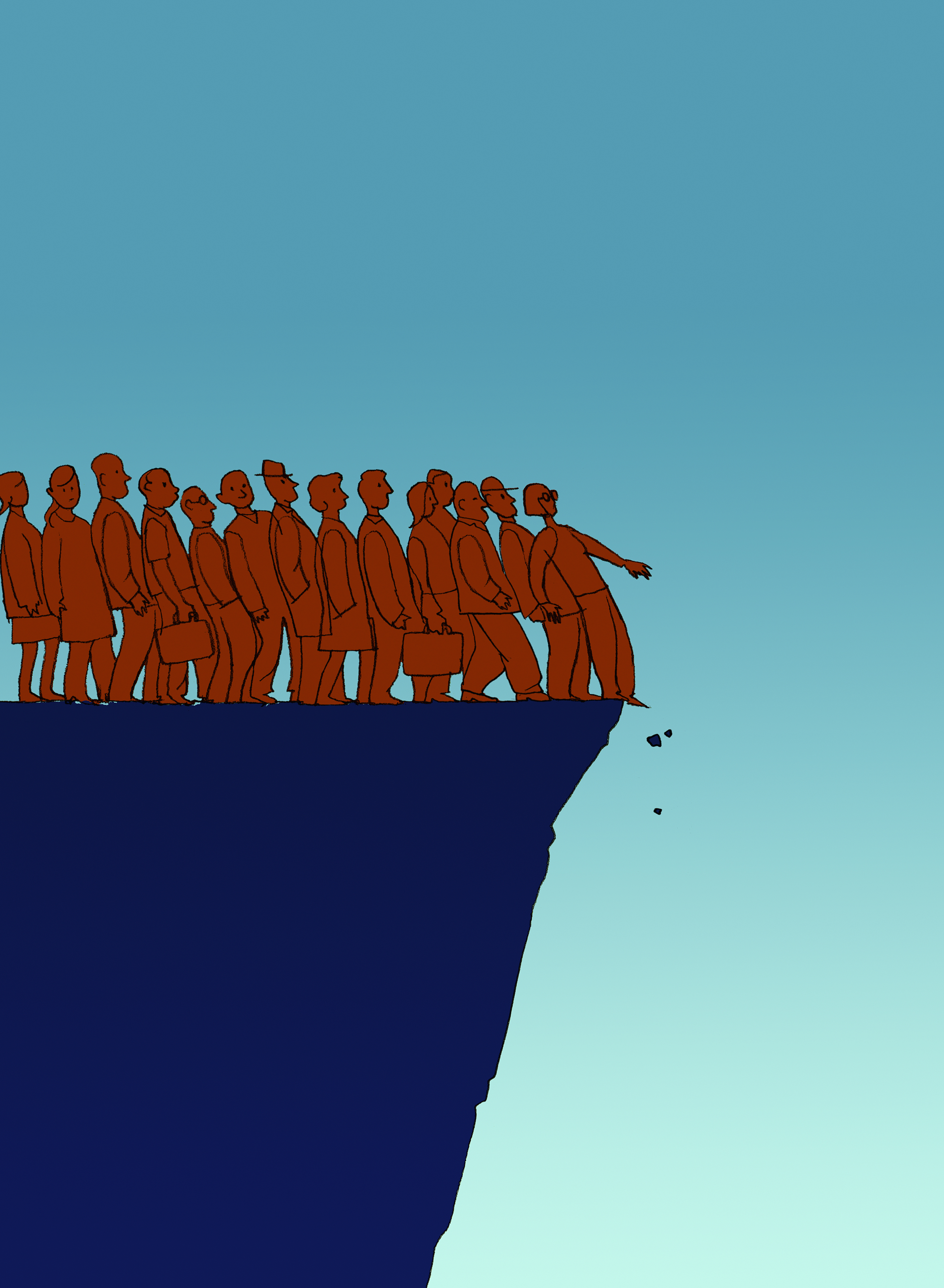

Is America creeping toward another recession?

It's starting to look that way. And here's what's scarier: If a recession does hit, we really can't do much of anything about it.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

It's been seven years since the 2008 collapse. And if you look at the timing of recessions in recent decades, we're due for another one awfully soon.

Now, predicting recessions is an exceedingly tricky business. Almost by definition, you can't see them coming: Markets are dynamic systems, defined by actions and reactions and ever-shifting balances of forces. So if actors in a market spot the early signs that could indicate a recession, their natural self-interest will lead them to take actions that should head off the recession. The economic short-circuits that actually cause a recession are the ones nobody spots.

Still, you can at least keep an eye on the circumstantial evidence. And the data points that suggest the economy is taking a wrong turn are building up.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Let's start with the Institute of Supply Management's manufacturing index, which comes out every month. The release for November arrived on Tuesday, and at 48.6, it's the worst we've seen since June 2009. More importantly, any number under 50 means the manufacturing sector is actually contracting. In recent years, this index has only dropped below 50 during the Great Recession, and then in one very brief blip in late 2012.

[[{"type":"media","view_mode":"media_large","fid":"136549","attributes":{"alt":"","class":"media-image","height":"399","typeof":"foaf:Image","width":"600"}}]]

The next data point comes via Stephen Foley at the Financial Times. Since the start of 2015, prices for leveraged loans — debt extended to companies and individuals who are already well in the hole — have dived considerably from their post-Great Recession trend. Demand for this sort of debt appears to be drying up thanks to a slowdown in the economy, as potential buyers worry that the loans may stop paying off as much, and that defaults will rise.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

(Graph courtesy of the Financial Times.)

Both of these developments may be due, at least in part, to the reversal of the domestic shale oil boom and the slowdown in the Chinese economy. And while Foley allowed that "the loan market is not the only place that corporate America can go to raise money," he also sees "signs that other sources of credit may also be getting harder to come by." This is particularly ironic since the Federal Reserve is widely expected to begin raising interest rates this month — a macroeconomic policy move that aims to ward off too-high inflation by, well, constricting the supply of credit.

Finally, back in mid-November, David Dayen talked to economist Dean Baker about the ratio of business inventories to their sales. Basically, the amount of unsold goods businesses are piling up in stock rooms and warehouses has been steadily rising since roughly 2012. And the ratio of unsold goods to sales now stands at almost 1.4 to one. Other than a massive increase and then sell-off of inventories in the immediate aftermath of the 2008 collapse, that ratio bounced along happily at just under 1.3 to one between 2006 and 2012.

(Graph courtesy of The New Republic)

Now, purchases this holiday season are expected to be higher than usual. So that could bleed off a lot of the excess inventory. But if it doesn't, the only way companies can keep their finances in order is to eventually cut production to prevent their inventories from getting any bigger, and then allow the build-up to slowly sell off. And cutting production means lost jobs and incomes.

Baker thinks a slowing economy is the culprit: People just aren't making enough money to buy as much stuff as before, so companies are accumulating a backlog. Dayen also pointed to flat retail sales, slowing traffic at ports, climbing vacancy rates for office space and retail space, and other indicators of a general economic slowdown.

This all remains circumstantial. By themselves, economic headwinds like the Chinese slowdown, the drop in domestic oil production, or a possible bubble pop in the tech sector aren't enough to throw the economy into recession. But put them all together and things start to look more ominous. Baker himself, according to Dayen, "doesn't believe a recession is imminent." But we could be looking at a slowdown to 1 percent economic growth — down from our already measly 2 percent growth — which would be plenty bad all by itself.

What's scarier, though, is the question of what we'd do if this does turn into a recession. Because the answer is, we really can't do much of anything.

Normally, if we got hit by a modest downturn, the Federal Reserve would just cut interest rates to boost the economy back towards growth. But interest rates are already at zero. Indeed, one of the reasons the Fed is itching to raise them is precisely so it will have room to cut them again.

Still, this puts the cart before the horse. What should raise interest rates is a growing economy, which multiplies the opportunities for investment and increases the supply of credit. Then the Fed can ride that natural upward pressure, and cut rates as needed. But if the Fed starts constraining the supply of credit now, before the economy has taken off, it just makes growth all the harder to achieve.

The other possibility is for the federal government to start deficit spending in a big way again. To no small degree, interest rates are low right now because there's a lot of global demand for safe assets to invest in, like U.S. debt. More debt spending would soak up that demand and thus raise interest rates, and also boost economic growth by pumping up aggregate demand. Unfortunately, with American politics still addled by austerity fixation, this is supremely unlikely to happen, barring another round of Democratic supermajorities in the legislature combined with a Democratic White House.

In fact, as Dayen noted, a downturn would perversely make it more likely a Republican wins the 2016 presidential race, further entrenching the current situation.

The economy has been improving, but it remains on very thin ice. And unless we get some really surprising changes in the course of U.S. macroeconomic policy, it's going to be on thin ice for a very long time to come.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

The pros and cons of noncompete agreements

The pros and cons of noncompete agreementsThe Explainer The FTC wants to ban companies from binding their employees with noncompete agreements. Who would this benefit, and who would it hurt?

-

What experts are saying about the economy's surprise contraction

What experts are saying about the economy's surprise contractionThe Explainer The sharpest opinions on the debate from around the web

-

The death of cities was greatly exaggerated

The death of cities was greatly exaggeratedThe Explainer Why the pandemic predictions about urban flight were wrong

-

The housing crisis is here

The housing crisis is hereThe Explainer As the pandemic takes its toll, renters face eviction even as buyers are bidding higher

-

How to be an ally to marginalized coworkers

How to be an ally to marginalized coworkersThe Explainer Show up for your colleagues by showing that you see them and their struggles

-

What the stock market knows

What the stock market knowsThe Explainer Publicly traded companies are going to wallop small businesses

-

Can the government save small businesses?

Can the government save small businesses?The Explainer Many are fighting for a fair share of the coronavirus rescue package

-

How the oil crash could turn into a much bigger economic shock

How the oil crash could turn into a much bigger economic shockThe Explainer This could be a huge problem for the entire economy