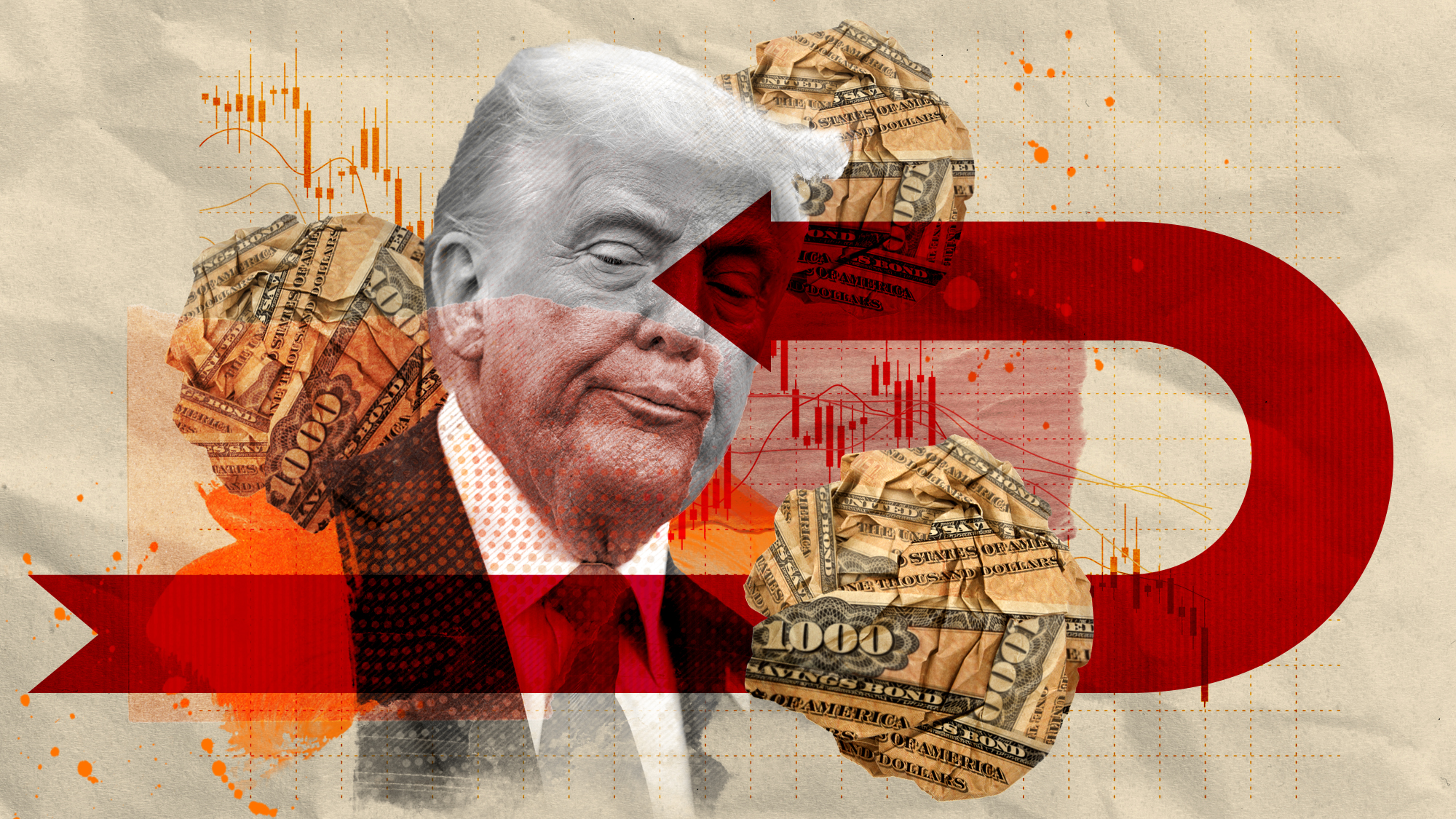

4 reasons the stock market is tanking

Here's why October has not been kind to investors

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Stock markets did not have a good day on Tuesday. The Dow Jones, the S&P 500, and the Nasdaq all dropped around a percentage point. Granted, the market close wasn't as bad as the open, when stocks plunged over 500 points. But still, the day was the latest descent in a slide that's been going on for weeks. The Dow is down almost six percentage points and is headed for its worst month since August 2015; the S&P 500 is on track for its fifth straight week of declines; and all three indexes hit three-month lows at some point on Tuesday.

What happened?

Markets are jittery about at least four ongoing trends: slowing economic growth in China; the brewing trade war between China and the U.S.; the international outcry over the disappearance of journalist Jamal Khashoggi; and slow but steady upward march of U.S. interest rates. All four sources of anxiety had a collective moment on Tuesday.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

1. Slowing growth in China

For years, observers have worried about a possible slowdown in the Chinese economy. The country's communist-capitalist hybrid deeply entangles its banking sector with its government, so China can't really suffer a financial crisis the same way America can. But China can mismanage its resources, build more capacity than it has demand to utilize, and cause GDP to slow to a crawl. Since China is a big source of sales for businesses around the world, that would have repercussions for markets in America and elsewhere.

Well, China's official growth rate in the third quarter of 2018 was 6.5 percent. That's crazy high by American standards, but the slowest rate the country has seen since 2009. Chinese authorities also just announced a suite of new policies to pump new credit and capital into the country's private firms. You'd think that would count as good news, but markets apparently took it as evidence that the Chinese government is worried. Major Asian stock index from Japan to Shanghai and Hong Kong all took a dive.

Finally, 3M and Caterpillar — two major industrial players on U.S. stock markets that are viewed as bellwethers — just reported their latest results. And both said their China sales are slowing down.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

2. Trade war with China

Caterpillar and 3M also warned that the tariffs President Trump has slapped on China will drive up their operating costs by around $100 million each this coming year. Caterpillar explicitly said it would have to raise its own prices thanks to Trump's tariffs on steel and aluminum. And Harley-Davidson — which was in a public spat with the president over its offshoring plans — said tariffs would add $48 million to its costs this year. Stock prices for all three fell 5 to 6 percentage points on the news. And Caterpillar's stock is down over 15 percent over the last month.

Meanwhile, a fourth company, United Technologies Corp., which specializes in everything from jet engines to elevators, announced it would have to raise prices as well if tariffs stick around through next year.

It wasn't all bad news: Both Caterpillar and Harley-Davidson reported strong revenues and profits. But investors are on a hair-trigger over the trade war. "The ramifications of a prolonged trade war are really seeping into investors' minds right now," Art Hogan, a chief strategist at the investment bank B. Riley FBR, told CNBC. "I think we're coming to a capitulation point."

3. The scandal over Jamal Khashoggi

Reports now confirm the well-known journalist and critic of the Saudi Arabian government was killed in the country's Turkey consulate by agents of the regime. The incident has sparked a massive international outcry, and Western CEOs and government officials have been pulling out en masse from an upcoming business conference in Riyadh.

It's not clear how far major companies around the world will go in cutting their ties. But Saudi Arabia's massive oil resources and plans for its sovereign wealth fund present an unprecedented profit opportunity for Western financial firms in particular. If the break becomes permanent, a lot of future returns investors were expecting could disappear. Those tensions contributed to stock markets' retreat across both Asia and Europe on Tuesday. (Admittedly, the ongoing fights over Brexit and Italy's new budget didn't help either.)

4. United States interest rates

By any historical measure, U.S. interest rates aren't high. But they were rock bottom for years after the Great Recession. As corporate profits recovered pretty quickly after the collapse, this combination of big returns plus ultra-low interest rates led to a bonanza for investors. Now that the Federal Reserve is slowly but steadily hiking rates, stock markets worry the party may finally be over.

Those increases have driven the interest rate on U.S. Treasuries up to 3.2 percent — not high, but higher than they've been in a long time. That uptick was also apparently big enough to freak out the markets: Major stocks — Amazon, Bank of America, Nvidia, Twitter, and Alphabet (the parent company for Google) — all dropped on Tuesday. Meanwhile, the yields on those same Treasuries dipped again as investors fled stocks for the comparative safety of government bonds.

Of course, underneath all these ups and downs is the brute fact that U.S. economic fundamentals remain strong. The day-in-day-out travails of wealthy investors may command a disproportionate share of our national attention, but ultimately the stock market is not the real economy.

"You look at everything going on — Saudi Arabia, the oil market, Brexit, Italy, the U.S. elections, the Fed raising rates — I could go on and on," Brad McMillan, the chief investment officer at Commonwealth Financial Network, told The Washington Post. "The question isn't why is the market reacting. The question is why isn't it worse."

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

The Week Unwrapped: Do the Freemasons have too much sway in the police force?

The Week Unwrapped: Do the Freemasons have too much sway in the police force?Podcast Plus, what does the growing popularity of prediction markets mean for the future? And why are UK film and TV workers struggling?

-

Properties of the week: pretty thatched cottages

Properties of the week: pretty thatched cottagesThe Week Recommends Featuring homes in West Sussex, Dorset and Suffolk

-

The week’s best photos

The week’s best photosIn Pictures An explosive meal, a carnival of joy, and more

-

Did markets’ ‘Sell America’ trade force Trump to TACO on Greenland?

Did markets’ ‘Sell America’ trade force Trump to TACO on Greenland?Today’s Big Question Investors navigate a suddenly uncertain global economy

-

Texas is trying to become America’s next financial hub

Texas is trying to become America’s next financial hubIn the Spotlight The Lone Star State could soon have three major stock exchanges

-

What a rising gold price says about the global economy

What a rising gold price says about the global economyThe Explainer Institutions, central banks and speculators drive record surge amid ‘loss of trust’ in bond markets and US dollar

-

Is a financial market crash around the corner?

Is a financial market crash around the corner?Talking Points Observers see echoes of 1929

-

The AI bubble and a potential stock market crash

The AI bubble and a potential stock market crashToday's Big Question Valuations of some AI start-ups are 'insane', says OpenAI CEO Sam Altman

-

DORKs: The return of 'meme stock' mania

DORKs: The return of 'meme stock' maniaFeature Amateur investors are betting big on struggling brands in hopes of a revival

-

Dollar faces historic slump as stocks hit new high

Dollar faces historic slump as stocks hit new highSpeed Read While stocks have recovered post-Trump tariffs, the dollar has weakened more than 10% this year

-

How the US bond market works – and why it matters

How the US bond market works – and why it mattersThe Explainer Donald Trump was forced to U-turn on tariffs after being 'spooked' by rise in Treasury yields