The euro's spectacular fall

Everything you need to know, in four paragraphs

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Planning a trip to Europe this summer? "If so, congratulations: The world's financial markets have smiled upon you," said Jordan Weissmann at Slate. "The euro is in the midst of a spectacular free fall" — down more than 12 percent against the dollar since the start of January. Last year, a euro was worth as much as $1.39; this week, it was trading around $1.05, a 12-year low. Some financial experts project the shared currency will continue to slide, hitting parity with the dollar by the end of the year, before going as low as 85 cents by 2017. "For American tourists, buying a glass of wine in Paris is becoming cheaper by the day."

Interpreting changes in currency markets is notoriously difficult, said Matt O'Brien at The Washington Post. The reason for the euro's tumble, though, is clear. "To boost Europe's extraordinarily weak economy," the European Central Bank has for months been printing money and buying heaps of bonds, just as the Federal Reserve did during several rounds of quantitative easing following the 2008 financial crisis. That's led interest rates to fall across Europe — sometimes into negative territory — all while short-term interest rates in the U.S. have steadily crept northward, thanks to the improving U.S. economy. Big investors, especially those in Europe, have responded by moving their money out of euros and into dollars. "Think about it like this. Would you rather buy a German 10-year bond that pays 0.25 percent or a U.S. 10-year bond that pays 2.1 percent?" And "voilà," that's exactly how the euro falls 24 percent against the dollar in less than a year.

From a European standpoint, a tumbling euro "certainly sounds like a bad thing," said Mike Bird at Business Insider. But it's actually "fantastic news for Europe's recovery." That's because a weaker currency makes European exports, which account for more than a quarter of the continent's GDP, much cheaper for overseas buyers, which in turn boosts eurozone economic growth. "French and Italian cars, German machine tools, and Irish drugs" have all become dramatically more affordable in the last few months. You can be certain that's music to the ears of long-struggling CEOs across the continent. The weaker euro is "the bloc's best hope for growth right now."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

On the flip side, the dollar is stronger than it's been in years, said Paul Krugman at The New York Times, and that's "bad for America." Sure, a strong dollar translates into cheaper imports, which can be a blessing for U.S. consumers. But it also makes it harder for U.S. manufacturers to sell their goods overseas. And if corporations respond to these headwinds by cutting back on hiring, the fragile economic recovery could quickly hit the skids. That's why the Federal Reserve needs to be extra careful about raising interest rates, said Danielle Kurtzleben at Vox. "Raising rates could make the dollar even stronger, and that could both be a further drag on inflation and weigh on growth." A cheaper European vacation certainly sounds nice. But not quite as nice as a real and lasting U.S. recovery.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Trump’s EPA kills legal basis for federal climate policy

Trump’s EPA kills legal basis for federal climate policySpeed Read The government’s authority to regulate several planet-warming pollutants has been repealed

-

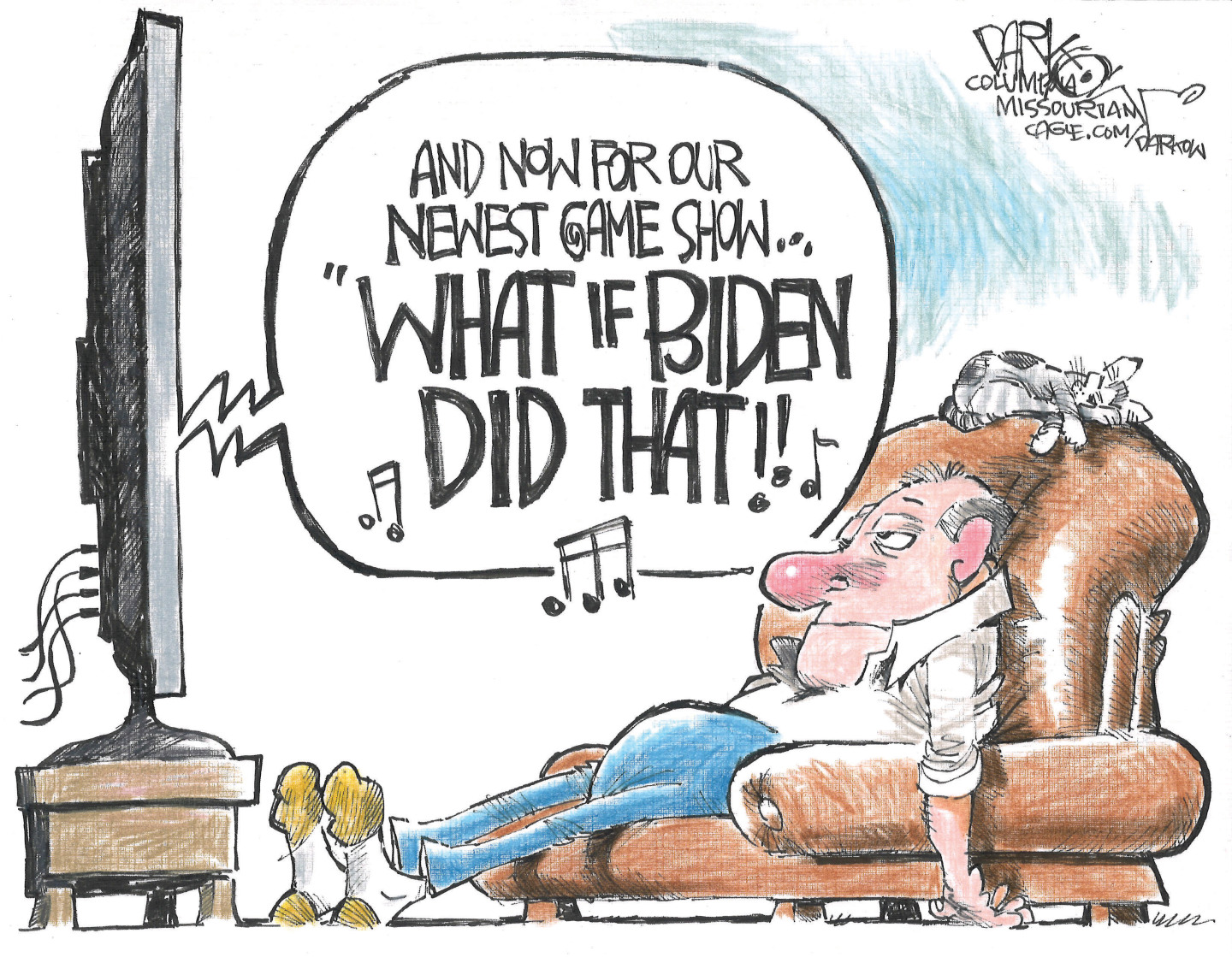

Political cartoons for February 13

Political cartoons for February 13Cartoons Friday's political cartoons include rank hypocrisy, name-dropping Trump, and EPA repeals

-

Palantir's growing influence in the British state

Palantir's growing influence in the British stateThe Explainer Despite winning a £240m MoD contract, the tech company’s links to Peter Mandelson and the UK’s over-reliance on US tech have caused widespread concern

-

The pros and cons of noncompete agreements

The pros and cons of noncompete agreementsThe Explainer The FTC wants to ban companies from binding their employees with noncompete agreements. Who would this benefit, and who would it hurt?

-

What experts are saying about the economy's surprise contraction

What experts are saying about the economy's surprise contractionThe Explainer The sharpest opinions on the debate from around the web

-

The death of cities was greatly exaggerated

The death of cities was greatly exaggeratedThe Explainer Why the pandemic predictions about urban flight were wrong

-

The housing crisis is here

The housing crisis is hereThe Explainer As the pandemic takes its toll, renters face eviction even as buyers are bidding higher

-

How to be an ally to marginalized coworkers

How to be an ally to marginalized coworkersThe Explainer Show up for your colleagues by showing that you see them and their struggles

-

What the stock market knows

What the stock market knowsThe Explainer Publicly traded companies are going to wallop small businesses

-

Can the government save small businesses?

Can the government save small businesses?The Explainer Many are fighting for a fair share of the coronavirus rescue package

-

How the oil crash could turn into a much bigger economic shock

How the oil crash could turn into a much bigger economic shockThe Explainer This could be a huge problem for the entire economy