The stock market's 'melt up': Will the rally end painfully?

The Dow is on a tear, but with economic storm clouds looming, complacent investors may be in for a rude awakening

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Even as European economies flirt with disaster, the U.S. stock market is proving "surprisingly buoyant." The Dow Jones Industrial Average has risen by 19 percent since October, a "melt up" that some market analysts say defies logic, given that the global economic outlook is rather grim and the American economy has yet to make a clear recovery. Do American investors see bright spots others are missing, or are they walking blindly off a cliff?

A disaster is brewing: The European Central Bank is buying massive amounts of bonds, says Michael Sivy at TIME, to prevent interest rates from rising and crushing Europe's most debt-laden economies. All that "hot money" is fleeing the weakest European countries and seeking safe havens, including here in the U.S. That's "creating a bubble in Treasury bonds and a possibly unsupported stock market rally" in the U.S. When that money stops flowing, or some European country defaults, "U.S. shares could take a sizable hit."

"Why this stock rally can't be trusted"

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Investors should be wary, but not panic: It does seem that "complacency has set in," says Michael Santoli at Barron's. But that doesn't mean sheep-like "investors will soon be led to slaughter." The rally is legit, and has been led by home builders, semiconductors, railroads, and financial firms. Still, it's always "wise to stay on alert for unwelcome surprises."

Main Street sees the writing on the wall: "Wall Streeters are buying now, asking questions later," in an attempt to ignite a "buying frenzy," says Anthony Mirhaydari at MSN Money, but Main Street investors aren't fooled. They're watching pump prices rise as holiday bills come due, and they're painfully aware of the "economic headwinds" of sovereign debt issues and mixed economic reports. "Until this dynamic changes, we're stuck in the mud." Main Street sees what's coming, even if Wall Street can't. "And it's not good."

"Is Wall Street manipulating this rally?"

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’the week recommends The pasta you know and love. But ever so much better.

-

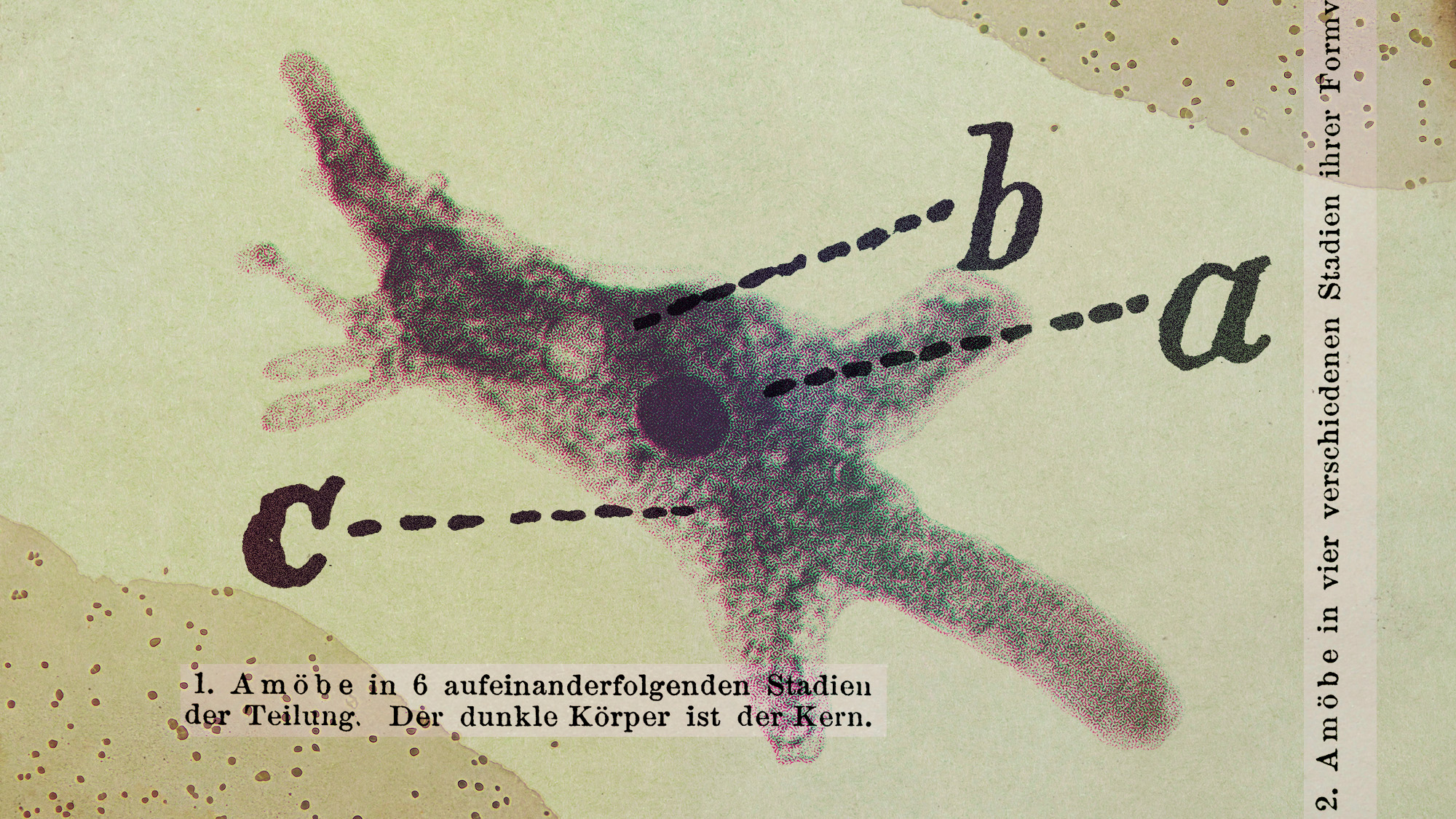

Scientists are worried about amoebas

Scientists are worried about amoebasUnder the radar Small and very mighty

-

Buddhist monks’ US walk for peace

Buddhist monks’ US walk for peaceUnder the Radar Crowds have turned out on the roads from California to Washington and ‘millions are finding hope in their journey’