Can a 'monster' tax hike save Illinois?

Illinois governor Pat Quinn, a Democrat, has approved a record income tax increase of 66 percent for his constituents. Can it help the state recover from the recession, or will it make the economy worse?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

While many states are attempting to cut spending to trim recession-fueled deficits, Illinois is taking the opposite tack. The state's Democratic governor, Pat Quinn, has approved a "monster" tax increase to close a $15 billion budget gap that pushed the state to the brink of insolvency. The personal income tax rate will jump from 3 percent to 5 percent. Corporate rates also will rise, giving the state an extra $6.8 billion a year, which lawmakers hope will quickly resolve their financial crisis. But is raising taxes really the best way to tackle a deficit in hard economic times? (Watch a Fox News discussion about Illinois' tax hike)

Why should taxpayers suffer for government stupidity? I'm sorry, says Brian Sullivan at Fox Business, but Illinois taxpayers should not be coughing up for the "foolish spending" of the past. This tax bombshell will undoubtedly do "more harm than good." Companies will flee to Indiana and Wisconsin, and those individuals "with the means to leave the state" will. Truly, Illinois lawmakers are "the worst in the country."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

It is tough medicine, but it will work: "Painful as it is," says Rick Newman in U.S. News and World Report, Illinois' tax hike will stave off "a bigger economic disaster." If the state had defaulted on its debt, "taxes would have to go a lot higher, with draconian cuts in services." Besides, "the price is not quite as high as it might sound." Illinois' new personal income tax rate of 5 percent is "still lower than rates in many other states."

"When a tax hike is good news"

What happens next is the important thing: The tax hike "hurts, no question," says Eric Zorn in the Chicago Tribune. But it's the only way to end the "accounting tricks and hand-waving assumptions" that got us into this mess in the first place. Now, our Democrat-led legislature must "find common cause with Republicans," reform unnecessary spending, and usher in "a new era of responsibility and transparency." Otherwise, it will be all pain and no gain.

"The can stops here — Democrats' tax hike aims at ending years of game-playing in Springfield."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’the week recommends The pasta you know and love. But ever so much better.

-

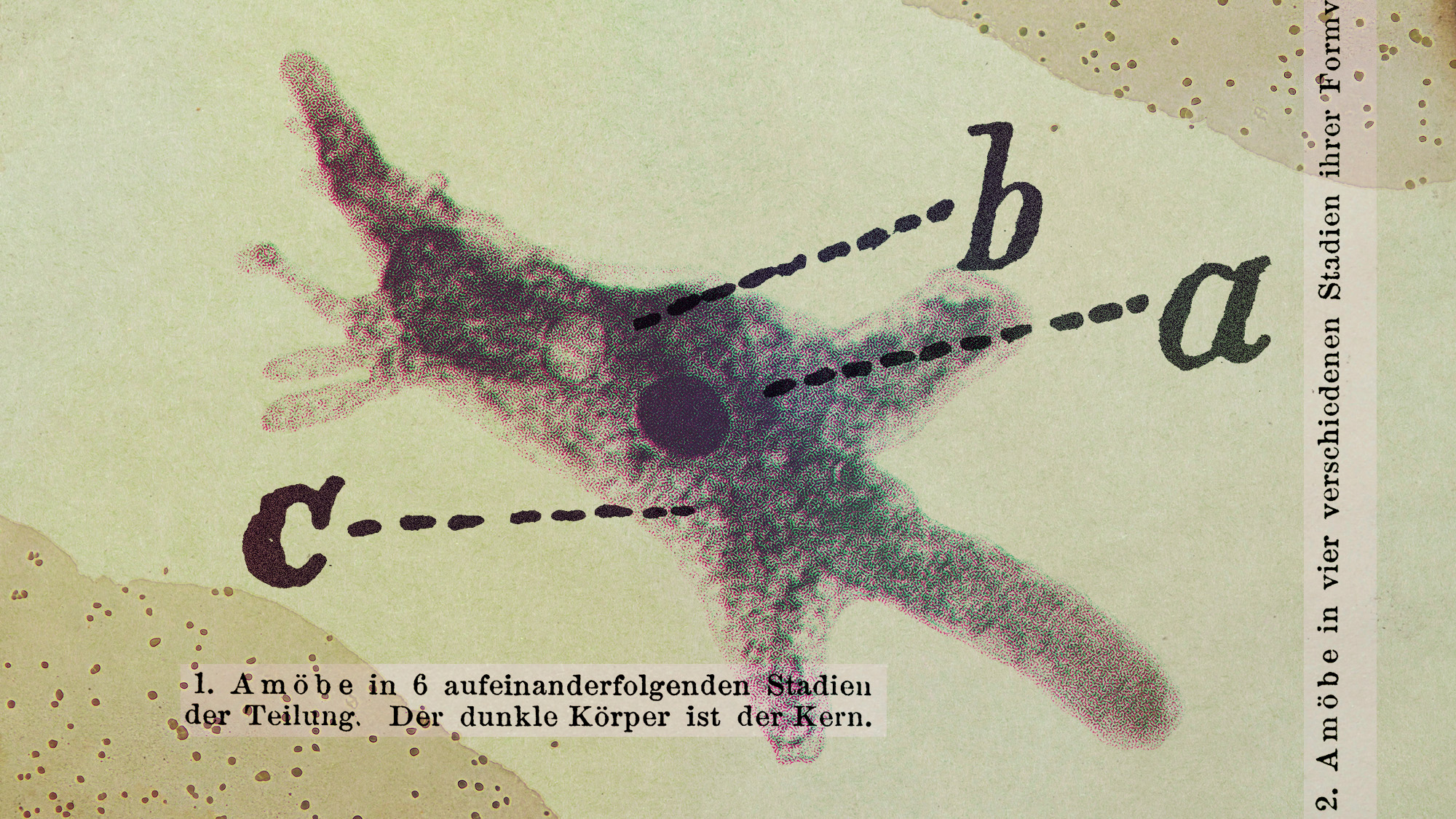

Scientists are worried about amoebas

Scientists are worried about amoebasUnder the radar Small and very mighty

-

Buddhist monks’ US walk for peace

Buddhist monks’ US walk for peaceUnder the Radar Crowds have turned out on the roads from California to Washington and ‘millions are finding hope in their journey’