China's turmoil shows how the world is turning into a bizarro European Union

The global economy is more integrated than ever. And what it is suffering from is a lack of consumption.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Here's one big picture takeaway from the recent global financial freak-out occasioned by China's uncertain economic future: It's becoming less and less useful to think of national economies as separate things.

China may have a considerable trade surplus overall, but its gangbuster construction and industrial expansion also require raw material: enormous amounts of steel from Brazil, iron ore from Australia, oil from Indonesia, and god-knows-what from everywhere else. So as China slows, other developing countries are slowing too.

The ups-and-downs of the U.S. dollar are also taking a toll on the developing world, as investment goes rushing into them and then back out again. Europe is grappling with its own grinding economic slump and the Greek crisis, while Russia appears headed for a recession too.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Meanwhile, yields on government bonds across the advanced world are headed for the basement, suggesting global investors are looking for any safe spot they can find to park their money.

In short, the whole globe is beginning to look like a bizarro-world version of the European Union: effectively one economy, but with no coherent policy authority capable of dealing with its problems. And what this bizarro-world EU seems to be suffering from more than anything is a lack of consumption.

At the biggest-picture level, economics is about the balancing act between production and consumption. You can never really have overproduction in the technical sense — think of a barter economy, in which everything that's produced is also the stuff with which you buy everything else that's produced. But economies use money, and that means you can have runs on the money supply itself: People hoard money for its own sake, rather than using it to make economic exchanges. The result is overproduction in practice, if not in theory — and at the end of the day this is all a recession is, either at the national or the global level.

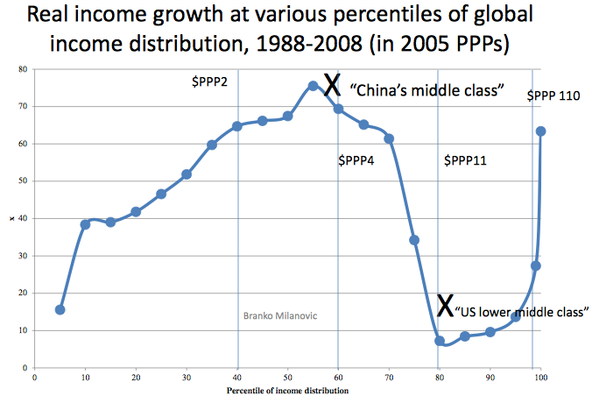

The background story here is that the distribution of income growth around the world since the late 1980s has been rather odd. The bottom two-thirds of the globe made out quite well, as did the global elite. But the top third below the elite — the global upper class, which shakes out to "most lower- and middle-class Americans and Europeans" — did really poorly:

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

(Graph courtesy of Branko Milanovic, via Paul Krugman.)

In one sense, it's fair to ask if this is really such a big deal. Most of the world is way poorer than even the lowest American, so we should want to prioritize their income prospects. The problem is the global upper class also supplies the bulk of the world's consumption: If their incomes tank, it's not clear who's going to keep buying all the stuff that was produced so the bottom two-thirds could raise their incomes.

Arguably, this happened because of rising inequality in the advanced world. The elites are hoarding tons of money — primarily through a voracious and out-of-control global financial system — that should've gone to the global upper class. Such a redistribution would have smoothed out the curve in the graph above. (The far right end of the blue line above should be considerably lower, while the trough just to its left should be considerably higher.)

The world appears to be running out of people to buy enough stuff, especially when you consider that a large portion of China's recent growth was driven by debt — state-run companies borrowing to produce more of all sorts of goods in quantities greater than the global economy could handle. Europe is in no position to help. And America's recovery, while real, is too tepid to even boost the domestic economy back to solid growth, much less to carry the rest of the world with it. If China's contraction proves severe enough — still, thankfully, an open question — there will be no contenders left.

So if we want to do something about this, what do we do?

Unlike the countries within the European Union, Europe as a whole and America still thankfully control their own currencies. But as the yields on their bonds show, those currencies are beginning to behave more alike. The benchmark interest rate in the United States has been at zero for years, and the eurozone recently got there as well. Quantitative easing has been a mixed success at best, so it's not entirely clear how much looser it can get.

So if looser monetary policy is going to save us, China itself remains the likeliest bet. It still has a fair amount of room to cut its interest rates before reaching zero. And even if its 7 percent growth figure is propaganda, the real number is almost certainly well above America and the rest of the West. The chances that China pulls itself out of this mess are still high.

The other option is debt spending. The goal here, after all, is to move more money down to the broad everyday populations of Europe, America, and China so they can start spending again. (The most radical reforms of monetary policy being proposed would do the same thing.) China already has a debt problem, and it's not clear its political institutions are up to the task of directing the spending properly anyway. Europe has no continent-wide fiscal policy — that's still governed country to country — so it couldn't move sufficient money even if it wanted to.

America is the only country that has both a big enough population to get the job done, and one federal fiscal policy overseeing that entire population. Contrary to popular opinion, we have enough room to take on scads more debt. And the behavior of international bond yields makes it clear the financial markets are begging someone to borrow lots more.

Obviously, trying to turn America into an engine for global consumption wouldn't do our trade balance any favors. But the whole idea here would be to pump up U.S. demand so high that its effect on the economy would overwhelm any drag from a bigger trade deficit. The best thing we could do with the borrowed money would be to just cut every American a check. But there are more traditional policies that could come close to achieving the same result.

Of course, even this idea is pretty unrealistic, politically speaking. What's sobering is that it's arguably more realistic than the alternatives.

So we should all be hoping China gets its act together and pulls out of this on its own.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

Touring the vineyards of southern Bolivia

Touring the vineyards of southern BoliviaThe Week Recommends Strongly reminiscent of Andalusia, these vineyards cut deep into the country’s southwest

-

American empire: a history of US imperial expansion

American empire: a history of US imperial expansionDonald Trump’s 21st century take on the Monroe Doctrine harks back to an earlier era of US interference in Latin America

-

Elon Musk’s starry mega-merger

Elon Musk’s starry mega-mergerTalking Point SpaceX founder is promising investors a rocket trip to the future – and a sprawling conglomerate to boot