The Catch-22 in Spotify's business model

The streaming service just can't seem to scale profitably

Spotify published some eye-popping financials on Monday. It managed to pull in $2.18 billion in revenue in 2015, up 45 percent from 2014. And it's still losing money.

This gets at one of the difficulties intrinsic to the business of streaming music. Offering free music along with ads to generate revenue has allowed Spotify in particular to expand massively: It now boasts 75 million users worldwide. Yet the vast majority of its revenue — $1.95 billion — comes from its 30 million paid subscribers. Revenue from ads was just $219 million.

So, perversely, the part of Spotify that's losing them money is the part that's gaining them all the new users. Or, as Spotify put it in their report: "Subscription-only models have not yet proven scale and free user models, while scaling, have not proven a path to profitability. Spotify has the combined power of both."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

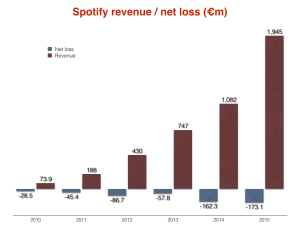

Except that combined power looks pretty middling. Spotify has lost money every year since 2010 and while the losses are becoming smaller and smaller portions of its revenue, the losses are nonetheless sticking around. (Because Spotify is a Swedish company, the graph below is in euros.)

(Chart courtesy of Music Business Worldwide and Spotify.)

Amusingly, the company even used the same phrasing about the combined powers of subscriptions and free users in 2014, too. And that power has yet to show up.

So what's going on here?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

A big piece of the puzzle is the record label companies. Their sales may be declining, but they remain the legal gatekeepers for most of the artists Spotify and other streaming services get their music from. Only a trickle of the money the record industry makes every year gets back to the musicians who actually write and perform. And meanwhile the record industry is using its leverage to bleed the streaming services for all they're worth in royalty payments: Spotify alone paid out a gobsmacking $1.83 billion to the record companies in 2015 — the vast majority of the company's operating costs. That payment, in turn, amounted to over 10 percent of the record industry's worldwide 2015 revenue.

So the record labels and the streaming services are in a kind of mutual death grip. The latter is on the decline, but it still has the ownership rights to squeeze the up-and-coming industry and thus hold off the inevitable. Meanwhile, the up-and-coming industry has to pay out the nose to remain up-and-coming.

Spotify has a few possible avenues. It could always increase the volume of its advertising, and it's playing around with original video programming. But more ads could be self-defeating, as they could drive away new and old users. And it's not clear how popular the video service will be.

In fact, a 2014 study actually suggested Spotify and other streaming services will never be profitable as long as the basic outlines of the business model — including the high royalty payments — remain fundamentally unchanged. When Apple added a paid music subscription service back in 2015, for instance, observers noted that even if it matched Spotify's 15 million paying subscribers (at that time) it would add less than 1 percent to Apple's 2016 revenue.

So one question here is whether the system of laws that gives the record industry those monopoly rights is just and defensible.

But another question is, if the profitable part of the business model can never get that big, why try to go big? There's nothing dishonorable about running a modestly-sized business that will never rise above a certain threshold of users.

The answer is, of course, that like most start-ups in the tech world, Spotify is racing to cash out on Wall Street. The company is privately owned, but recently raised another $1 billion in private debt financing. And the terms of the financing more or less guarantee it will go public sometime soon. So, as with many tech companies, Spotify isn't attempting to build a sustainable business model. It's just trying to keep the enterprise going just long enough and grow it just big enough so its stakeholders can sell all their shares.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

Which way will Trump go on Iran?

Which way will Trump go on Iran?Today’s Big Question Diplomatic talks set to be held in Turkey on Friday, but failure to reach an agreement could have ‘terrible’ global ramifications

-

High Court action over Cape Verde tourist deaths

High Court action over Cape Verde tourist deathsThe Explainer Holidaymakers sue TUI after gastric illness outbreaks linked to six British deaths

-

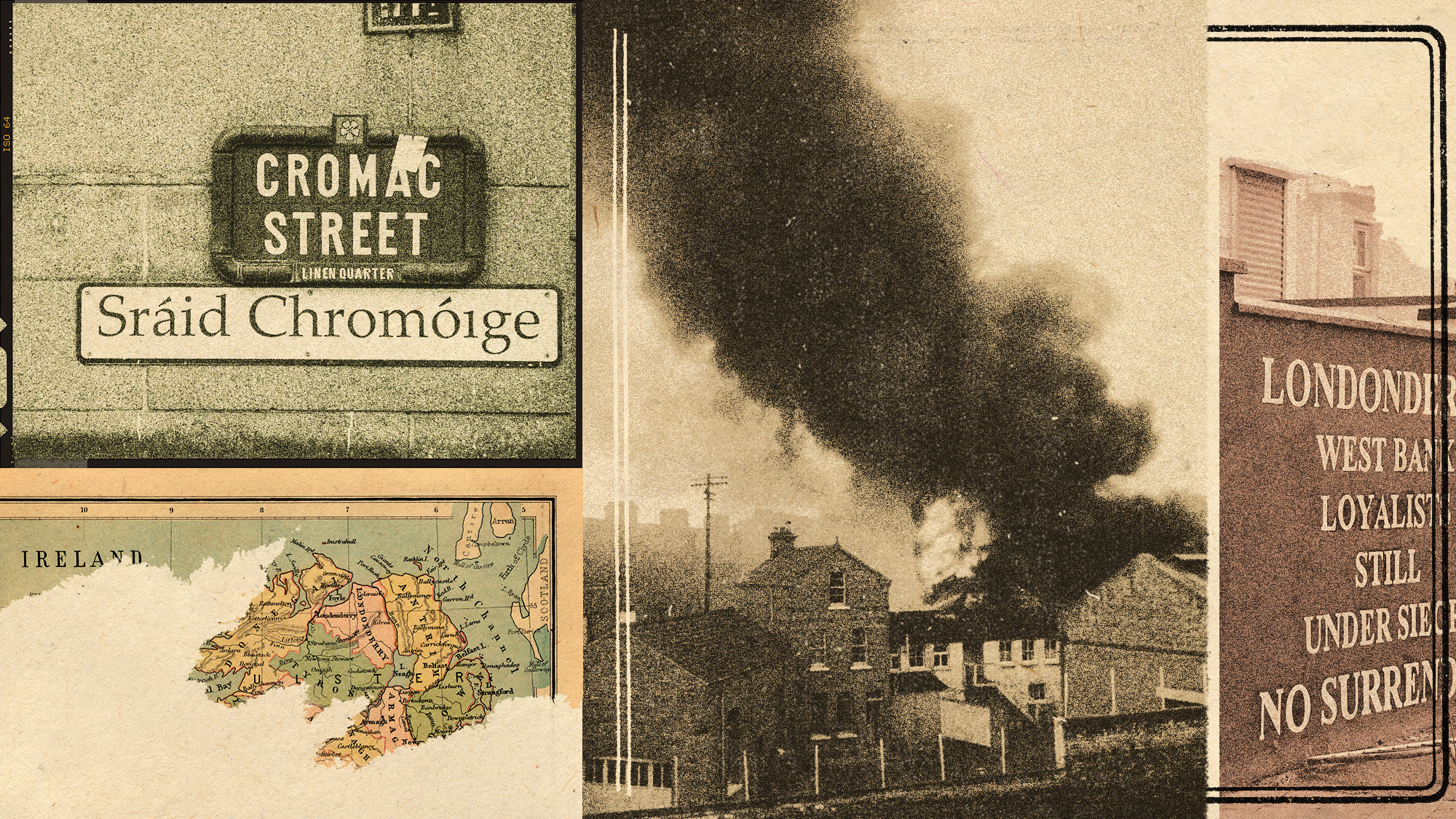

The battle over the Irish language in Northern Ireland

The battle over the Irish language in Northern IrelandUnder the Radar Popularity is soaring across Northern Ireland, but dual-language sign policies agitate division as unionists accuse nationalists of cultural erosion

-

The pros and cons of noncompete agreements

The pros and cons of noncompete agreementsThe Explainer The FTC wants to ban companies from binding their employees with noncompete agreements. Who would this benefit, and who would it hurt?

-

What experts are saying about the economy's surprise contraction

What experts are saying about the economy's surprise contractionThe Explainer The sharpest opinions on the debate from around the web

-

The death of cities was greatly exaggerated

The death of cities was greatly exaggeratedThe Explainer Why the pandemic predictions about urban flight were wrong

-

The housing crisis is here

The housing crisis is hereThe Explainer As the pandemic takes its toll, renters face eviction even as buyers are bidding higher

-

How to be an ally to marginalized coworkers

How to be an ally to marginalized coworkersThe Explainer Show up for your colleagues by showing that you see them and their struggles

-

What the stock market knows

What the stock market knowsThe Explainer Publicly traded companies are going to wallop small businesses

-

Can the government save small businesses?

Can the government save small businesses?The Explainer Many are fighting for a fair share of the coronavirus rescue package

-

How the oil crash could turn into a much bigger economic shock

How the oil crash could turn into a much bigger economic shockThe Explainer This could be a huge problem for the entire economy