How a robot can help you retire

Three top pieces of financial advice — from the rip-off of rental car insurance to the value of health savings accounts

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Here are three top pieces of financial news and advice:

Rental car insurance isn't worth it

Buying rental car insurance might feel like a "prudent, adult move," but it usually isn't, said Joseph Stromberg at Vox. If you own a car, your insurance plan likely covers the two most common types of protection offered by rental companies: a loss damage waiver, which covers damage to the vehicle, and liability insurance, which covers damage to other cars and drivers. Additionally, most credit card companies automatically offer collision insurance for vehicles rented with their cards. You can also pass on personal accident insurance and theft protection, which ought to be taken care of by your health and homeowners insurance. Bottom line: Consult all your options "before you get to the rental counter."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

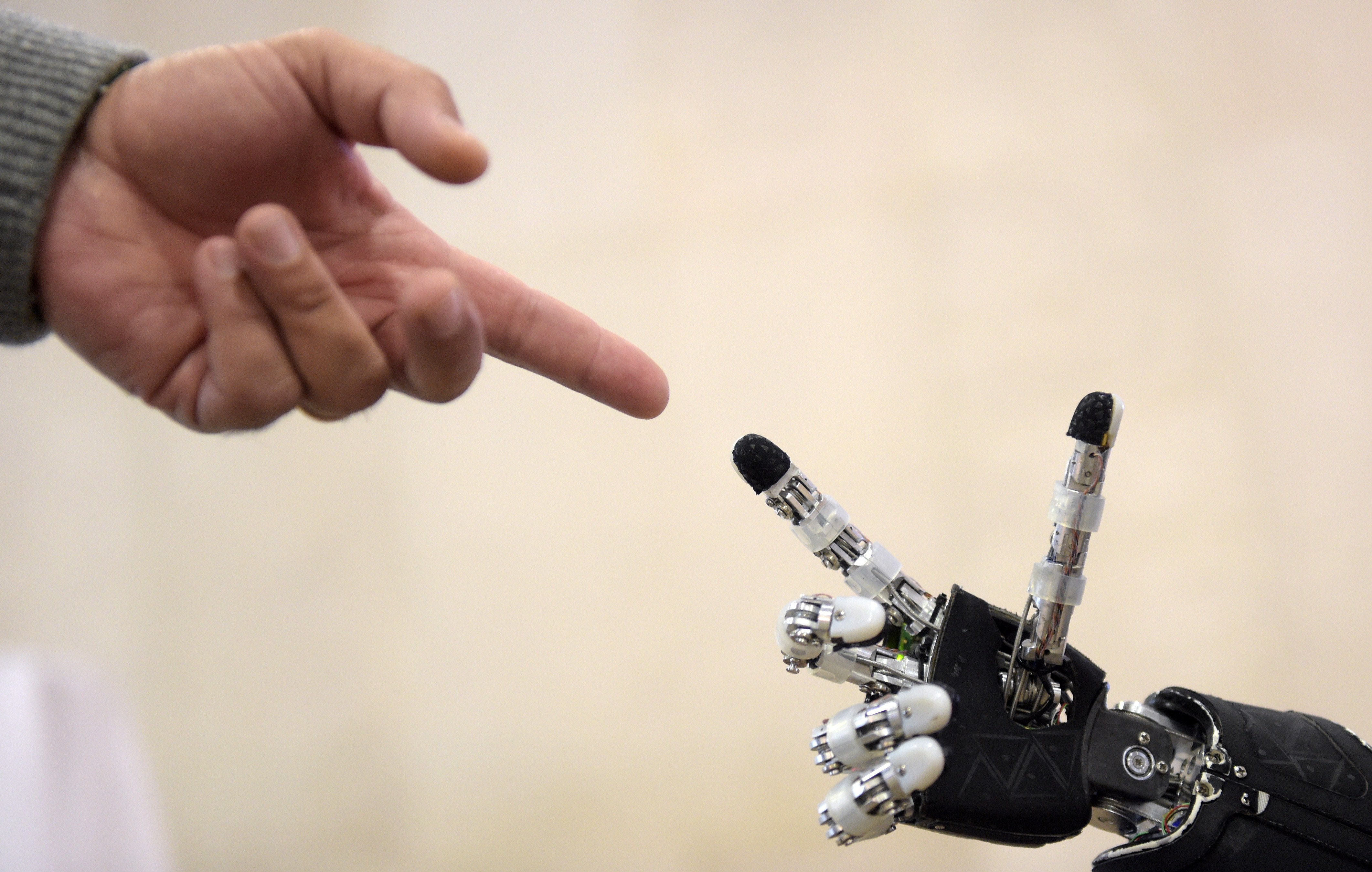

Retiring with a robo-adviser

"Robo-advisers" that provide computer-generated financial advice are catching on with retirees, said Eleanor Laise at Kiplinger. The automated advisers are cheaper than their human counterparts, who typically charge 1 percent or more of assets, but there are trade-offs. Some robo-advisers only build new portfolios from cash, meaning investors will have to sell off some of their current holdings, potentially triggering capital gains taxes. Investors should also investigate the range of investments recommended. Retirees looking for advice on drawing down their accounts "will find big differences" among the automated services. Some will craft a customized drawdown strategy, but others "can't even handle IRA-required minimum distributions."

When HSAs trump 401(k)s

"When it comes to saving for retirement, there may be a better place for your next dollar than your 401(k)," said Katie Lobosco at CNN. A health savings account, offered with most high-deductible health insurance plans, provides many of the same benefits as a traditional retirement account. Like a 401(k), the money in an HSA can be invested in stocks and bonds, and companies will often make contributions to your account. Contributions for HSAs are tax-free, and so are withdrawals. You can also withdraw from your HSA at any time without penalty, as long as the money is used for medical expenses. Contribution limits are lower, however; a family can contribute up to $6,650 a year. But with couples spending an average of $220,000 on health care in retirement, an HSA can be a smart way to save for future health costs.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Local elections 2026: where are they and who is expected to win?

Local elections 2026: where are they and who is expected to win?The Explainer Labour is braced for heavy losses and U-turn on postponing some council elections hasn’t helped the party’s prospects

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict