Halliburton

Halliburton outbids other suitors for British oil services firm Expro. The Gap sees a fall in sales but a promising growth in profits. And an uncertain summer kills the

NEWS AT A GLANCE

Halliburton bids for British rival Expro

Oil services giant Halliburton offered $3.38 billion for smaller British competitor Expro International, topping an April takeover bid by private equity firm Candover and Goldman Sachs. (MarketWatch) Oil services firms have benefited as high oil prices are spurring oil exploration and well maintenance. Expro's key asset is an experimental technology to fix oil wells from ships, not rigs, which would save money. (Reuters) "This is not over as I think Candover will come back with another bid," said Jane Coffey at Royal London Asset Management. "I expect then Halliburton to top Candover's bid and become the winner, unless there's another industrial player," she added. (Bloomberg)

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The Gap snapping back

The Gap Inc., the largest U.S. clothing retailer, reported a 40 percent rise in quarter profit, to $249 million, beating analysts' expectations. But revenue missed Wall Street forecasts, dropping 5 percent, to $3.38 billion. Same-store sales dropped 11 percent, the 15th consecutive quarterly decline. (AP in Yahoo! Finance) Shares rose 2 percent in extended trading. The rise in profit was attributed to an ongoing turnaround effort by CEO Glenn Murphy, who has focused on closing unprofitable stores and cutting inventory to prevent profit-crimping steep discounts. (Reuters) "Half of the battle is knowing what their problem is, and Gap has finally figured out what theirs is," said analyst Christine Chen at Needham & Co. (Bloomberg)

Ford looks ahead, warily

Ford Motor Co. scrapped its goal of returning to profitability in 2009, amid high gas prices and a related drop in truck and SUV sales. Ford, General Motors, and Chrysler rely on pickups and SUVs for much of their profits, and Ford now forecasts decade-low demand for these vehicles next year. (The New York Times) Ford said it would cut production in response to the slower sales. "This is an embrace of reality," said analyst Pete Hastings at Morgan Keegan. (Reuters) In good news for GM, striking workers at parts supplier American Axle and Manufacturing approved a new contract with pay cuts. American Axle mostly makes parts for pickups and SUVs. (AP in CNNMoney.com)

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Selling a tough summer

For municipal tourism promoters, the crucial summer traveling season is approaching fast—and with some new challenges. High gas prices, reduced airline capacity, and the broader economic slump have created something of a perfect storm for the domestic tourism industry. And that means that in ads, the soft sell is being replaced by harder-hitting pitches. The Las Vegas visitors’ bureau, for example, has dropped the playful “What happens here stays here” slogan for the more direct “Do Vegas right now.” “The travel pie may shrink in 2008,” said Gary Sain at the Orlando, Fla., tourism bureau. “Our job is to get a disproportionate share of the pie.” (The New York Times)

-

The best dark romance books to gingerly embrace right now

The best dark romance books to gingerly embrace right nowThe Week Recommends Steamy romances with a dark twist are gaining popularity with readers

-

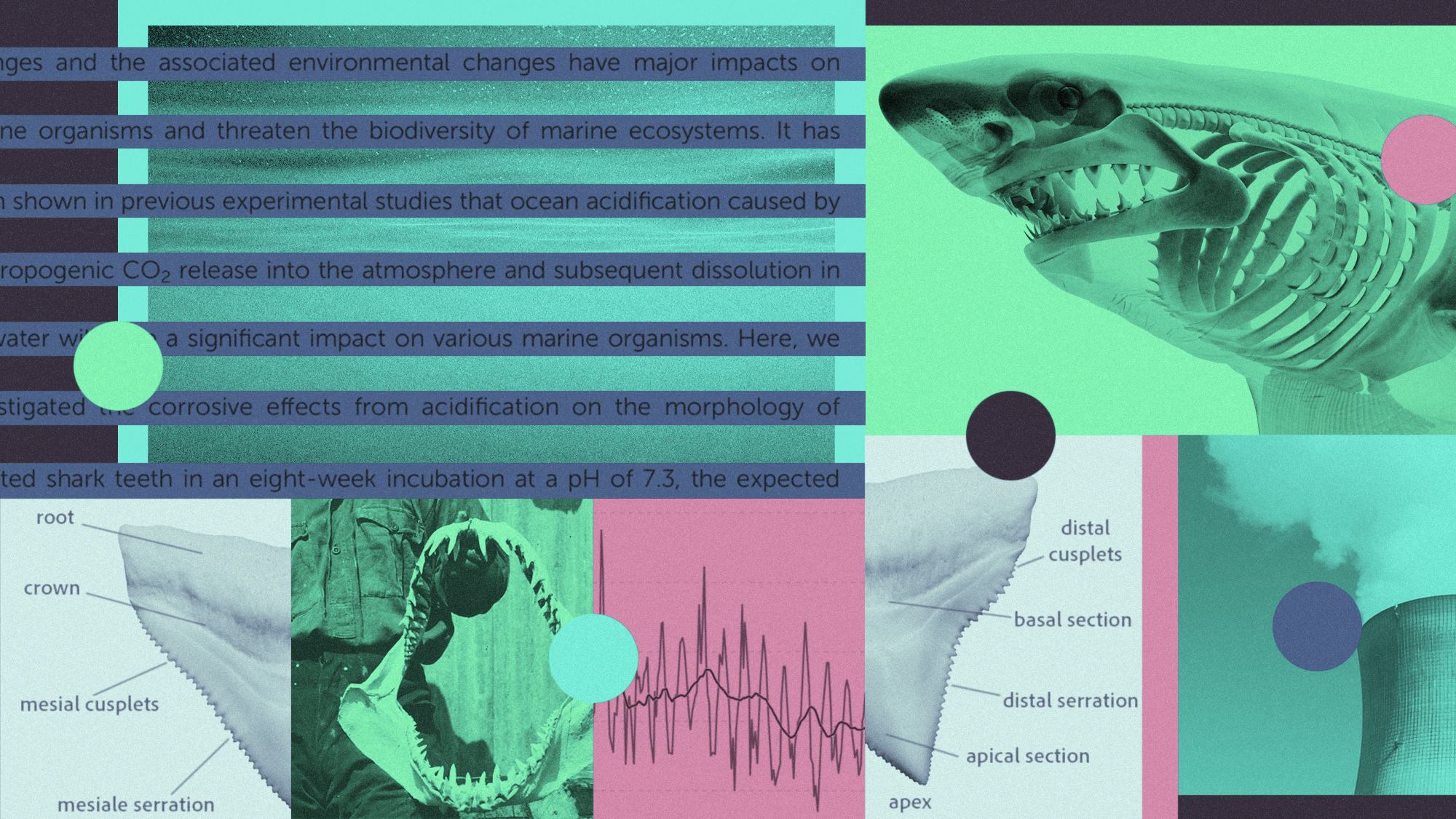

The ocean is getting more acidic — and harming sharks’ teeth

The ocean is getting more acidic — and harming sharks’ teethUnder the Radar ‘There is a corrosion effect on sharks’ teeth,’ a study’s author said

-

6 exquisite homes for skiers

6 exquisite homes for skiersFeature Featuring a Scandinavian-style retreat in Southern California and a Utah abode with a designated ski room