Family finances: Time to open up?

The economic crisis is rewriting the rules of etiquette—people are now more willing to talk about money.

“Money used to be like religion or sex: It wasn’t talked about in polite company,” said Megan K. Scott in the Associated Press. But the economic crisis is rewriting the rules of etiquette, and Americans are commiserating about their mounting debt and shriveling portfolios. “I think it lessens the anxiety” to talk about it, says Micki LeSueur, a Chicago property owner who has blogged about her financial troubles. “It doesn’t feel so isolating.” Nearly everyone has been affected by the ill economy, even the very well off. The suddenness of the economic crisis and the wide media coverage dedicated to credit card debt and mortgage foreclosures seems to be encouraging previously reticent people into “coming out of the closet about their financial troubles.”

Such newfound openness couldn’t come at a better time for most families, said Dayana Yochim in TheMotleyfool.com. “I’m not advocating throwing manners out the drive-through deposit window.” But there is value, financially and psychologically, in confiding in close friends and loved ones about the difficult financial decisions you’re faced with. If you have children at home, make them privy to dollars-and-cents discussions. “Do your kids know what it costs to put a roof over their heads, and macaroni and cheese in their tummies?” Talk to them about the value of a dollar now, and they’ll have a better shot at being fiscally responsible adults.

Honesty is even more important—and more difficult—between parents and grown children, said Ron Lieber in The New York Times. Many parents inevitably will be called on to help their offspring through these tough times—and, likewise, many children will have to bail out their past-retirement parents. But too often, “grown children don’t know precisely how the devastation in the markets has affected their parents’ portfolio, and the older parents don’t know what their children’s monthly debt payments are.” Ask tactfully: Try putting your concerns in writing, and make clear that you aren’t questioning anyone’s judgment or trying to take control. Talking about steep investment losses or unwieldy mortgages will likely be uncomfortable. “Silence, however, is good for no one.”

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

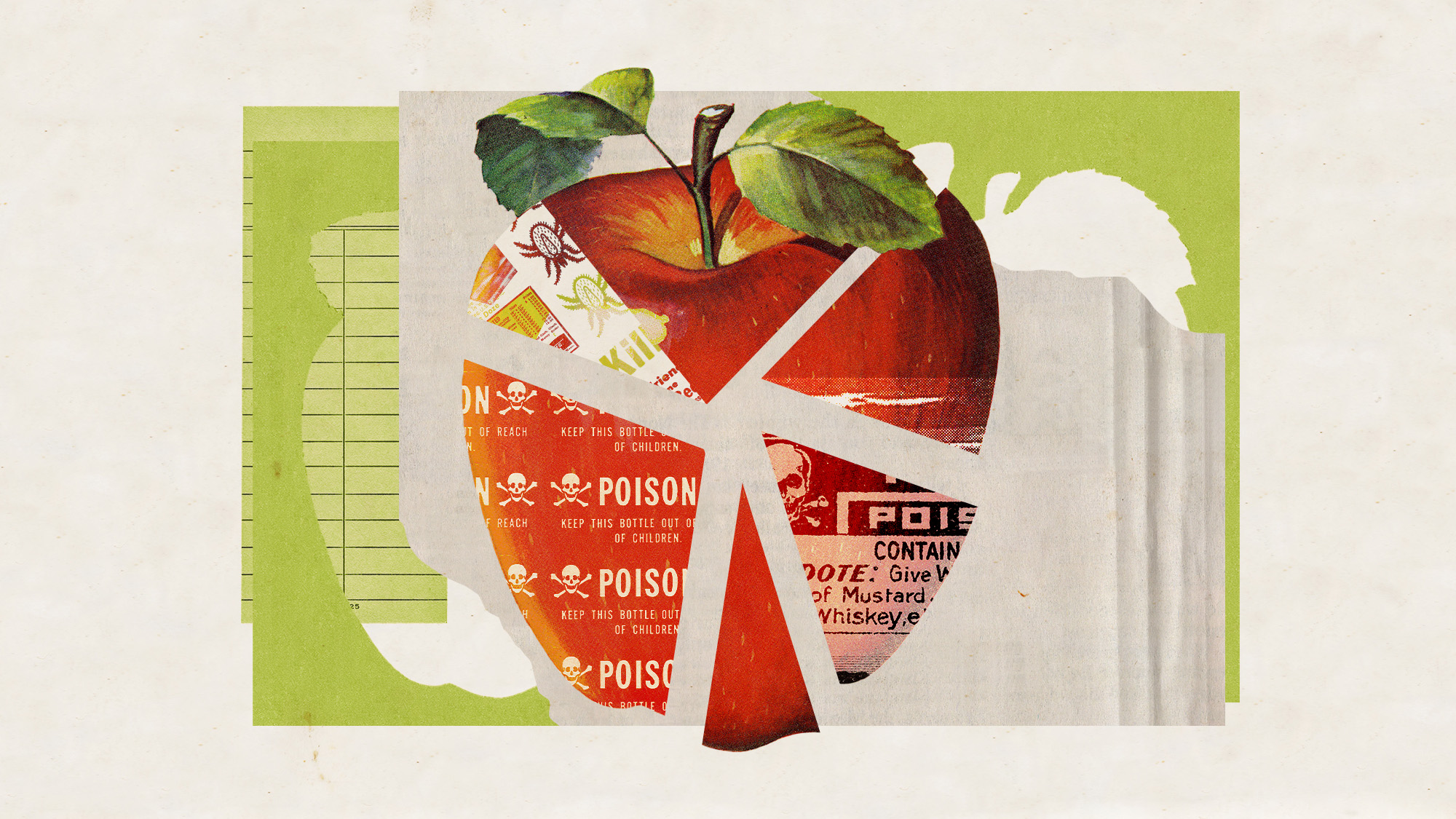

Europe’s apples are peppered with toxic pesticides

Europe’s apples are peppered with toxic pesticidesUnder the Radar Campaign groups say existing EU regulations don’t account for risk of ‘cocktail effect’

-

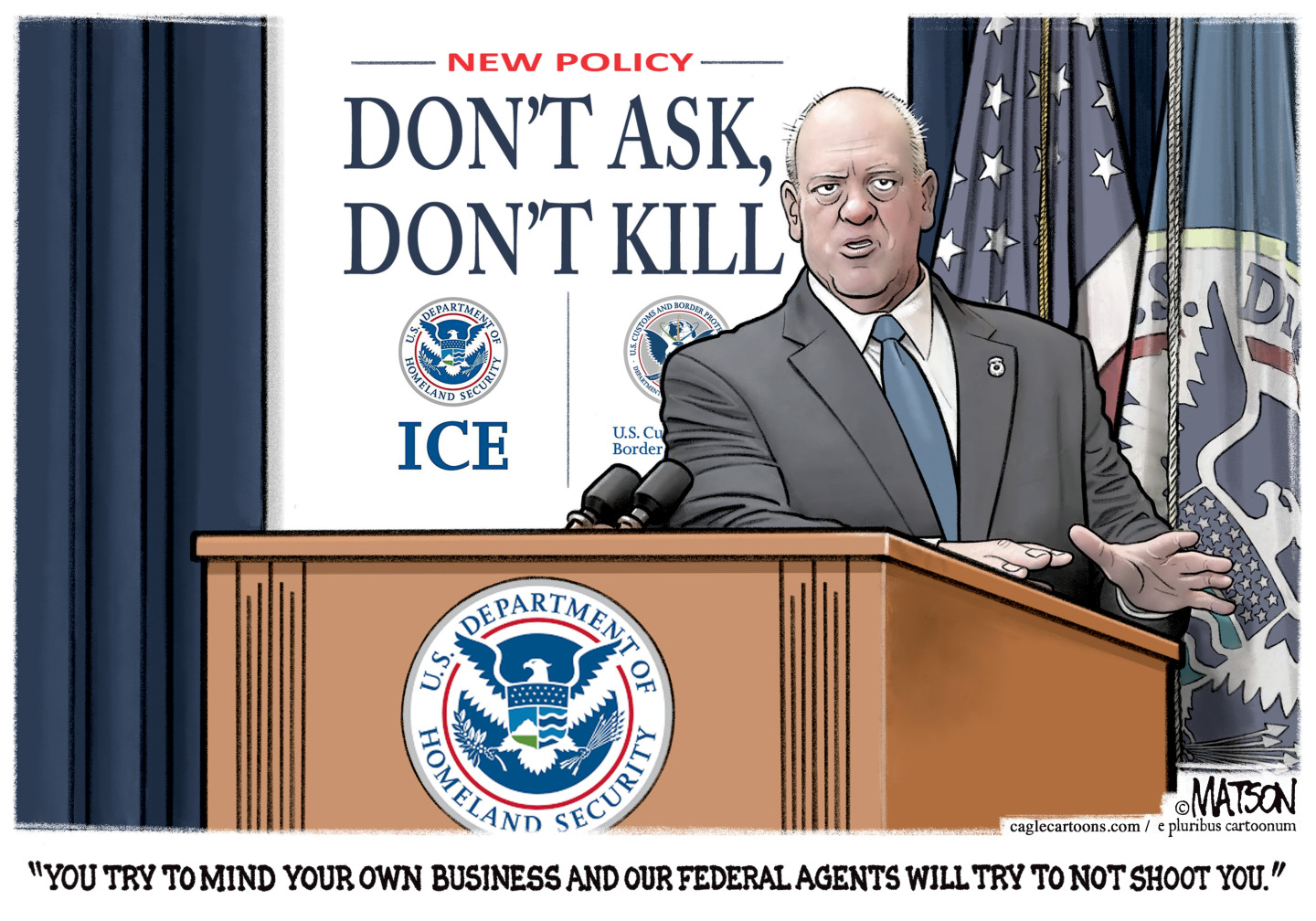

Political cartoons for February 1

Political cartoons for February 1Cartoons Sunday's political cartoons include Tom Homan's offer, the Fox News filter, and more

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history