Is the stock market headed for a crash?

Investors are panicking. But is the stock market really as overvalued as some fear?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

For the moment, the stock market rout seems to be over.

After several days of weakness and back-to-back gut-punch drops on Friday (666 points) and Monday (1,175 points), the Dow Jones Industrial Average (along with the other big indexes) closed out Tuesday on a high note, with the Dow ending up more than 550 points. It was nowhere near enough to make up for the recent bloodbath losses, but it was at least enough to stop the bleeding.

Everyone more or less agrees that the markets were overvalued. But just how overvalued?

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

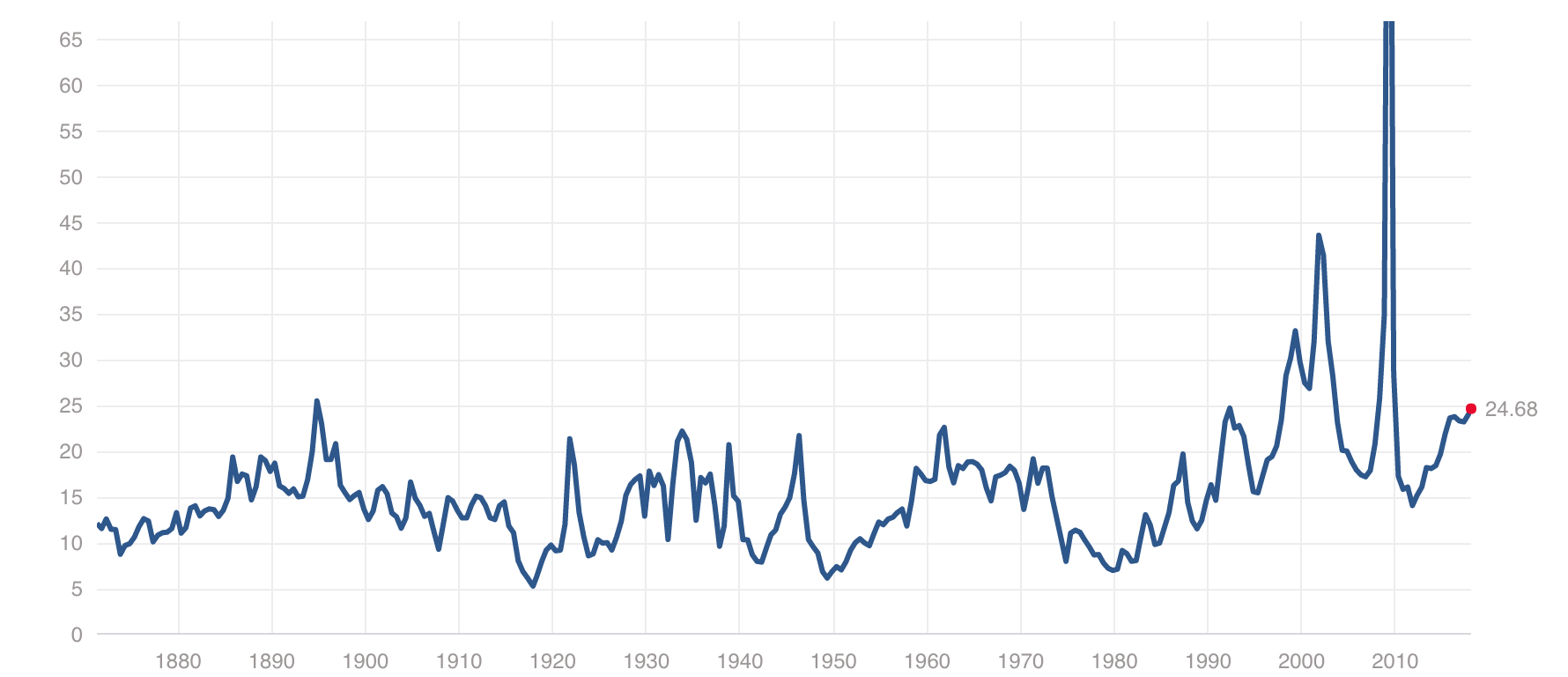

Let's look at price-to-earnings (P/E) ratio. That's how many dollars investors are willing to plunk down for every dollar of a company's profit. If a stock is selling for $50 a share, and that company's earnings-per-share is $5, then the price-to-earnings ratio is 10. You can look at the P/E ratio for an individual company. Or, if you want to get a look at the economy as a whole, you can look at the P/E ratio for a whole index.

If the P/E ratio gets unusually high compared to its historical average, that's generally evidence that we're in for a correction. Obviously, one way to get a correction is for the stock market to tank and prices to fall — which brings the ratio back into its historic bounds.

Here's the P/E ratio for the S&P 500 going back over a century.

As you can see, today's P/E ratio is high compared to the historic norm. But it's not that high. We're nowhere near the stock market crash in 2001 or 2007-08's housing bust, which led to the Great Recession. Judging by the P/E ratio, the stock market today may well be "frothy," as observers love to say, but it's not really a bubble.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Frothy certainly justifies a price correction, which is exactly what we're going through. But it doesn't suggest the need for a massive correction. And remember, the stock market experiences modest panics pretty regularly. While Monday's 1,175-point drop was the single worst one-day points plummet in history, "on a percentage basis, [Monday's] drop doesn't even enter the top 250," Pavel Molchanov, an equity analyst at Raymond James, told The Washington Post. "Also, the past week provides a reminder — painful but timely — that volatility has not been repealed. Nothing goes up in a straight line."

That said, there are still some ominous signals.

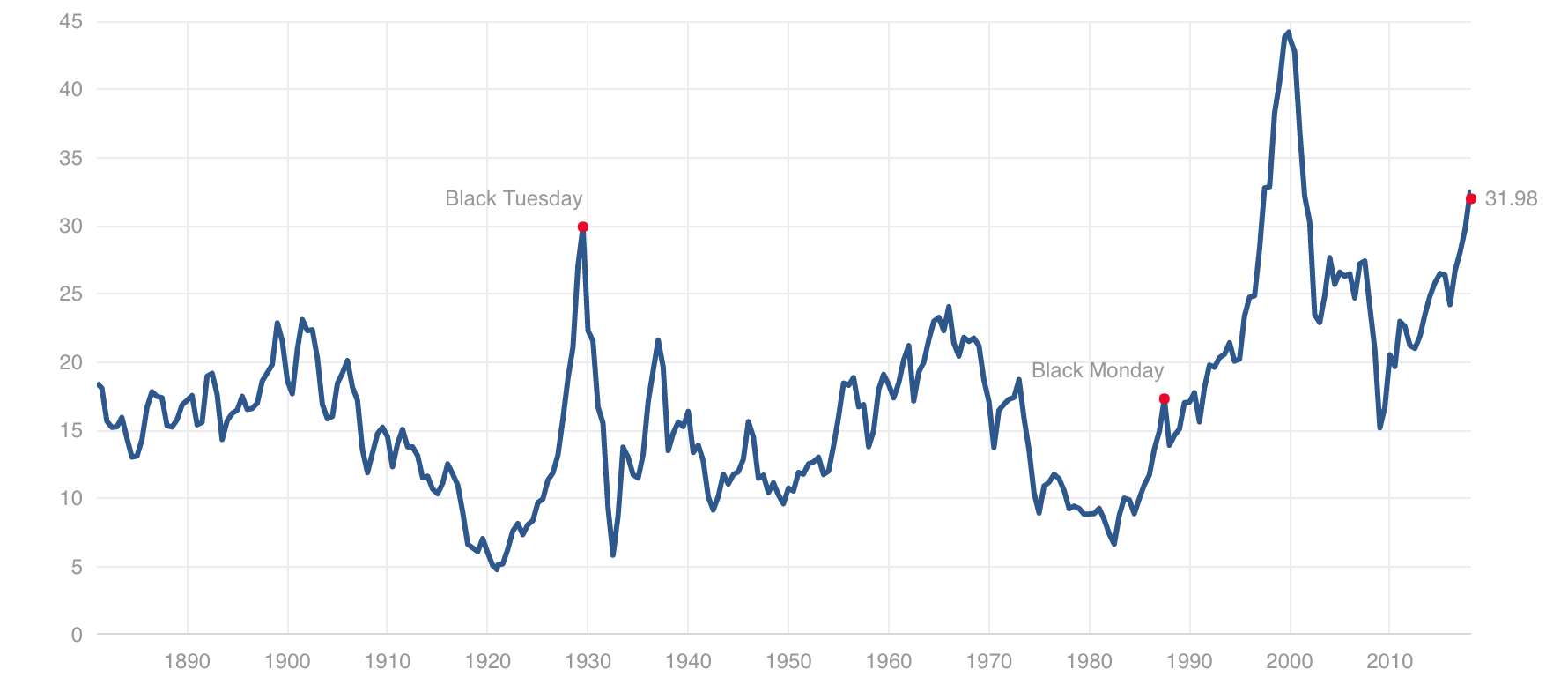

The P/E ratio above is calculated using earnings over the last 12 months. But oftentimes, it takes years for a full picture of company earnings to become clear. So economist Robert Shiller came up with a tweak: He calculated the P/E ratio of the S&P 500 using the average earnings over the last 10 years. The idea was to smooth out the fluctuations and give a better read on fundamental long-term value.

It's called the "cyclically-adjusted price-to-earnings ratio" (or CAPE). Here it is.

That's a lot scarier. At a ratio just over 30, we're well above the historical average of 15 — and above where we were just before the 2008 bust.

But don't panic just yet. Because the CAPE is inherently backward looking, it can be thrown off by weird stuff that came before. And stock markets have been on a bizarre rollercoaster over the last 10 years. Furthermore, Shiller's ratio is designed to predict long-term outcomes, not short-term crashes. "The current level of CAPE suggests a dim outlook for the American stock market over the next 10 years or so, but it does not tell us for sure nor does it say when to expect a decline," Shiller wrote in March 2017.

"There is no clear message from all of this," he continued. "Long-term investors shouldn't be alarmed and shouldn't avoid stocks altogether." They shouldn't get over-excited about bull markets under President Trump either. And they should probably be shifting their risk calculations and moving a bit more money into bonds. But that was about it.

It's worth noting, too, that while an unusually high P/E ratio will generally correct, a collapse in stock prices isn't the only way to correct. Earnings could also surge, raising the denominator, and thus bringing the ratio down.

Could future earnings possibly justify such a high current Shiller CAPE? "Big American companies are wielding increased market power, enabling them to earn outsized profits at the expense of America's customers," The Economist pointed out late last year. Industry has become more concentrated, with the biggest firms accounting for larger shares of all revenue. All of which suggests growing monopoly power, and more barriers to competition. That, along with the decreased power of unions, helps companies increase earnings.

Companies have gotten very good at exploiting workers and customers to pocket ever-higher profits. And that suggests that the stock market's recent sky-high valuations have real, concrete justifications. The plunge over the last few days may not be a necessary correction so much as one of the market's regular-but-temporary panics.

That would be good news for the minority of Americans with robust investment portfolios. But not for anyone else.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

Why is the Trump administration talking about ‘Western civilization’?

Why is the Trump administration talking about ‘Western civilization’?Talking Points Rubio says Europe, US bonded by religion and ancestry

-

Quentin Deranque: a student’s death energizes the French far right

Quentin Deranque: a student’s death energizes the French far rightIN THE SPOTLIGHT Reactions to the violent killing of an ultraconservative activist offer a glimpse at the culture wars roiling France ahead of next year’s elections

-

Secured vs. unsecured loans: how do they differ and which is better?

Secured vs. unsecured loans: how do they differ and which is better?the explainer They are distinguished by the level of risk and the inclusion of collateral

-

The pros and cons of noncompete agreements

The pros and cons of noncompete agreementsThe Explainer The FTC wants to ban companies from binding their employees with noncompete agreements. Who would this benefit, and who would it hurt?

-

What experts are saying about the economy's surprise contraction

What experts are saying about the economy's surprise contractionThe Explainer The sharpest opinions on the debate from around the web

-

The death of cities was greatly exaggerated

The death of cities was greatly exaggeratedThe Explainer Why the pandemic predictions about urban flight were wrong

-

The housing crisis is here

The housing crisis is hereThe Explainer As the pandemic takes its toll, renters face eviction even as buyers are bidding higher

-

How to be an ally to marginalized coworkers

How to be an ally to marginalized coworkersThe Explainer Show up for your colleagues by showing that you see them and their struggles

-

What the stock market knows

What the stock market knowsThe Explainer Publicly traded companies are going to wallop small businesses

-

Can the government save small businesses?

Can the government save small businesses?The Explainer Many are fighting for a fair share of the coronavirus rescue package

-

How the oil crash could turn into a much bigger economic shock

How the oil crash could turn into a much bigger economic shockThe Explainer This could be a huge problem for the entire economy