Will debt downgrades doom the eurozone recovery?

Standard & Poor's docks the credit ratings of France, Spain, Italy — and even the rescue fund charged with bailing out struggling European nations

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

In the last few days, S&P has docked the credit ratings of France, Italy, Spain, Portugal, Cyprus, Austria, Malta, Slovakia, Slovenia, and the European Financial Stability Facility — the temporary bailout fund charged with rescuing debt-plagued nations. French President Nicolas Sarkozy has shrugged off the loss of his country's sterling AAA credit rating with Standard & Poor's, saying it "changes nothing" for Europe's second-largest economy. And at least initially, investors have taken the news that France is now a mere AA+ in stride — France's borrowing costs actually inched down in its first bond auction after the downgrade. Still, are these downgrades proof that the eurozone is doomed?

France, and Europe, are headed for disaster: S&P was right to sound the alarm about France, says Peter Morici at Fox News, not to mention the eight other eurozone governments it knocked down a notch. "The euro will inevitably collapse and chaos will follow, endangering even the strongest governments." If anything was surprising about this latest round of downgrades, it's that S&P let the region's real economic engine, Germany, keep its AAA rating, implying that Germany is risk-free, when the reality is that nobody's safe.

"Standard & Poor's gets France right, Germany wrong"

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But acknowledging the problem is progress: For a year, European leaders have avoided tackling their debt crisis head on, the Financial Times' Gillian Tett tells Yahoo Finance. The fact that France has now been stripped of the top credit rating — albeit by just one of the three big ratings agencies — suggests that "things now are so bad, nobody can deny reality." Once politicians agree they're in "a real crunch" they tend to "get their act together and find a solution." This credit downgrade might just scare them straight.

"FT's Tett: Europe's debt crisis is going to end soon — for better or worse"

Forget France. It's the bailout fund that should worry us: Investors aren't panicking about France because it's still one of the safest bets around, says Dean Popplewell at MarketPulse FX. That's why "the biggest fallout from the rating agency's actions" will come from its Monday downgrade of the creditworthiness of the European Financial Stability Facility. If that leads to higher rates for EFSF bonds, there will be less bailout money to help Greece and other countries in danger of defaulting on their debts, which will make resolving the debt crisis much harder.

"S&P downgrades eurozone bailout fund to AA-plus"

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’the week recommends The pasta you know and love. But ever so much better.

-

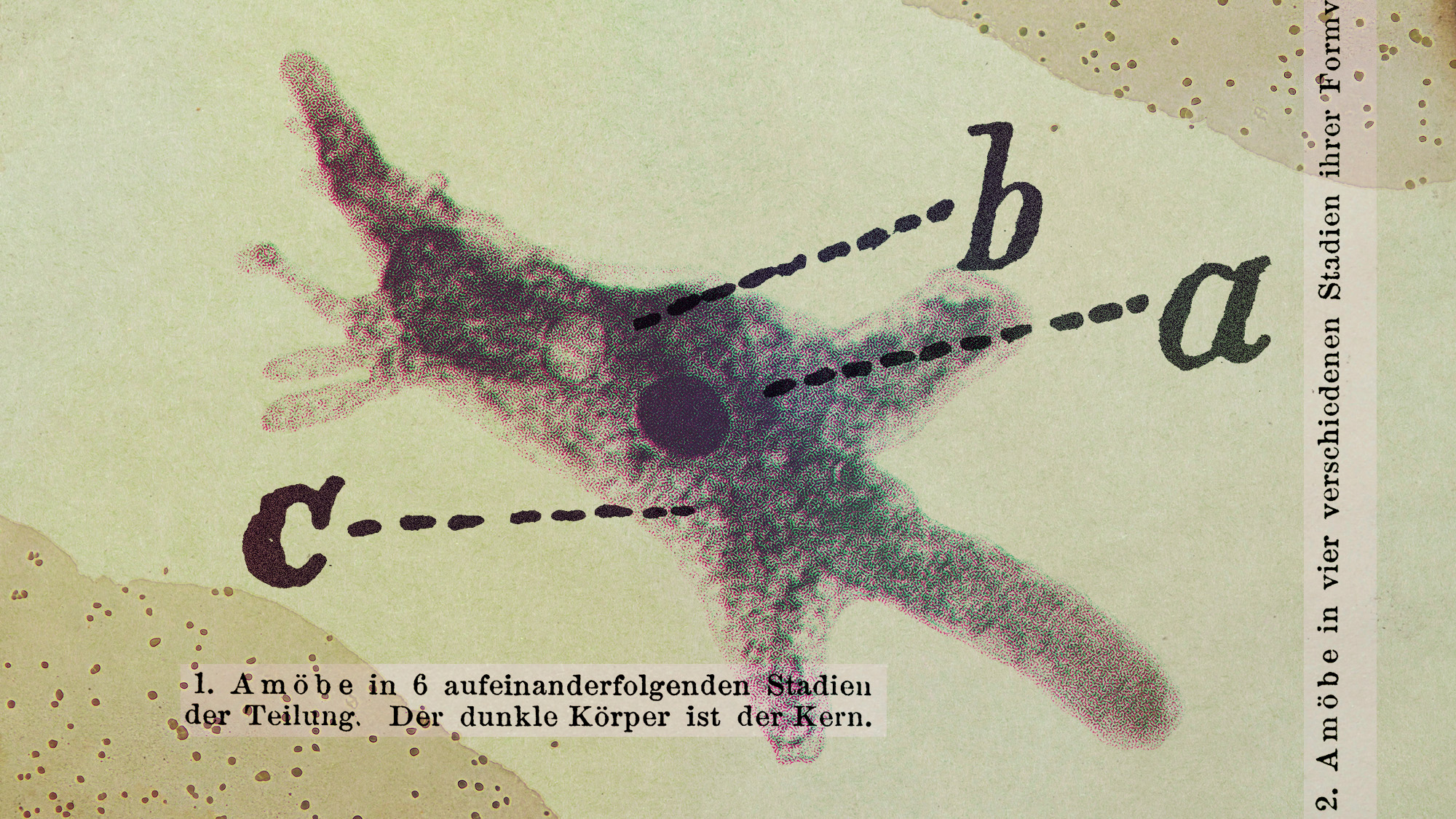

Scientists are worried about amoebas

Scientists are worried about amoebasUnder the radar Small and very mighty

-

Buddhist monks’ US walk for peace

Buddhist monks’ US walk for peaceUnder the Radar Crowds have turned out on the roads from California to Washington and ‘millions are finding hope in their journey’