What caused the retail apocalypse?

It wasn't Jeff Bezos

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

By now you've probably heard of the retail apocalypse. Employment in general merchandise stores has fallen by almost 90,000 jobs since October. Just like manufacturing jobs before them, brick-and-mortar retail jobs are finally falling to the twin forces of technology and globalization — this time in the form of Amazon and e-commerce. Or so goes the narrative.

But while not entirely wrong, this story vastly oversimplifies what's going on with retail. And it completely misses what's arguably the key detail.

To lose so many jobs is indeed eye-popping — especially since the underlying fundamentals in the economy suggest it's slowly-but-steadily improving. But this isn't the first time that the sector has seen a sudden job loss on that scale. Zoom out to the historical trend since 1992, and the number of people employed in general merchandise is headed up. From that perspective, last year's 90,000 plunge looks more like an (admittedly dramatic) blip. It could signal a fundamental shift. But we just don't know yet.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Since 1950, wholesale and retail trade has indeed slowly shrunk as a share of all employment, from 15.9 percent to 11.5 percent in 2009. But retail is still considered a better gig than, say, fast-food work. In fact, as the economy continues to improve, retail employment is poaching staff from fast-food chains to deal with a high turnover rate.

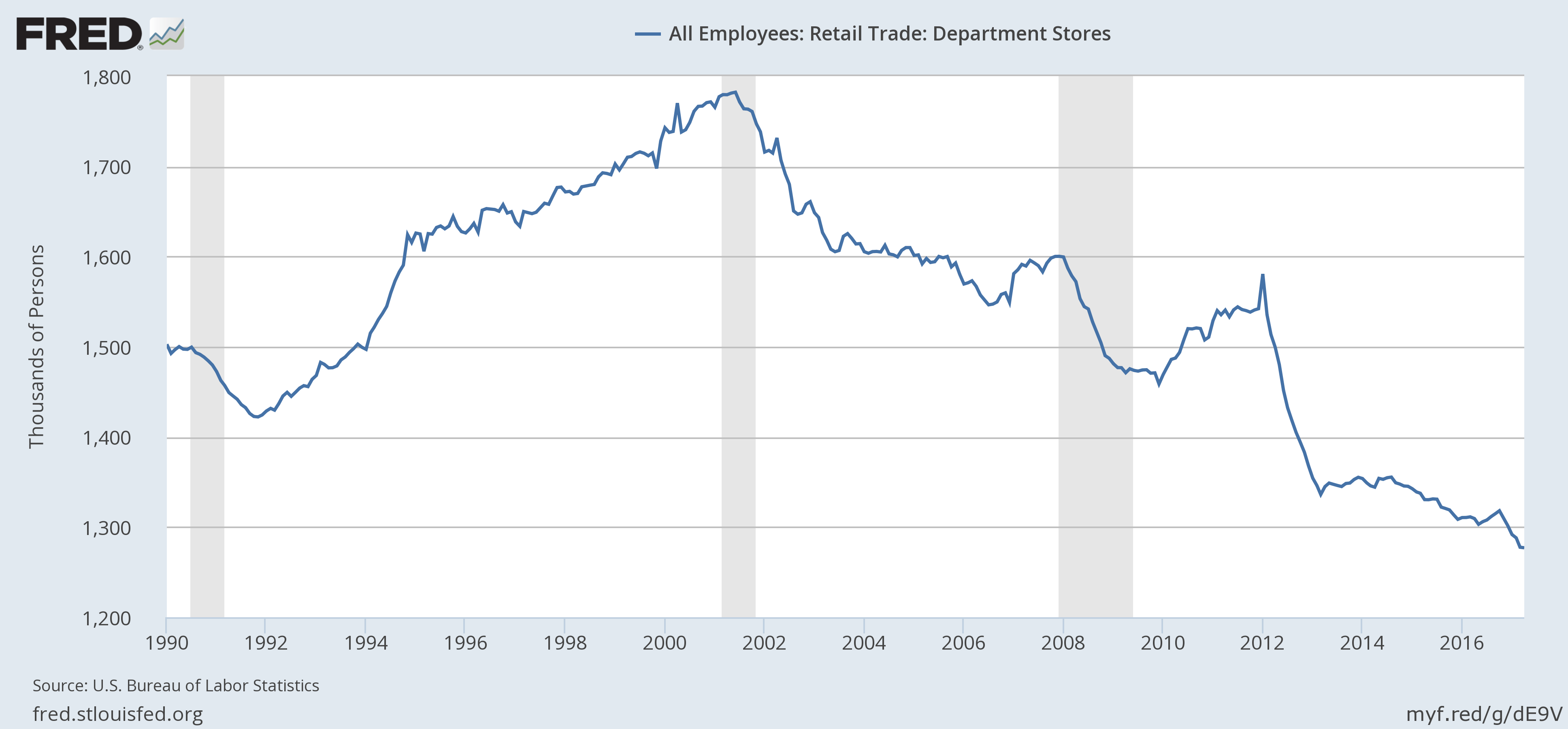

But things get interesting when we pick apart what we mean by "retail." Employment in department stores has bled 500,000 jobs since 2001 — 18 times the number of jobs the coal industry lost in the same period.

Recognizable brands like Macy's and Sears are looking shaky: the former plans to close 68 stores and lay off 10,000 workers, while the latter's business model has been rotting for years and may collapse altogether. Malls across the country — long the home of these department store chains — are dying and emptying out.

That's significant because department stores like Macy's and Sears rely on a particular kind of consumer base: middle-income, but also geographically dispersed. If you're going to have a mall with department stores in every decent-sized town, you need middle-class consumers in every decent-sized town, too.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

That's precisely the sort of consumer we've lost. For the last few decades, middle- and lower-class wages have stagnated, while the portion of Americans high up the income ladder provide more and more of all consumer spending. The national economy has also gone through a remarkable geographic shift, in which pretty much all new job and business creation occurs in major cities.

By far the best kind of equitable income distribution program is a tight labor market, where there are perpetually more job openings than workers. A surplus of opportunities force employers to compete for workers and keep pay high. But they also ensure that whenever technology or economic shifts destroy old industries (as inevitably happens), new good-paying jobs are readily available to pick up the displaced workers, and employers in new sectors have no choice but to provide on-the-job-training on their own dime.

But since the 1980s, American fiscal and monetary policymaking has largely abandoned the Keynesian approaches that maintained tight labor markets. Instead they've focused on balanced budgets and low inflation, creating a perpetual situation in which the supply of workers outpaces the supply of jobs. Economists largely agree, for instance, that opening up trade with China eliminated about one million U.S. jobs — but the really important point is that they weren't replaced with anything. Job creation in the U.S. economy is just in a perpetual funk. Hence the decline of good-paying middle-class jobs, and the rise of poorly compensated service work.

In fact, starting in 2001, after the entrance of women into the labor force ran its course, the employment rate among prime-age workers started steadily falling. That trend, as it happens, matches up nicely with the decline of department stores.

So it shouldn't surprise us that business models that rely on the idea of broadly shared middle-class prosperity are dying.

The point here is not to completely discount the importance of the internet and technology in the decline of department stores. That the fall-off began around 2001 is pretty telling. But if American policymakers had stuck with the mid-century's devotion to full employment, the arrival of e-commerce would have had a much different effect.

For instance, manufacturing has been in decline as a share of all jobs since the 1950s, but no one really complained up until the 1980s. Before then, unions remained strong, jobs in new industries paid well and accommodated workers transitioning from other sectors, and new job openings were readily available to people leaving shrinking industries.

Another example: As the Times reported, many retail stores still pay salespeople based on commission, even though more and more shoppers go to the brick-and-mortar establishments just to look, and then buy online. An empowered workforce would be able to demand a cut of that revenue. But in a world where unemployment is a perpetual threat and employers hold all the power, workers are stuck taking whatever offer they can get.

In that alternative world, the decline of department stores would likely not have been nearly as bad. And workers would have had far more leverage to demand better deals as their employers introduced the new technology.

In this sense, department stores and the retail sector are like a human body. If it's already healthy and robust, any unexpected shock to the system (like Amazon, for instance) can be weathered easily. But if it's already sick and exhausted, that same shock might just kill it.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.