'Dead wrong' Jamie Dimon: 4 takeaways from the banker's Senate testimony

The chief of banking giant JPMorgan Chase apologizes for a $2 billion trading loss, but adamantly insists that government regulation is not the answer

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

On Wednesday, Jamie Dimon, the head of JPMorgan Chase, testified before the Senate Banking Committee and faced questions about a huge $2 billion trading loss that the bank was humiliated by in May. The loss stemmed from a complex hedging strategy involving credit default swaps — insurance-like contracts that essentially allow investors to bet on whether the value of a given asset will rise or fall. Critics charge that such recklessly risky trades fueled the financial crisis of 2008, and argue that JPMorgan's loss proves that more government regulation of Wall Street is necessary. Dimon apologized at the hearing, but remained unbowed in his conviction that President Obama's Dodd-Frank Act — which sought to overhaul the financial regulatory system — is a bad law. Here, four takeaways from Dimon's testimony:

1. Dimon admits that he was 'dead wrong'

Dimon conceded to senators that he had been "dead wrong" to dismiss initial news reports that suggested JPMorgan's trade could blow up in the bank's face. But Dimon didn't take all the blame upon himself. Instead, he pointed the finger at former investment executive Ina Drew — a longtime ally who was sacked in the aftermath of the loss — saying she had assured him that "this was an isolated, small issue and that it wasn't a big problem." Dimon remained vague about what exactly went wrong with the trade, saying only that a hedge — an investment taken to offset the risk of another investment — "morphed into something that rather than protect the firm, created new and potentially larger risk."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

2. He still hates the Volcker Rule

Dimon testified that it was "possible" that the Volcker Rule — a provision of the Dodd-Frank Act that bars banks from using their own money to make risky trades — might have prevented the loss from getting out of hand. However, he maintained that the Volcker Rule, which has yet to be implemented, is "vague" and "unnecessary." Dimon went on to assail the Dodd-Frank Act as a whole, saying, "I would prefer a simple, clean, strong regulatory system, with real intelligent design, but that's not what we did."

3. Dimon will go after executive pay

The banker said it's "likely" that JPMorgan will retract pay doled out to executives who bungled the trade. This would be the first time that JPMorgan has executed such a clawback. Dimon said the bank's board "will review every single person," and threatened to go after stocks and bonuses as well. It remains unclear whether Dimon — who earned $23 million in 2011 — would claw back some of his own salary, too. Since announcing the loss, JPMorgan's shares have plunged 20 percent, wiping out $30 billion in market value.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

4. Senators didn't handle Dimon too roughly

While some Democratic senators pressed Dimon on regulation and risk-taking, overall he was treated quite "cordially," unlike Goldman Sachs CEO Lloyd Blankfein, who was on the receiving end of brutal questioning during his testimony in 2010. Sen. Jim DeMint (R-S.C.) even told Dimon that the committee could "hardly sit in judgment of your losing $2 billion. We lose twice that every day here in Washington." The harshest criticism Dimon received was from a group of protesters who were escorted out of the chamber by security.

Sources: ABC, Bloomberg Businessweek, CNN, Forbes, The Huffington Post, New York Daily News, Reuters, The Washington Post

-

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’the week recommends The pasta you know and love. But ever so much better.

-

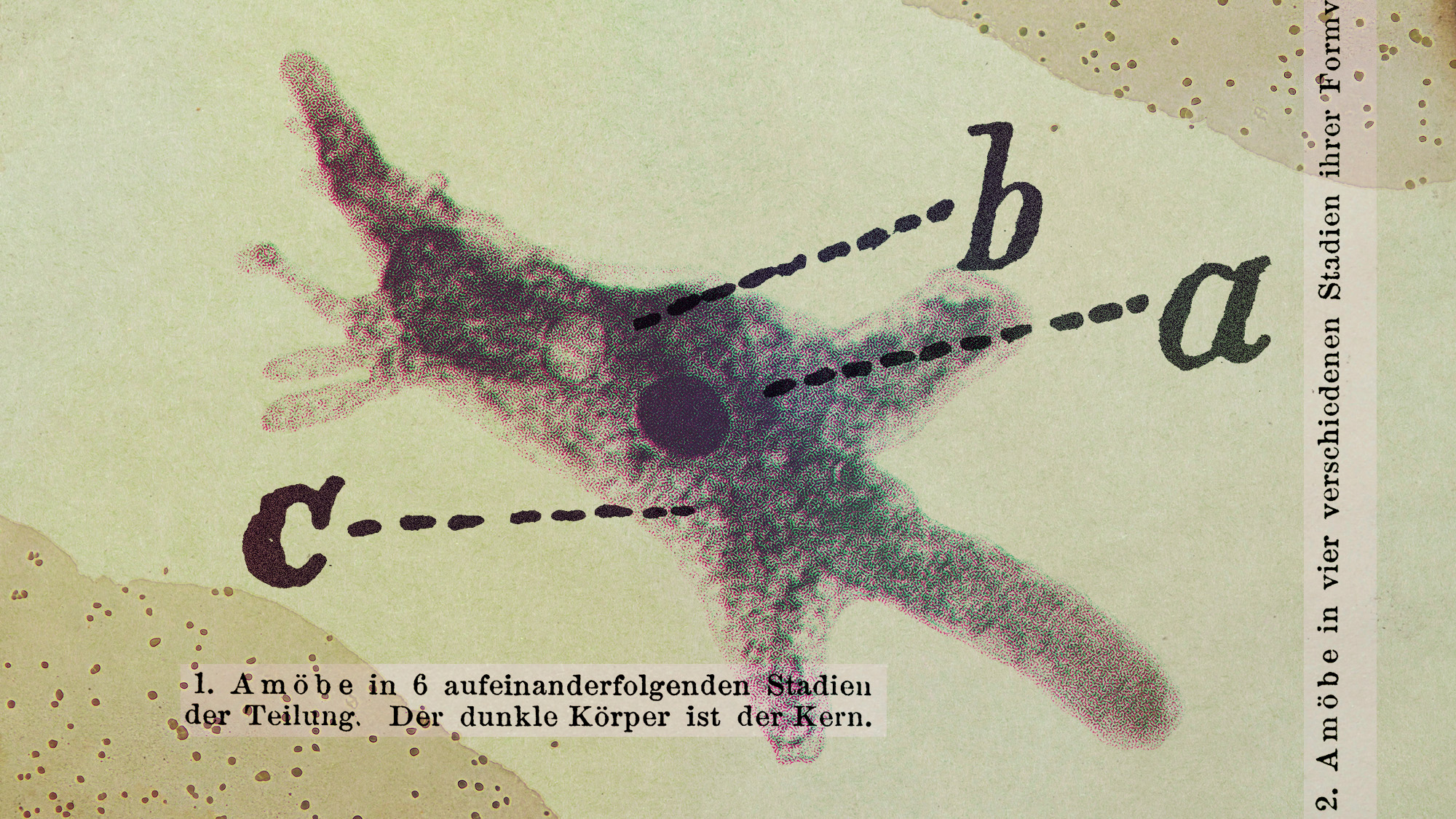

Scientists are worried about amoebas

Scientists are worried about amoebasUnder the radar Small and very mighty

-

Buddhist monks’ US walk for peace

Buddhist monks’ US walk for peaceUnder the Radar Crowds have turned out on the roads from California to Washington and ‘millions are finding hope in their journey’