Americans are absurdly overworked

And more work isn't the answer

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Millennials: What are they ruining today? The latest answer, given by a Politico article sponsored by the financial company Prudential, is retirement. Millennials just aren't accumulating enough assets to retire on time! But not to worry, they'll be fine so long as they are "willing and able to work longer than their parents and grandparents did."

This solution actually undersells the problem. There is a retirement crisis already happening — though it's true it's only going to get worse. But more work is not the answer. Americans already work far too much. If we want to fix work and retirement, policymakers are going to have to get over their irrational hatred of welfare.

To be fair, the actual content of the Politico article is reasonably sympathetic to the plight of us millennials. Writer Alicia H. Munnell, an economist at Boston College and former head of the Office of Economic Policy in the Clinton administration, acknowledges that we "entered the labor market during tough times" and are "less likely than previous cohorts to receive important employer-sponsored benefits such as retirement savings plans and health insurance." The conclusion of longer work after 65 is an unfortunate deduction from the fact of coming of age during a world-historical economic crisis, not some addle-brained elderly scolding about The Kids Today.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But this reasoning is also a good example of how incoherent neoliberal assumptions permeate mainstream discussions of working and retirement.

Let me consider retirement first. The implicit presumption in Munnell's analysis is that in order to retire, individuals simply must accumulate a big asset hoard and then spend it down over time. This is because neoliberalism frames the economy as a freestanding entity somehow divorced from government, which does best left to its own devices. Moral behavior means subjecting oneself to the market economy. Therefore, retirement is best accomplished by individuals saving and investing within the market system.

When pressed, neoliberals will of course admit that government has an important role to play in the economy. But this assumption even taints thinking about parts of the retirement system which are straightforward government programs. Munnell presents Social Security as some kind of unalterable background condition, noting that if you take it at 62, the payout is much smaller, while if you wait until 70 it's a lot bigger. She does mention that its trust fund may run out in a decade or two, but does not mention the payout schedule is a policy decision that could be changed at any time, nor that patching up the program's finances would be trivially easy.

Let's stop thinking about individuals and consider the economy as it really is: a collective enterprise, built on and backstopped by government policy at every level. America is fantastically wealthy, in large part because the American worker is the most productive in the world (about tied for first with those of France, Germany, Denmark, and a few others).

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

That productive work is what enables retirement — which, let's remember, is when an elderly person stops working and still has money to live on. The inescapable nature of not working means the retired population must somehow get access to daily goods and services produced by the younger population of workers. That can come in the form of welfare handouts, transfers from friends and family, savings, or capital income from asset ownership.

But due to neoliberal assumptions detailed above, the final two options here are massively valorized in mainstream discussions of work and retirement. Saving and asset ownership are morally praiseworthy examples of self-discipline, while getting handouts from family or the government is evidence of laziness (and probably dishonesty). Indeed, retirement discussions are typically centered around why saving rates aren't high enough and how they might be increased, not whether it's a good idea to do so in the first place. This thinking is so pervasive that even Social Security — a straightforward tax-and-transfer welfare program — is ludicrously presented to the citizenry as an individual savings program.

There are huge problems with trying to do retirement through savings and asset ownership, as I explain here. In brief, the main problem is that savings and asset ownership are far easier for the rich to access, because they have much more disposable income and inherit more money. The one retirement savings program kinda-sorta aimed at the middle class — that is, various tax benefits like the 401(k) — has been a massive failure, mainly enriching the wealthy and sundry fee-skimming financial companies.

By contrast, Social Security has been far and away the most successful part of the U.S. retirement system, cutting elderly poverty by some 71 percent between 1967 and 2000 as benefits were ratcheted up. Welfare is what really gets the retirement goods.

That brings me to work. All this maniacal individualism coupled to an irrational hatred of welfare severely warps America's distribution of work. The best way to see this is by contrast with the Nordic countries. Contrary to popular belief in the U.S., large swathes of their generous welfare states are dedicated to helping people find and keep jobs. Universal paid leave and child-care benefits help parents stay in the workforce, while generous unemployment benefits plus job placement, education, and training programs help people find new work when they lose a job. Generous sick leave and mandatory vacation reduces work hours, requiring employers to hire more people for the same amount of work.

Finally, generous pension and health-care systems allow people to actually retire when they reach 65.

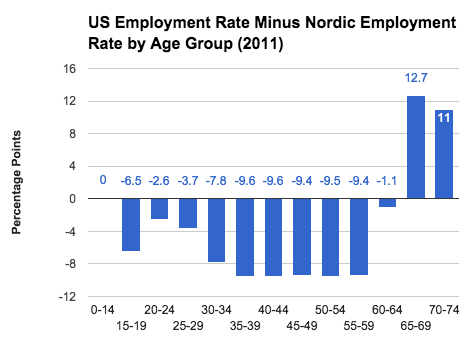

America's stingy welfare state has three enormous downsides: First, a lower proportion of its prime working-age population (from 25-54) has a job — only 79.1 percent, compared to 81.9 percent in Denmark or 82.4 percent in Norway. But on the other hand, a vastly greater share of our elderly population works, mostly because they can't afford to retire. Those two blue bars on the right demonstrate the existing retirement crisis:

And finally, those people who do have jobs work considerably more than Nordic countries — 1,742 hours a year per person, as compared to 1,429 in Norway or 1,414 in Denmark. (Finland is closer to the U.S., but it's also poorer than the other Nordics.) That difference between Denmark and the U.S. represents more than two months of full-time work per person every year.

There is no reason millennials should expect to work until they die. In a country that can think sensibly about its economic system, greater wealth and labor productivity should mean less work, earlier retirement, and generally more creature comforts of all kinds. The reason that's not happening here is that America's economic ideology and institutions have been rigged on behalf of the ultra-rich. With sensible, simple reforms, we could have both work for all who want it, and decent rest for the sick and elderly.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

A dreamy long weekend on the Amalfi Coast

A dreamy long weekend on the Amalfi CoastThe Week Recommends History, pasta, scenic views – this sun-drenched stretch of Italy’s southern coast has it all

-

Can foster care overhaul stop ‘exodus’ of carers?

Can foster care overhaul stop ‘exodus’ of carers?Today’s Big Question Government announces plans to modernise ‘broken’ system and recruit more carers, but fostering remains unevenly paid and highly stressful

-

6 exquisite homes with vast acreage

6 exquisite homes with vast acreageFeature Featuring an off-the-grid contemporary home in New Mexico and lakefront farmhouse in Massachusetts