Does the E.U.'s Greek debt deal solve anything?

Investors rally after Europe agrees to help Greece. But don't celebrate quite yet, critics warn: This might not be nearly enough

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Stocks soared on Thursday after European leaders announced a deal to keep Greece from defaulting on its debt. Big banks agreed to write down 50 percent of Greece's loans, and European Union nations promised to increase the size of their bailout fund to $1.4 trillion. Has Europe finally taken action bold enough to prevent the crisis from exploding?

Yes. The EU is finally getting serious: European leaders have "been in denial that far greater and more comprehensive measures were necessary" to prevent complete disaster, says Michael Schuman at TIME. "This agreement shows they're waking up to reality." They're repairing and recapitalizing Europe's banks, restructuring Greece's debts, and making the bailout fund big enough to "fight contagion" in other struggling countries. These are all "crucial" steps that had to be taken to tackle the crisis.

"Europe's new debt crisis agreement: the good, the bad, the ugly"

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

This helps Greece — but what about the rest of Europe? Don't be fooled by all the backslapping — European leaders have failed, again, say the editors of The Economist. The Greek write-down was essential — the floundering nation just can't pay all its debts — but the deal won't solve anything without "a credible firewall around heavily indebted yet solvent borrowers such as Italy," which this agreement lacks. Until that is in place, European banks will never regain the confidence they need to "get on with the business of lending."

Don't expect this deal to solve America's problems, either: This welcome agreement could indeed douse the fear of contagion, says Dunstan Prial at Fox Business. But it does nothing to spur growth in Europe's fragile economy. And "a sluggish European economy dampens demand for U.S. exports." There are "indirect" problems for the U.S., too. Europe and China are major trading partners, as are the U.S. and China. So "if Europe's slowdown causes a drag on the Chinese economy, that hurts the U.S.," too.

"EU puts out fire, but lots of smoke remains"

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’the week recommends The pasta you know and love. But ever so much better.

-

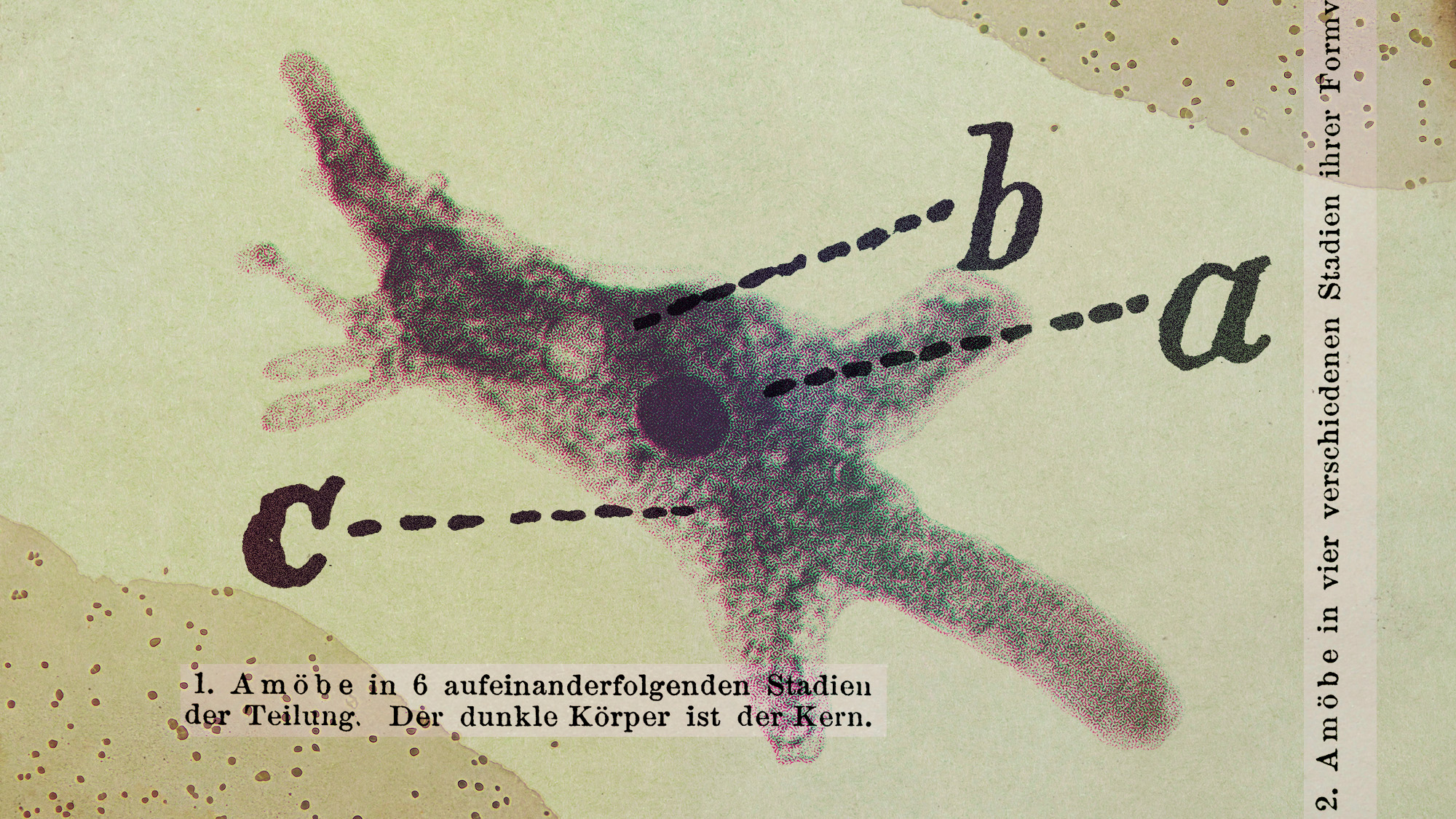

Scientists are worried about amoebas

Scientists are worried about amoebasUnder the radar Small and very mighty

-

Buddhist monks’ US walk for peace

Buddhist monks’ US walk for peaceUnder the Radar Crowds have turned out on the roads from California to Washington and ‘millions are finding hope in their journey’