The Great Recession never ended

The economy still needs a massive boost

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

In the first few years after the 2008 economic crisis, a great deal of political attention and energy was focused on continuing economic problems. The Obama stimulus was too small, and it was followed by tons of austerity after Republicans swept the 2010 midterms, so unemployment came down with grinding slowness. But as unemployment has finally reached something like normal levels — and as the ongoing catastrophe of the Trump presidency has consumed everyone's attention — possible economic under-performance has faded from view.

But the problems are still there — indeed, in some ways things are actually getting worse. The Great Recession never fully ended.

First, recall that an economic crash is caused by a collapse in demand — essentially, total spending plummets throughout the economy. Virtually nobody disagrees that this was the case right after the 2008 financial crisis, but many today think that the demand problem has been solved.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

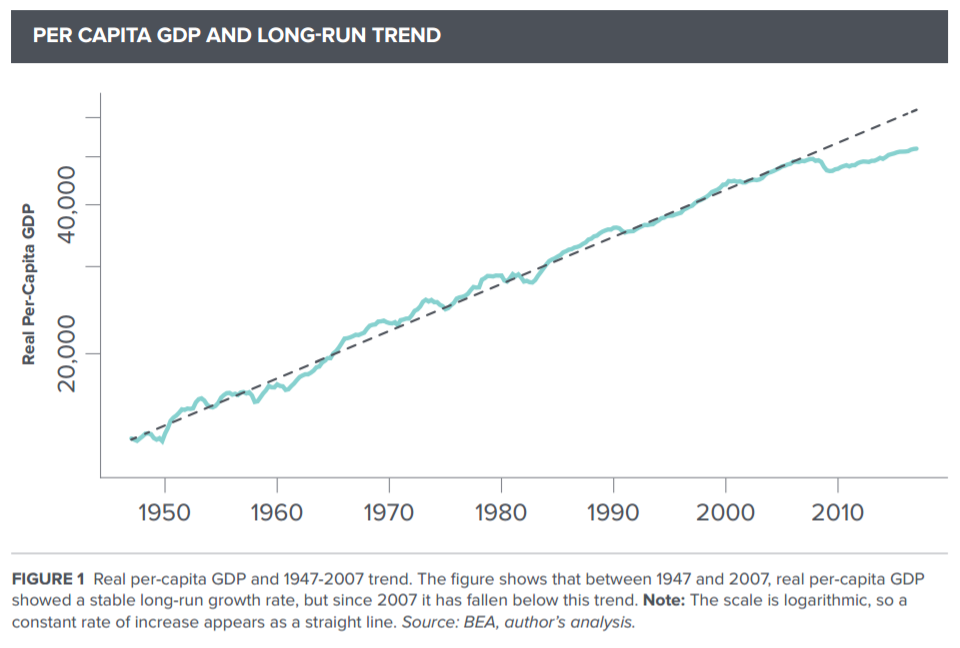

Economist J.W. Mason, a professor at John Jay College and a fellow at the Roosevelt Institute, has compiled a detailed argument that lack of demand is still the major problem in a brilliant paper. The most obvious and jarring part of the case is the fact that from the end of the Second World War to 2007, inflation-adjusted American GDP per person trundled upwards at a rate of 2.2 percent per year. Any periods of slower growth were followed by periods of catch-up faster growth.

But after 2007, there was not only the worst economic crash since the Great Depression, but no catch-up growth whatsoever. On the contrary, the succeeding years after the immediate crash have seen much slower than average growth — and as a result, the gap between what forecasters thought the trajectory of economic output would be in 2006 is actually bigger today than it was in 2010, and getting steadily worse. It sure looks for all the world like the crisis was just never completely fixed:

(Courtesy Roosevelt Institute)

In other words, it's quite possible that not only are we very far from maximum economic output — meaning literally trillions of economic output gone unproduced every year, and more importantly millions of people left unemployed for no reason — but also that maximum output might be receding ever further over the horizon.

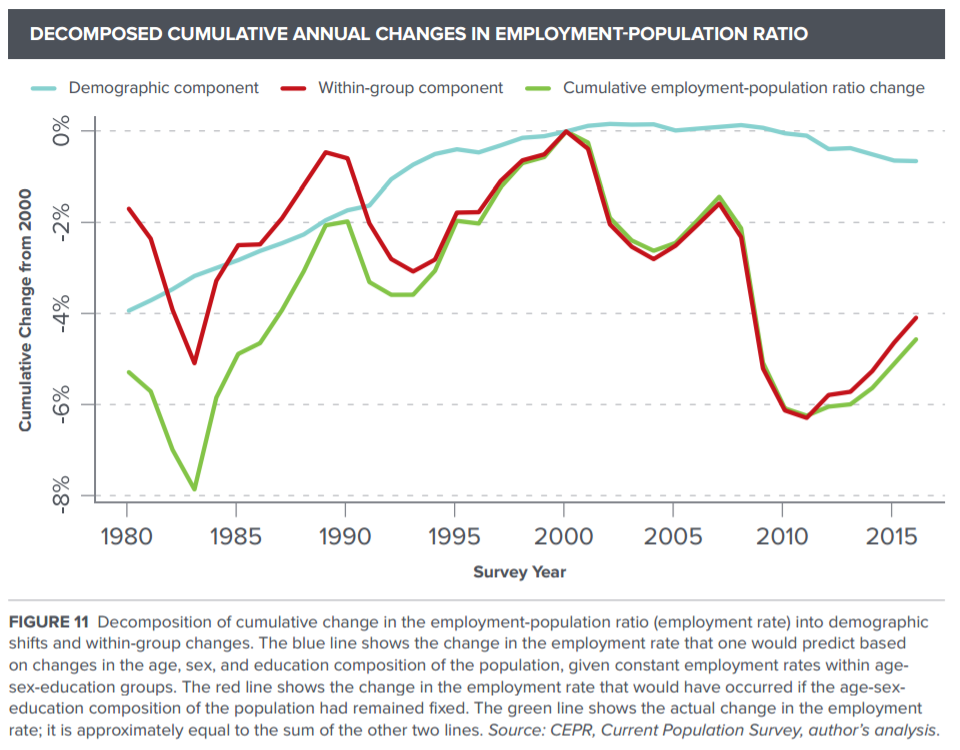

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The second interesting facet of the argument has to do with demographics. When you break out the decline of economic production, about half of it comes from declining labor force participation — that is, the percentage of people employed or looking for work. Inflation paranoiacs argue that this is due to demographic changes, namely the aging of the workforce. To examine this case, Mason conducts a "shift-share analysis," basically a counterfactual taking the employment rate of various categories of people from 2007, and projecting them onto current, older demographic realities. So measured, demographics explains about 40 percent of the decline in labor force participation.

However, the American population is not just getting older, it's also getting more educated — which is associated with greater labor force participation. If you include education as a demographic variable, the aging-based decline in the labor force almost totally vanishes. "All else equal, older people are less likely to be employed, and educated people are more likely to be. Over the past decade or two, these two factors have essentially canceled one another out," Mason writes. Here the green line is reality, the red line is the fixed demographic counterfactual, and blue line is the no-crisis counterfactual:

(Courtesy Roosevelt Institute)

The gap between the green and the red lines is the portion of labor force decline that is explained by demographics including education — that is, almost none of it. In other words, it's probably not the case that an aging population has crashed the supply of workers.

But that's not remotely all. Productivity, inflation, interest rates, the wage share of national income, and rates of investment have also fallen since the recession, and stayed low. There are good arguments that lack of demand can account for each one of these things. A partial summary: Productivity and investment are low because businesses are not incentivized to spend money on labor-saving machinery when workers are cheap; inflation and interest rates are low because the economy is below capacity; the wage share of income is low because workers have little bargaining power.

Skeptics of more stimulus to create demand have levied arguments against most of these factors, but they often strain credulity, or are mutually exclusive. Robert Gordon, for instance, argues that productivity has crashed because we have run out of innovations, but this sort of supply shock should create higher inflation. Others argue that robots are displacing workers from their jobs, but that should show up as higher productivity and higher interest rates (in addition to being totally inconsistent with the first story). Low demand, by contrast, can explain each part of the ailing economy.

Taken together, the American economy looks quite similar to that of around 1939 or so. Back then, the New Deal had partially fixed the Great Depression, but had failed to restore full employment due to anxious politicians (including FDR) flipping out about the budget deficit and turning to austerity. It took the stupendous mega-spending of war mobilization to break the political deadlock and restore full employment and production.

In 1939 as today, many argued that limp performance was simply the best that could be done. But it turned out after the war the economy did not collapse back to its prewar levels. Instead (after a brief hiccup from demobilization) it rocketed up into its greatest boom in history. Without the war, it's easily possible that America would have continued stuck in a quasi-depression indefinitely — as we appear to be today. But conversely, there is every reason to at least try to smash the economy back up to trend with another very large stimulus. Without it, we're due to start our second Lost Decade next year.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

The pros and cons of noncompete agreements

The pros and cons of noncompete agreementsThe Explainer The FTC wants to ban companies from binding their employees with noncompete agreements. Who would this benefit, and who would it hurt?

-

What experts are saying about the economy's surprise contraction

What experts are saying about the economy's surprise contractionThe Explainer The sharpest opinions on the debate from around the web

-

The death of cities was greatly exaggerated

The death of cities was greatly exaggeratedThe Explainer Why the pandemic predictions about urban flight were wrong

-

The housing crisis is here

The housing crisis is hereThe Explainer As the pandemic takes its toll, renters face eviction even as buyers are bidding higher

-

How to be an ally to marginalized coworkers

How to be an ally to marginalized coworkersThe Explainer Show up for your colleagues by showing that you see them and their struggles

-

What the stock market knows

What the stock market knowsThe Explainer Publicly traded companies are going to wallop small businesses

-

Can the government save small businesses?

Can the government save small businesses?The Explainer Many are fighting for a fair share of the coronavirus rescue package

-

How the oil crash could turn into a much bigger economic shock

How the oil crash could turn into a much bigger economic shockThe Explainer This could be a huge problem for the entire economy