Corporations have a 1 percent problem, too

The top 1 percent of corporations are doing great in this economy. But the other 99 percent? Not so much.

Usually when we use "corporations" and "inequality" in the same sentence, we're talking about how the latter benefits the former. We'll say that corporations and the people who run them are getting richer while everyone else is getting poorer. And there's a lot of truth to that. But it's also true that there's a big inequality problem among corporations.

For instance, you've probably heard about how corporations are hoarding well over a trillion in cash reserves that they're not using. What people mean by "cash reserves" here is money in business checking accounts, or in highly liquid assets like money market funds — basically the next best thing to having a pile of dollar bills lying around.

S&P Global Ratings released a report last week looking at the finances of over 2,000 American companies — excluding the financial sector — and found their cumulative cash reserves have reached a staggering $1.84 trillion. The kicker is that the top 25 companies — roughly the top 1 percent of U.S. corporations — control 51 percent of that cash. And in a development that mirrors the "fractal inequality" amongst individual Americans, just the top five companies — Apple, Microsoft, Alphabet (Google's parent corporation), Cisco, and Oracle — controlled a third.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Moody's released its own report around the same time that found slightly different numbers, but effectively the same distribution.

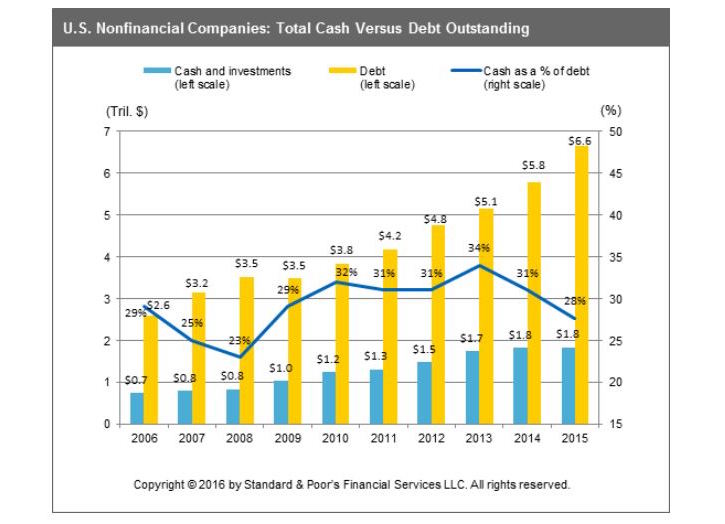

But what's really creepy is the debt situation. U.S. companies' total cash reserves may be up to $1.84 trillion, but their total debt burden has hit $6.6 trillion. Moreover, the debt has been growing at a much faster rate than the cash reserves over the last decade.

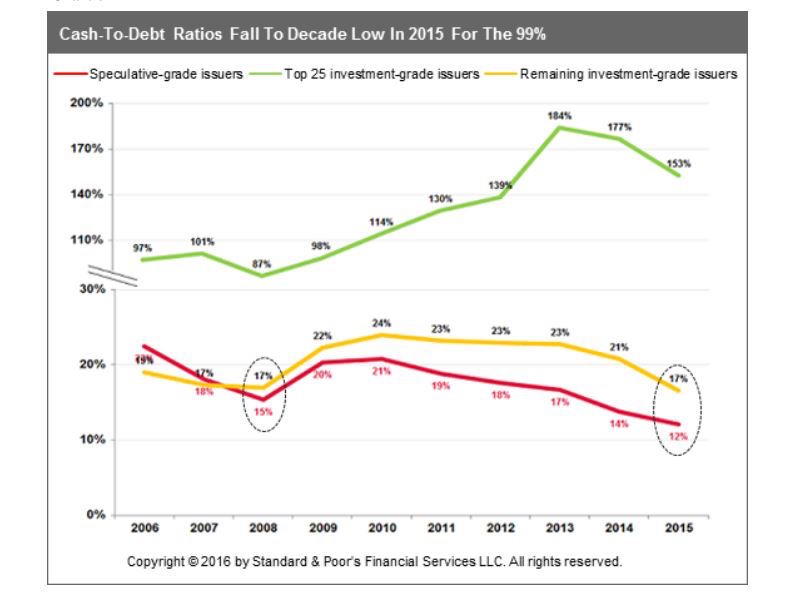

And inequality among companies is just as eye-popping when it comes to debt. Those top 25 corporations are sitting pretty, with a cash-to-debt ratio of 153 percent. That means for every dollar of debt they owe, they have $1.53 in cash reserves on hand. Meanwhile, all other U.S. companies have far more debt than cash. The remaining investment-grade companies — the ones S&P and Moody's consider safe investments — have cash-to-debt ratios of just 17 percent: 17 cents of cash for every dollar of debt. The speculative-grade companies, i.e. the riskiest, have 12 percent cash-to-debt ratios. (The divide is so extreme that, in the graph below, S&P had to compress their y-axis to make it all fit.)

In fact, for the bottom 99 percent of companies, total debt rose $730 billion while total cash reserves fell by $40 billion.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

"If you remove the top 1 percent — because frankly they're just an anomaly — the rest of the companies live in a net-debt position that is getting worse," said Andrew Chang, who co-authored the S&P report. It's "the lowest we've seen in the past decade, including the years preceding the Great Recession."

In 2016, there have already been 72 companies that defaulted on their debt — mostly in oil, gas, metals, mining, steel, and one from utilities. By this point in 2015, there had only been 39 defaults.

So this could be another sign we're staring down another recession. And it's certainly another piece of evidence that the Federal Reserve should refrain from raising interest rates in June. Most of these companies certainly don't need their service payments on all this debt increasing.

But the deeper question is just what on earth is going on.

As Chang said, the top 25 are weird outliers. Being mostly tech companies, maybe they're benefiting from natural monopolies; given the government's modern failure to enforce antitrust law, maybe they're benefiting from overwhelming market clout; maybe they have intellectual property rights that allow them to bleed the rest of the economy. But the remaining 1,975 or so companies appear to be slowly rotting: Piling on more debt as they lose the ability to add to their cash reserves, as if all their business models all simultaneously stopped working.

Productivity growth both in the U.S. and internationally is shockingly low, and the level of investment companies are making in the economy is as low as it's been in any recovery since at least 1953. "Companies really need to invest seriously in innovation," one economic expert told the Financial Times. "It is time for companies to move on the productivity agenda to turn this story around." But it's not like the top 1 percent of companies just chose to sit on cash and do nothing when they could be investing in productive endeavors. They did that because they couldn't find anything worthwhile to invest in.

This goes doubly for the bottom 99 percent of companies, who are sitting on much less cash while also piling up massive mounds of debt. This the sign of businesses which can't get enough revenue from the economy to keep their finances healthy and are borrowing to fill the gaps.

Meanwhile, investor demand for federal government debt remains as high as ever, evidence of a hunger for safe places to store money that are sheltered from the actual economy.

The defining characteristic of a healthy economy is a positive feedback loop. Money should go to the top of the economy as companies innovate new goods and services and take in increased revenue and profits from customers. Then that money should go back to the bottom as investors and companies find new demand to tap into, creating new jobs and employing workers and raising wages. But now that feedback loop has broken down into a one-way extraction from the bottom to the top. And not just extraction to corporations in general, but to a select few corporations, while everyone else slowly withers.

And it seems obvious at this point that the free market, on its own, is helpless to do anything about it.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

Syria’s Islamic State problem

Syria’s Islamic State problemIn The Spotlight Fragile security in prison camps leads to escape of IS fighters

-

Quiz of The Week: 17 – 23 January

Quiz of The Week: 17 – 23 JanuaryQuiz Have you been paying attention to The Week’s news?

-

The Week Unwrapped: What can we learn from a tool-wielding cow?

The Week Unwrapped: What can we learn from a tool-wielding cow?Podcast Plus, have we reached ‘peak billionaire’? When should troops disobey their superiors?