Why Wall Street is freaking out

Is it simply because things are finally getting back to normal?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Why are stocks cratering?

Plenty of other economic indicators are quite healthy. GDP growth for the third quarter was 3.5 percent. That's down from the 4.2 percent boom in the second quarter — but it's still good for America's best back-to-back quarterly growth in four years.

But stock markets are getting hammered. Sure, they recovered ground on Tuesday, but they remain well below their peaks at the beginning of October.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

So why is the stock market tanking even as economic growth booms?

Well for starters, because the stock market is not the real economy. But also, in this case, stock markets are likely falling because the real economy is returning to something like healthy normalcy.

This requires some explanation.

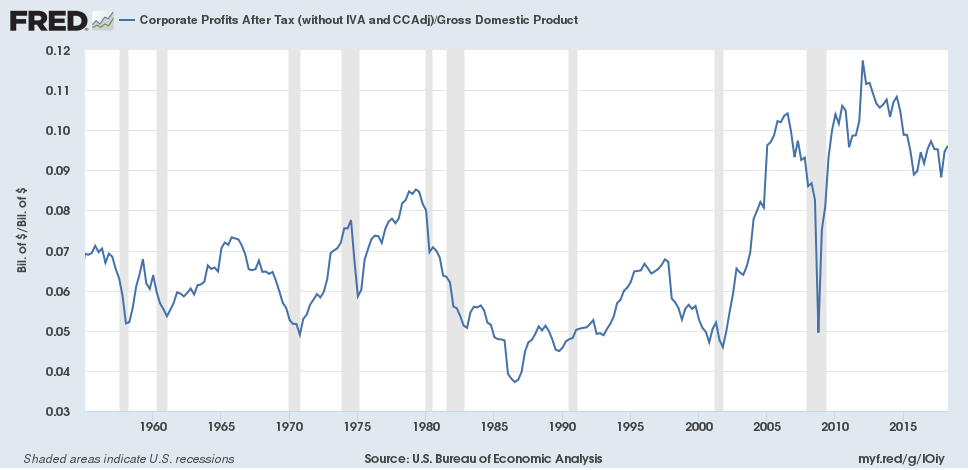

The dividend payments you get as a stockholder are pulled from company profits. Thus, the value of a given stock is largely a function of the business' expected profits. To understand why the stock market as a whole has been booming in recent years, notice that corporate profits as a whole have boomed as well.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

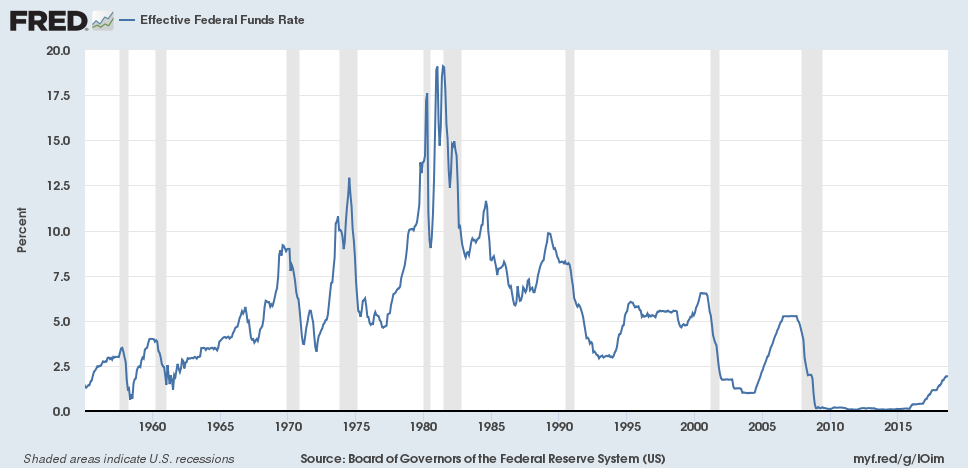

At the same time, however, as interest rates rise, stocks become less valuable. Higher interest rates make it more expensive for businesses to borrow and finance their operations, which eats into profits. Higher interest rates also increase the yield for safe assets like U.S. Treasuries, which lowers the comparable return on riskier bets like stocks.

Here's the Federal Reserve's target for national interest rates. As you can see, they fell to nothing during the same period corporate profits boomed.

In recent years, you may have seen a lot of financial stories about the "goldilocks economy." This is why. That unique combination of surging corporate profits and rock-bottom interest rates delivered an absolute bonanza for the investor class.

But now interest rates are rising and the real economy is growing. Investors are worried the party is coming to a close.

Indeed, the Fed is finally increasing interest rates largely because GDP growth is firming up. The central bank's job is to maximize job creation and stabilize prices. As the economy heats up, the Fed is worried that will increase inflationary pressure. Now, the central bank arguably has a habit of over-prioritizing inflation. But this is why it's tapping the brakes.

On top of that, as the economy strengthens, there will be more opportunities for profitable investments, and banks will be able to charge higher interest rates on the loans they offer.

All of which translates into higher interest rates for the national economy.

Now, obviously there's a lot out there scaring investors, from a slowdown in China’s growth to President Trump’s trade war. But rising interest rates and the potential end of the "goldilocks economy" is a big part of the stock panic.

And there's one more factor: unemployment.

The jobless rate is at a near-historic low. This at least theoretically gives workers more leverage to demand higher wages. When their services are more in demand, they can charge businesses more for them — and that rising worker pay eats into corporate profits. More competition may also simultaneously force businesses to cut prices to hold onto market share. As you may have noticed from that graph, the boom years of both the midcentury and the late 1990s line up with lower corporate profits. In fact, corporate profits have already taken a dip as the economy has strengthened — though they remain historically high.

America's economy faces real threats. But that's not why stock markets are freaking out. Rather, investors have been spoiled rotten by an economy that spent years granting them massive returns at the expense of the rest of the economy. They're freaking out because we're finally seeing signs — and really just very modest signs — that maybe things are returning to normal.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

The pros and cons of noncompete agreements

The pros and cons of noncompete agreementsThe Explainer The FTC wants to ban companies from binding their employees with noncompete agreements. Who would this benefit, and who would it hurt?

-

What experts are saying about the economy's surprise contraction

What experts are saying about the economy's surprise contractionThe Explainer The sharpest opinions on the debate from around the web

-

The death of cities was greatly exaggerated

The death of cities was greatly exaggeratedThe Explainer Why the pandemic predictions about urban flight were wrong

-

The housing crisis is here

The housing crisis is hereThe Explainer As the pandemic takes its toll, renters face eviction even as buyers are bidding higher

-

How to be an ally to marginalized coworkers

How to be an ally to marginalized coworkersThe Explainer Show up for your colleagues by showing that you see them and their struggles

-

What the stock market knows

What the stock market knowsThe Explainer Publicly traded companies are going to wallop small businesses

-

Can the government save small businesses?

Can the government save small businesses?The Explainer Many are fighting for a fair share of the coronavirus rescue package

-

How the oil crash could turn into a much bigger economic shock

How the oil crash could turn into a much bigger economic shockThe Explainer This could be a huge problem for the entire economy