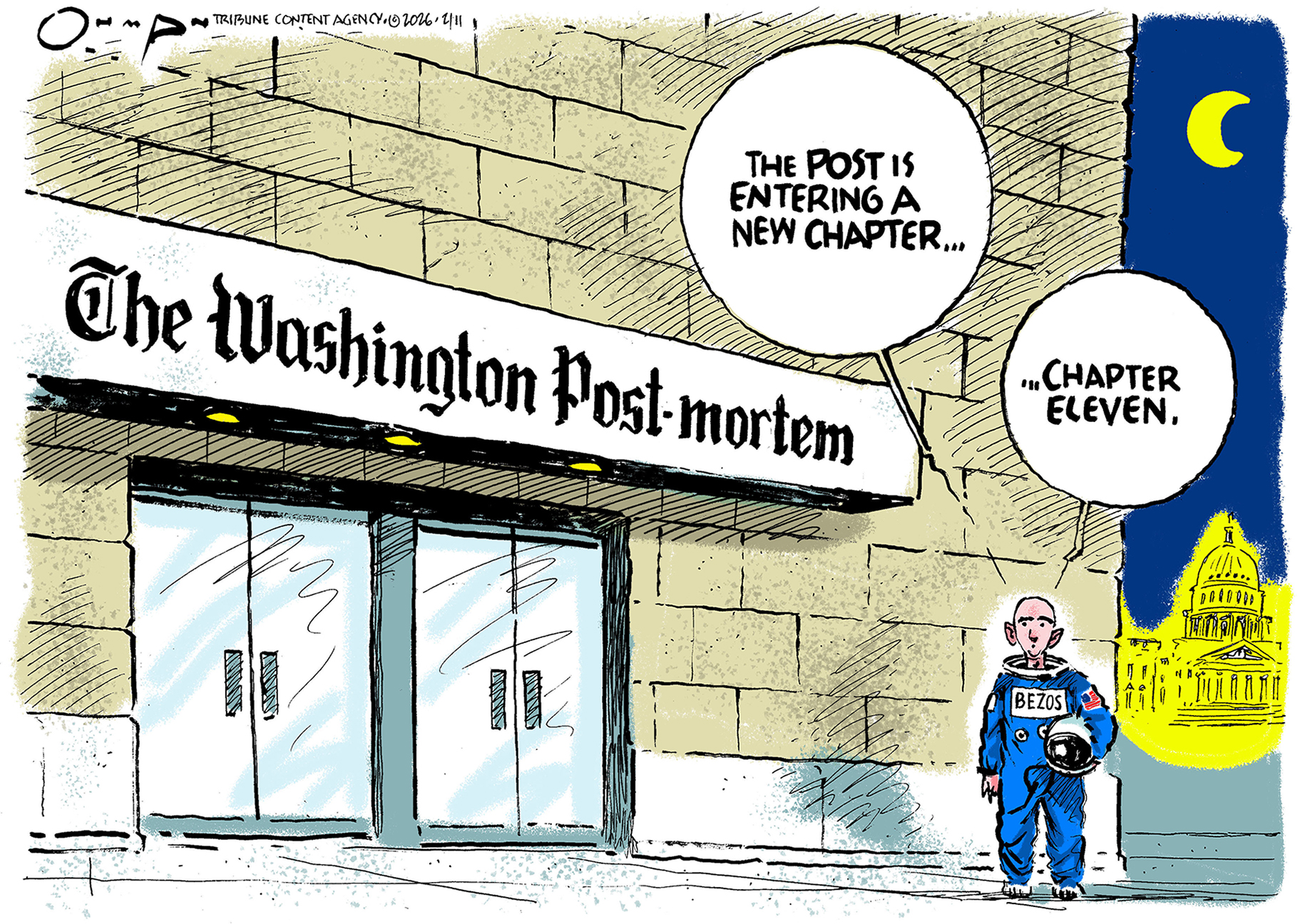

5 calamitous cartoons about the Washington Post layoffs

5 calamitous cartoons about the Washington Post layoffsCartoons Artists take on a new chapter in journalism, democracy in darkness, and more

-

Political cartoons for February 14

Political cartoons for February 14Cartoons Saturday's political cartoons include a Valentine's grift, Hillary on the hook, and more

-

Tourangelle-style pork with prunes recipe

Tourangelle-style pork with prunes recipeThe Week Recommends This traditional, rustic dish is a French classic

-

The news at a glance...International

feature International

-

The bottom line

feature Youthful startup founders; High salaries for anesthesiologists; The myth of too much homework; More mothers stay a home; Audiences are down, but box office revenue rises

-

The week at a glance...Americas

feature Americas

-

The news at a glance...United States

feature United States

-

The news at a glance

feature Comcast defends planned TWC merger; Toyota recalls 6.39 million vehicles; Takeda faces $6 billion in damages; American updates loyalty program; Regulators hike leverage ratio

-

The bottom line

feature The rising cost of graduate degrees; NSA surveillance affects tech profits; A glass ceiling for female chefs?; Bonding to a brand name; Generous Wall Street bonuses

-

The news at a glance

feature GM chief faces Congress; FBI targets high-frequency trading; Yellen confirms continued low rates; BofA settles mortgage claims for $9.3B; Apple and Samsung duke it out

-

The week at a glance...International

feature International