Should Congress extend the home-buyer tax credit?

After one extension, the home-buyer tax credit aiming to boost housing demand is due to expire in a month. Will it do any good to extend it again?

The housing recovery is approaching a critical test, as the clock ticks toward the expiration of home-buyer tax credit at the end of April. The credit -- up to $8,000 for first-time homebuyers and $6,500 for some people trading up -- has already been extended once, in November, but there appears to be little appetite in Congress for renewing it again. With home sales and prices stabilizing but still weak, will it do any good to extend the credit again, or is it time to let buyers go it alone? (Watch a report about tax credits for first-time homeowners)

Extend it to avoid scaring buyers: The credit should be phased out gradually, says Yale economics professor Robert Shiller, as quoted by The New York Times. Buyers remain nervous, and losing the credit all at once will scare them. "You don’t make drug addicts go cold turkey."

"Spurt of home buying as end of tax credit looms"

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

End the subsidies and let market forces work: The White House has tried everything to prop up the housing market, says Larry Kudlow in National Review, including "mortgage modifications, foreclosure abatements, and tax credits. None of it has worked." Enough "failed government interventions" -- we need more foreclosures and lower prices so market forces can get housing back on track.

"More foreclosures will solve housing"

The effect is wearing off, anyway: As the first expiration date loomed last year, many people rushed to buy homes to take advantage of it, says Barbara Kiviat in Time, but even then Deutsche Bank only attributed 5 percent of home sales to the credit. This time, "the extension seems to have drummed up many fewer sales than the original credit." So maybe we won't miss it.

"Extending the home-buyer tax credit: up is down and down is up"

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

There could be more trouble ahead for housing: Even free market fanatics must admit home sales are unlikely to increase much in 2010 without government help, says Robert Hyder in TotalMortgage.com. Yet we're losing two important programs at once. Along with the loss of the homebuyer tax credit, the Federal Reserve purchase of $1.25 trillion in mortgage-backed securities is being completed. Mortgage rates will rise as a result, and that's bad news for the already "feeble" housing market.

-

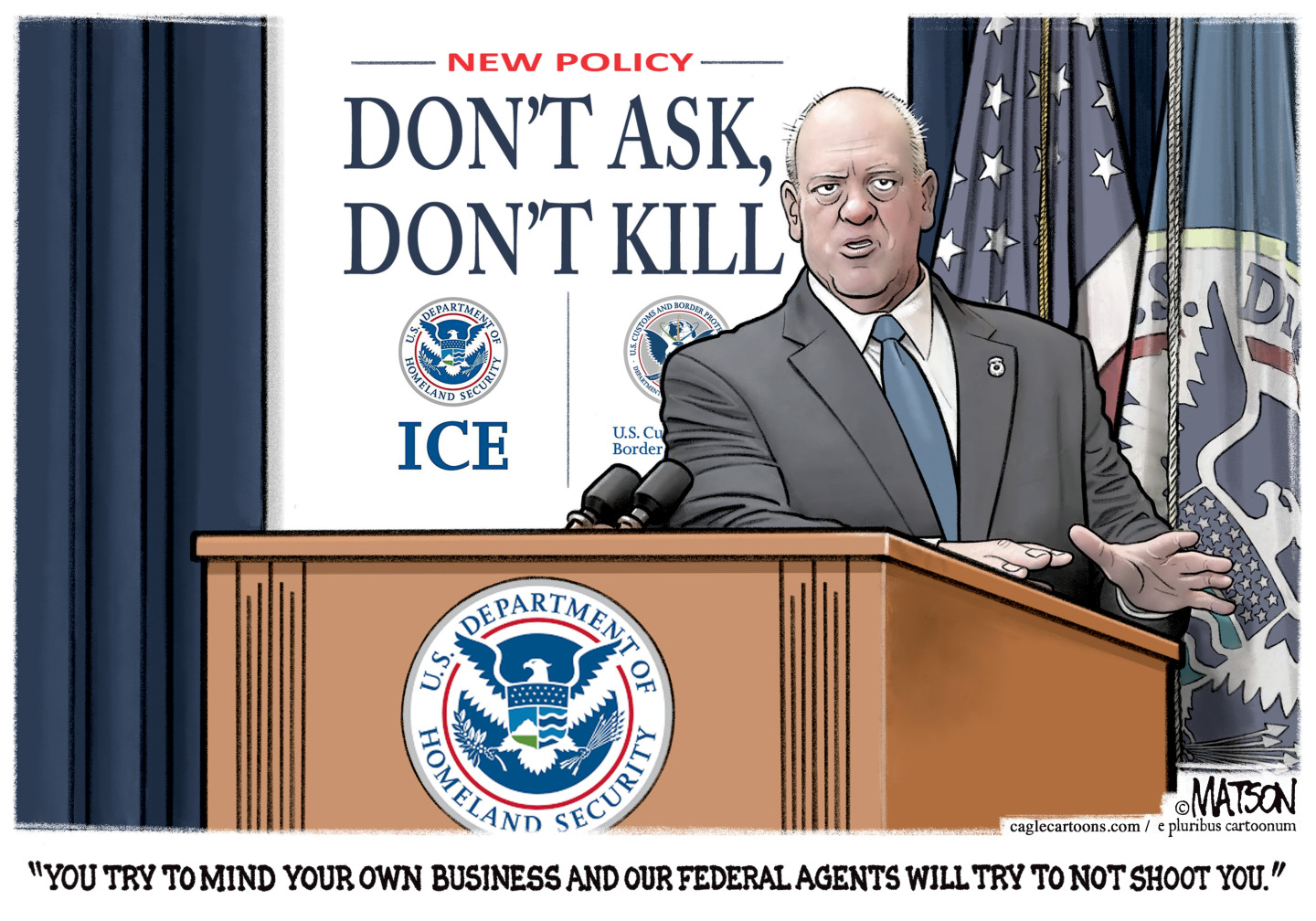

Political cartoons for February 1

Political cartoons for February 1Cartoons Sunday's political cartoons include Tom Homan's offer, the Fox News filter, and more

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history

-

Reforming the House of Lords

Reforming the House of LordsThe Explainer Keir Starmer’s government regards reform of the House of Lords as ‘long overdue and essential’