If the Tea Party hates Wall Street, why isn't it protesting GOP efforts to dismantle Dodd-Frank?

As Congress boosts the chances of a bank bailout, the Tea Party has been awfully quiet

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

For a movement supposedly founded on opposition to the Wall Street bailout, the Tea Party’s people in Congress seem awfully keen to take the reins off the financial sector.

On Wednesday, House Republicans amended the 2010 Dodd-Frank financial reform bill to delay for two years a requirement that big banks sell off risky debt bundles that entangle them with hedge funds and private equity firms. At the end of last year, they rolled back a provision that would’ve forced banks to trade credit default swaps using subsidiaries that aren’t federally insured. The GOP is also taking a run at lessening federal oversight over certain private equity activities and derivatives trading. House Financial Services Committee Chairman Jeb Hensarling (R-Texas) — a Tea Party ally — has spearheaded many of the efforts.

While most of Dodd-Frank remains intact, the moves represents a death-by-a-thousand-cuts strategy to allow Wall Street to engage in riskier behavior. And as the country has learned the hard way, risky behavior by Wall Street tends to create financial crises, and lawmakers pretty much always respond to those crises with bailouts. And while the Tea Party is a complex beast, fury over the 2008 TARP bill, which handed hundreds of billions of dollars to Wall Street, was clearly one of its founding impulses.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

So what gives? Why nary a peep from the Tea Party as the GOP effectively sets about trying to make a sequel to TARP more likely?

A fair amount has already been written on what makes the Tea Party tick, some of it diagnosing the movement as revanchist or racist. Other work has found the movement to be considerably more complex. But the importance of class should not be discounted. By all accounts, self-identified Tea Party members are noticeably more likely to earn over $50,000 and over $80,000 than the average American. They’re much more likely to be over 45. They’re more likely to hold a college degree. They are more likely to rank their financial situation as “very” or “fairly” good, and much more likely to oppose the minimum wage, social safety net spending, mortgage relief, capital gains taxes, and government provision of jobs.

Of particular note for this subject, Tea Party members are way more likely than the average American to trust banks and credit card companies to police themselves with regard to fair treatment of customers, versus government oversight.

In short, while it isn’t a bunch of Jamie Dimons, the Tea Party on average enjoys considerably more economic power and privilege than your everyday voter. As Michael Lind put it, they are “the ‘local notables’ — provincial elites whose power and privileges are threatened from above by a stronger central government they do not control and from below by the local poor and the local working class.”

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

That class position is important to understanding how the Tea Party has responded to the 2008 collapse, because class played a huge role in how people fared in its aftermath. Older Americans who did lose their jobs have faced an especially brutal situation, but employment for older Americans with college degrees was not hit nearly as hard as for the country as a whole. Also keep in mind that Tea Party members are more likely to be retired, and educated white Americans are much more likely to have built up the kind of wealth necessary to weather such crises.

The point is that, demographically speaking, Tea Party members may have been hurt by the 2008 recession, but they weren’t devastated by it. It’s for other groups of Americans — less educated, poorer, nonwhite — for whom Wall Street shenanigans and the recessions they induce are existential threats.

Meanwhile, because of their class position, the Tea Party also shares with Wall Street a hostility to big government and regulation, broadly speaking. From a self-interested standpoint, then, it actually makes a fair amount of sense for the Tea Party to oppose both regulating Wall Street and bailing it out: if the banks made bad bets, then let them fail and let the chips fall where they may. That, after all, is how capitalism is supposed to function.

Much of the American right’s understanding of economics and its relationship to government is characterized by a lack of desperation. The idea that questions of security or starvation, dignity or destitution, could trump the abstract principles of “how capitalism works,” is just absent. The Tea Party arguably views Wall Street not as manipulative overlords, but as competitors in the sport of capitalism. Richer and more powerful competitors, obviously. But competitors still. And while they don’t want their competitors getting unfairly bailed out by the referees, they don’t want the game to be changed, either.

It is for less fortunate and less privileged Americans that the game itself is the problem.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

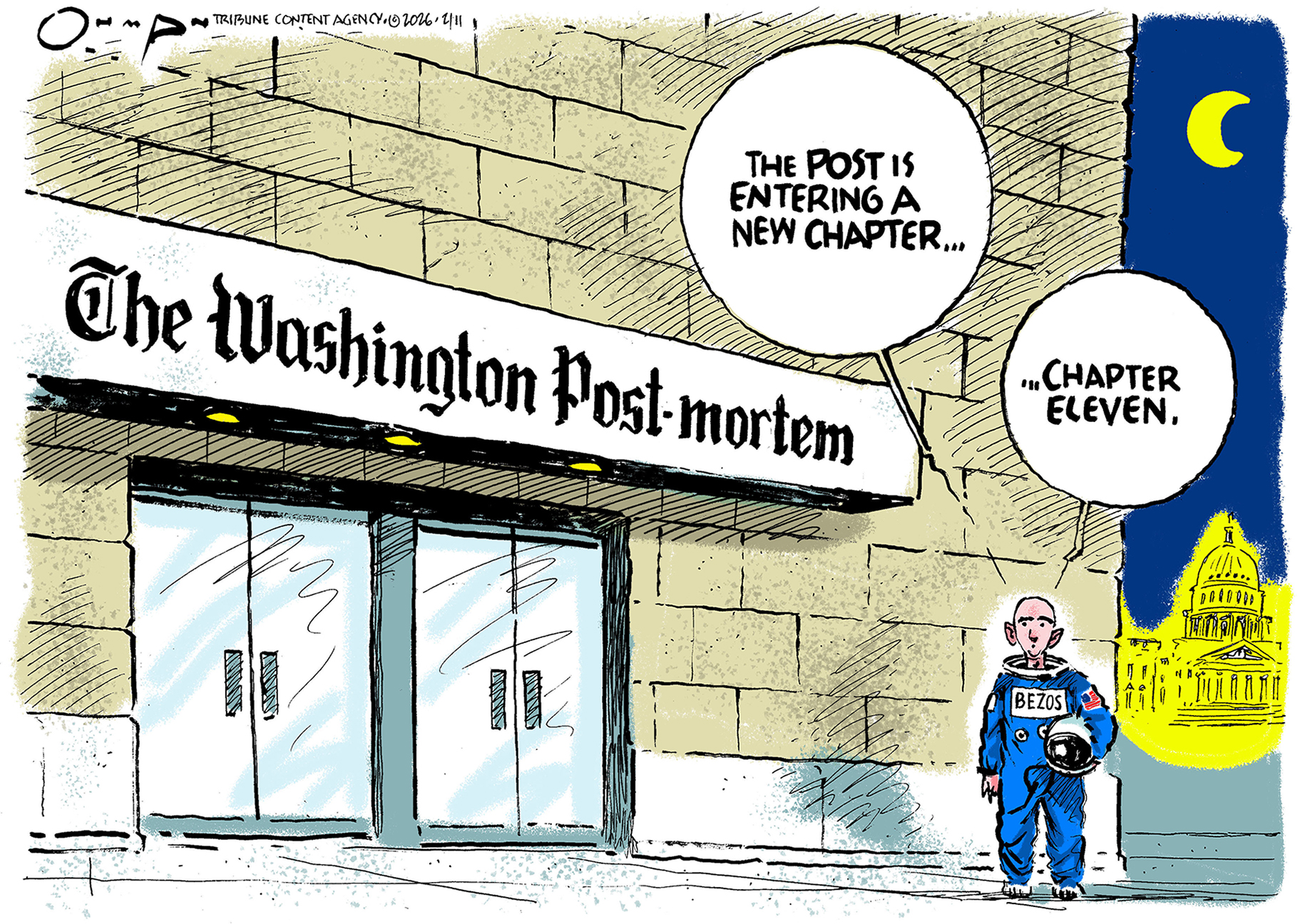

5 calamitous cartoons about the Washington Post layoffs

5 calamitous cartoons about the Washington Post layoffsCartoons Artists take on a new chapter in journalism, democracy in darkness, and more

-

Political cartoons for February 14

Political cartoons for February 14Cartoons Saturday's political cartoons include a Valentine's grift, Hillary on the hook, and more

-

Tourangelle-style pork with prunes recipe

Tourangelle-style pork with prunes recipeThe Week Recommends This traditional, rustic dish is a French classic

-

Late night hosts joke about Trump's forced exodus from Facebook to blog

Late night hosts joke about Trump's forced exodus from Facebook to blogSpeed Read

-

Fox News admits Biden doesn't actually want to cancel meat. Late night hosts pounce anyway.

Fox News admits Biden doesn't actually want to cancel meat. Late night hosts pounce anyway.Speed Read

-

Manhattan D.A. will stop prosecuting sex workers, not their clients, pimps, or sex traffickers

Manhattan D.A. will stop prosecuting sex workers, not their clients, pimps, or sex traffickersSpeed Read

-

John Oliver explains personal bankruptcy, how credit card lobbyists and lawyers make it much worse

John Oliver explains personal bankruptcy, how credit card lobbyists and lawyers make it much worseSpeed Read

-

John Oliver explores problems with U.S. nursing homes and long-term care, suggests you pay attention

John Oliver explores problems with U.S. nursing homes and long-term care, suggests you pay attentionSpeed Read

-

John Oliver tries to explain whether you should worry about the enormous U.S. national debt

John Oliver tries to explain whether you should worry about the enormous U.S. national debtSpeed Read

-

Late night hosts laugh at the giant ship blocking the Suez Canal, chide Fox News for fake Kamala Harris scandal

Late night hosts laugh at the giant ship blocking the Suez Canal, chide Fox News for fake Kamala Harris scandalSpeed Read

-

Utah governor signs bill requiring porn blocking on all new smartphones and tablets

Utah governor signs bill requiring porn blocking on all new smartphones and tabletsSpeed Read