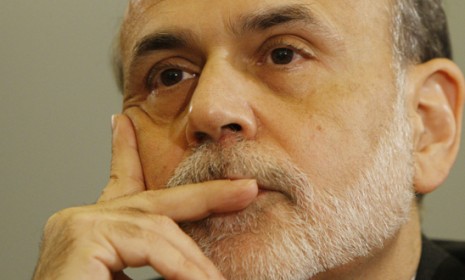

High gas prices: Blame the Fed?

The central bank's easy-money policies are coming under fire as prices rise at the pump

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

When the 2008 financial crisis struck, the Federal Reserve unleashed billions of dollars into the market in an attempt to jump-start the economy. Skeptics at the time said the Fed's loose monetary policies, which amounted to printing more money, would lead to a spike in inflation. Now that gas prices are rising, critics are bringing out their knives for the central bank, saying it is responsible for drivers' pain at the gas station. And they say the Fed holds the key to lowering prices, too — all it has to do is turn off the money spigot. Is the Fed to blame for expensive gas?

Absolutely. High prices are the result of easy money: The main suspect for rising gas prices is U.S. monetary policy, says The Wall Street Journal in an editorial. It's simple: "Oil is traded in dollars, and its price therefore rises when the value of the dollar falls." The Fed has signaled that it will continue to weaken the dollar with its easy monetary policy through 2014, and Americans will suffer the consequences every time they buy gas, or groceries. "This is the double-edged sword of an economic recovery 'built to last' on easy money rather than on sound fiscal and regulatory policies."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Nonsense. Gas prices are largely beyond the Fed's control: The Fed's policies likely devalued the dollar, but the principal cause of expensive gas is increased global demand, says Charles Lane in The Washington Post. Oil prices "have been trending upward for more than a decade," mostly because of "surging demand" in China, India, and other emerging economies. The only reason gas prices dipped in recent years was that the global econmic downturn crimped spending by consumers. In fact, the rising price of gas is "good news": It shows that consumers are spending more and the economy is recovering.

"Driving the politics out of gas prices"

The Fed is caught between competing pressures: Of course emerging-market demand is a factor, says Alen Mattich in The Wall Street Journal, but "somewhere in the collective central-banking brain," there must be at least some concern that loose monetary policy is helping drive up oil prices. Furthermore, there is the danger that these policies could have a "ratchet-like effect" on other gauges of inflation, too. However, the opposite tack — cutting off the flow of easy money — could run the "nascent" economic recovery "into the sand." The Fed faces a difficult decision in the coming months.

"How will central banks respond to oil prices?"

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Sepsis ‘breakthrough’: the world’s first targeted treatment?

Sepsis ‘breakthrough’: the world’s first targeted treatment?The Explainer New drug could reverse effects of sepsis, rather than trying to treat infection with antibiotics

-

James Van Der Beek obituary: fresh-faced Dawson’s Creek star

James Van Der Beek obituary: fresh-faced Dawson’s Creek starIn The Spotlight Van Der Beek fronted one of the most successful teen dramas of the 90s – but his Dawson fame proved a double-edged sword

-

Is Andrew’s arrest the end for the monarchy?

Is Andrew’s arrest the end for the monarchy?Today's Big Question The King has distanced the Royal Family from his disgraced brother but a ‘fit of revolutionary disgust’ could still wipe them out