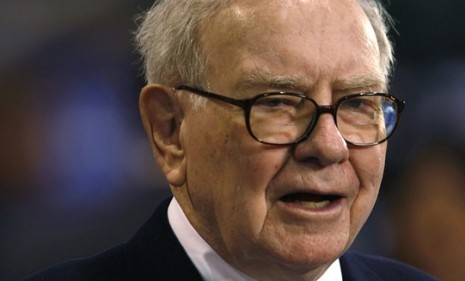

Warren Buffett's divisive plea: 'Raise my taxes'

The world's third-richest man argues for tax increases for the wealthiest Americans in a New York Times op-ed titled, "Stop Coddling the Super-Rich"

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

"Raise my taxes." That's the crux of Warren Buffett's message in his New York Times op-ed piece, "Stop Coddling the Super-Rich," published Monday. Concerned that mega-wealthy investors like himself aren't paying their fair share of taxes, Buffett writes, "While the poor and middle class fight for us in Afghanistan, and while most Americans struggle to make ends meet, we mega-rich continue to get our extraordinary tax breaks." He suggests an immediate raise in taxes for those earning more than $1 million — including income, dividends, and capital gains from investments — with an additional hike for those earning more than $10 million. Should politicians take heed?

Listen up, Washington: "When the poster-boy for a free market system pens a thoughtful op-ed" that argues for increasing the taxes on the super-rich, says Colby Hall at Mediaite, "pundits, politicians, and the 'people' should most certainly take note." Even though many lower or middle class voters oppose all tax hikes, even for the rich, that may be because they deludedly "consider themselves to be unrealized or unlucky millionaires."

"Warren Buffett makes argument for taxing the super-wealthy in NY Times op-ed"

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But Washington won't listen: To congressional Republicans, says Steve Benen at Washington Monthly, Buffett's recommendations are "tantamount to radical socialism." A proposal to increase taxes on "anyone by any amount" is an "automatic deal-breaker in GOP circles," and would gain no traction in Congress. In fact, House Budget Committee Chairman Paul Ryan is pushing for more tax breaks for the rich. "With this in mind, Buffett's advice will probably be ignored on Capitol Hill."

Besides, he's arguing for the wrong thing: Buffett's argument is flawed, says Joseph Lawler at The American Spectator. Increasing tax rates on income and capital gains, as he suggests, "is a terribly inefficient and unfair way" to send more revenue to the government. Instead, what Buffett should be arguing for is major tax reform that eliminates credits, deductions, and preferences — loopholes wealthy investors routinely benefit from. This would lead to "greater efficiency, higher growth, and higher tax revenue."

"Better ways to lower Warren Buffett's after-tax income"

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com