Is Groupon primed for a comeback?

The struggling daily-deals site sees its share price soar after releasing a better-than-expected earnings report

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Groupon reported this week that its revenue jumped by 89 percent since last year, a better-than-expected result that surprised investors and sent the daily-deals site's share price climbing by 16 percent. Groupon's stock had been declining ever since it launched its IPO in November, as investors soured on the company's poor earnings results and shady accounting corrections. Groupon was subsequently held up as the poster child for a burgeoning tech bubble, as over-exuberant investors had valued the company at close to $18 billion on its IPO — a figure that soon fell as low as $6 billion, though it's since clambered back to $8 billion. Is Groupon about to come roaring back?

Yes. Groupon is improving its business model: Groupon not only bulked up on revenue and expanded its customer base — it also brought down its marketing costs, says Rolfe Winkler at The Wall Street Journal. The company's harshest critics have "argued that its business model would collapse when it dialed down marketing expenses," saying the site was too dependent on advertising "to promote its daily deals." But now it looks like Groupon can grow and spend less.

"Watch out for Groupon's stock bounce"

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But Groupon still faces challenges: Groupon still didn't post a profit, and it's not clear when it might do so, says Sandra Guy at The Chicago Sun-Times. The company's accounting practices remain a source of distrust, and Groupon hasn't really cracked the smartphone market yet. Furthermore, customers could become tired of "getting bombarded with daily email deal offers," and Groupon is facing "significant competition from would-be copycats."

"Groupon, Facebook carry risks, say analysts"

And the stock is about to plunge: Groupon "has a major problem looming right up ahead," says Joan Lappin at Forbes. Groupon's pre-IPO shareholders have long been prevented from unloading their stock. But that will change June 1, when 95 percent of Groupon's shares will go on the market — that's right, "only 5 percent of the shares" are publicly traded today. "Whether those shares will come out in a torrent or a trickle… remains to be seen." But either way, the market will become awash with Groupon shares, supply will exceed demand, and many investors will be looking to unload Groupon stock.

"Groupon caught in the mother of all short squeezes"

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

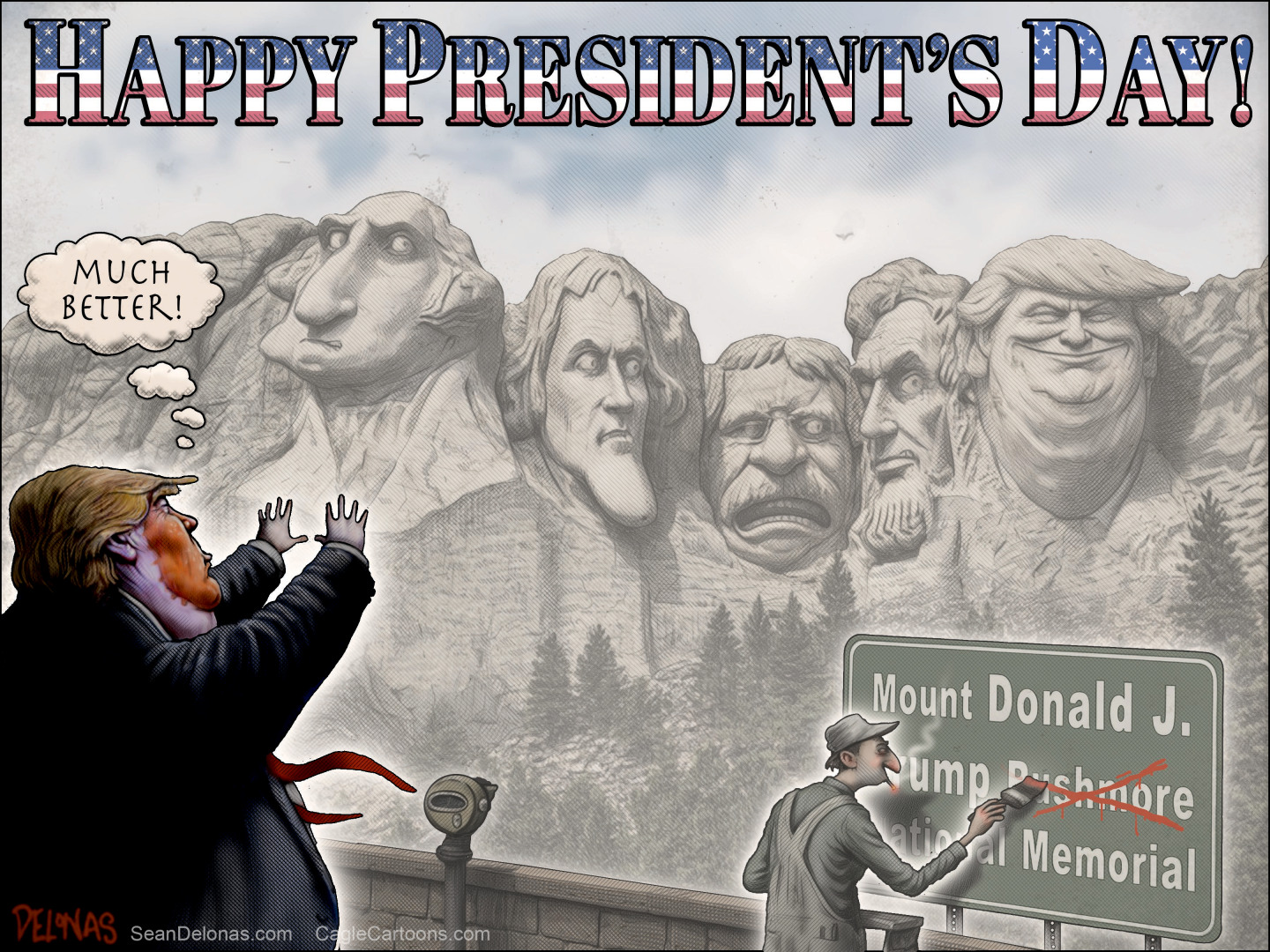

Political cartoons for February 16

Political cartoons for February 16Cartoons Monday’s political cartoons include President's Day, a valentine from the Epstein files, and more

-

Regent Hong Kong: a tranquil haven with a prime waterfront spot

Regent Hong Kong: a tranquil haven with a prime waterfront spotThe Week Recommends The trendy hotel recently underwent an extensive two-year revamp

-

The problem with diagnosing profound autism

The problem with diagnosing profound autismThe Explainer Experts are reconsidering the idea of autism as a spectrum, which could impact diagnoses and policy making for the condition