How the US bond market works – and why it matters

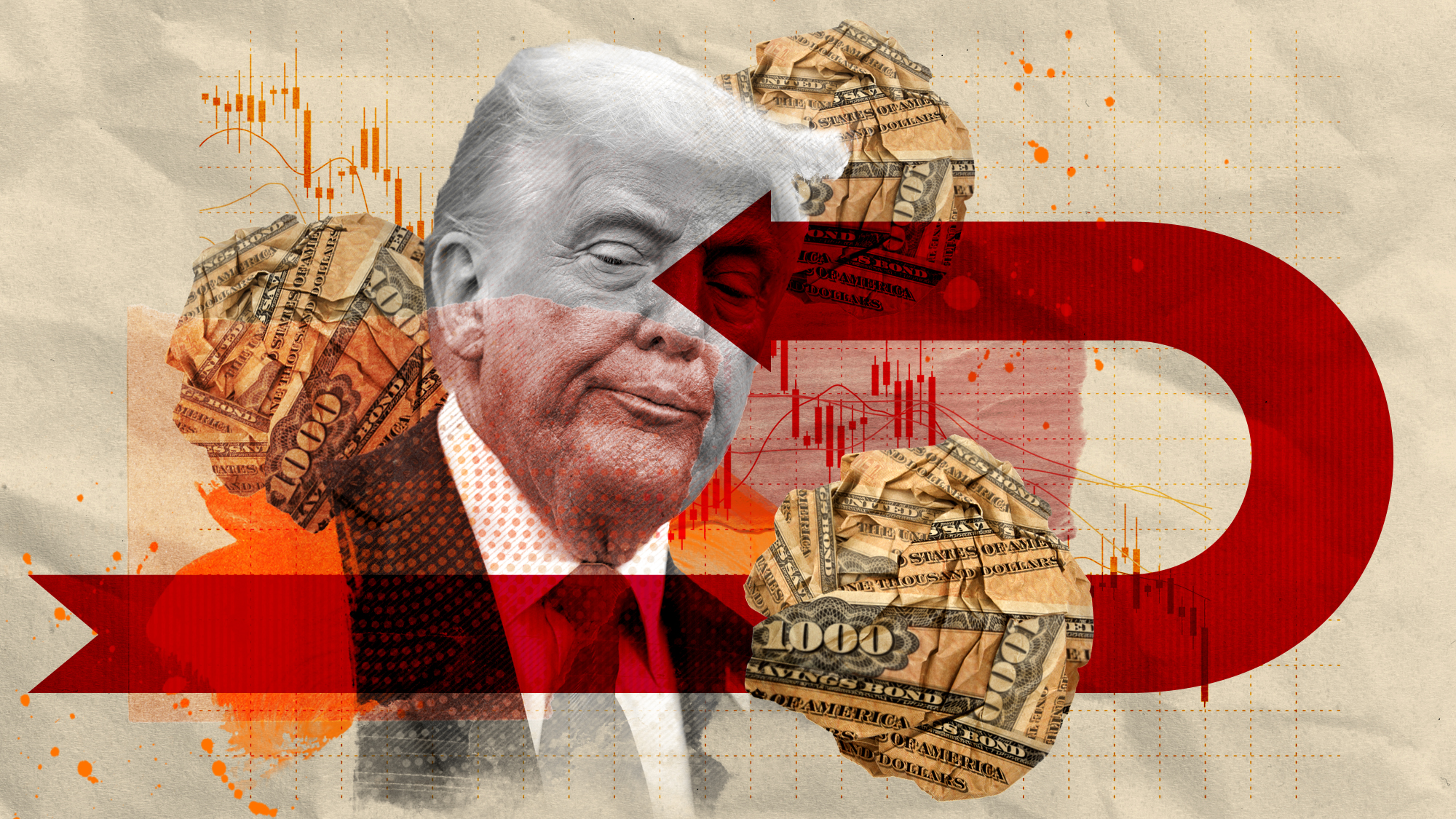

Donald Trump was forced to U-turn on tariffs after being 'spooked' by a sharp rise in Treasury yields

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

"I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter," said Democratic Party strategist James Carville in the 1990s. "But now I would like to come back as the bond market. You can intimidate everybody."

US government bonds, known as Treasuries, are "traditionally seen as a safe haven because they are guaranteed by the world's biggest economy", said The Guardian. But recent turmoil in the US bond market has called that certainty into question – and brought Donald Trump's tariff blitzkrieg to an abrupt halt.

What is the bond market?

Government bonds are "essentially an IOU", said the BBC. Used to raise money for public spending, they are issued with different "maturity" rates, most commonly over two, 10 or 30 years. Investors receive a fixed annual return, known as a coupon rate, for the term of the bond, but they can also sell the bond. This is mainly done by financial institutions like pension funds, as well as by central banks like the US Federal Reserve and the Bank of England.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

What are yields and why do they matter?

Donald Trump's "Liberation Day" tariffs shook global confidence in the stability of the US economy. Spooked investors began offloading their US government bonds, causing the value of the bonds to fall and their yield – the amount an investor can expect to make in proportion to what they paid – to increase.

The yield on 10-year Treasuries – considered "one of the key rates in the economy", said CNN – shot up from 3.9% to 4.5%. This represents a seismic shift when you consider movements of 0.2% in either direction are a "big deal", said the BBC.

It matters because when yields on existing bonds are higher, the government has to offer higher coupon rates to attract buyers for new bonds to fund new spending. That increases the cost of borrowing, which in turn "underpins a range of other borrowing costs for everyday Americans", including mortgage rates and business loans for everything from small enterprises to large corporations, said CNN.

Ultimately, Trump was forced to back down on his tariffs plans after being "spooked" by the shifting bond market, Ed Yardeni, president of Yardeni Research, told CNN.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

In fact, the ability of bonds to rapidly alter government policy is "well documented", said Al Jazeera. In 2022, UK prime minister Liz Truss was "brought down by her own skirmish with the bond markets" after just 49 days in office, said The Guardian. They judged her so-called mini-budget fiscally reckless, sending the yield on UK government bonds "rocketing" as the bond value "dropped like a stone", which in turn "forced mortgage companies to increase borrowing rates and wrecked Truss’s premiership". Trump may have "more resources", but "he faces similar concerns about the spillover effects".

Where does China come into it?

Foreign ownership of US bonds has almost doubled since 2010, rising by $3 trillion, according to Deutsche Bank. China is the second biggest holder of US government debt globally, after Japan, with close to $761 billion (around £570 million).

Currently subject to a 145% tariff on US exports, Beijing faces a "stark choice", said The Times: eat the losses or "risk economic turmoil by offloading US treasuries", which would damage its own dollar-denominated portfolio, which amounts to $3 trillion.

A strategic mass dumping of US bonds is China's potential "nuclear option", said The Telegraph. The "blow to the US would be seismic", although the "scenario is highly unlikely, not least because the pain for China would be huge".

-

Should the EU and UK join Trump’s board of peace?

Should the EU and UK join Trump’s board of peace?Today's Big Question After rushing to praise the initiative European leaders are now alarmed

-

Antonia Romeo and Whitehall’s women problem

Antonia Romeo and Whitehall’s women problemThe Explainer Before her appointment as cabinet secretary, commentators said hostile briefings and vetting concerns were evidence of ‘sexist, misogynistic culture’ in No. 10

-

Local elections 2026: where are they and who is expected to win?

Local elections 2026: where are they and who is expected to win?The Explainer Labour is braced for heavy losses and U-turn on postponing some council elections hasn’t helped the party’s prospects

-

Currencies: Why Trump wants a weak dollar

Currencies: Why Trump wants a weak dollarFeature The dollar has fallen 12% since Trump took office

-

TikTok: New owners, same risks

TikTok: New owners, same risksFeature What are Larry Ellison’s plans for TikTok US?

-

Trump wants a weaker dollar, but economists aren’t so sure

Trump wants a weaker dollar, but economists aren’t so sureTalking Points A weaker dollar can make imports more expensive but also boost gold

-

Leadership: A conspicuous silence from CEOs

Leadership: A conspicuous silence from CEOsFeature CEOs were more vocal during Trump’s first term

-

Did markets’ ‘Sell America’ trade force Trump to TACO on Greenland?

Did markets’ ‘Sell America’ trade force Trump to TACO on Greenland?Today’s Big Question Investors navigate a suddenly uncertain global economy

-

The end for central bank independence?

The end for central bank independence?The Explainer Trump’s war on the US Federal Reserve comes at a moment of global weakening in central bank authority

-

Can Trump make single-family homes affordable by banning big investors?

Can Trump make single-family homes affordable by banning big investors?Talking Points Wall Street takes the blame

-

What will the US economy look like in 2026?

What will the US economy look like in 2026?Today’s Big Question Wall Street is bullish, but uncertain