Why the yield curve inversion might not signal a recession

The economy has become a lot less predictable

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

One of the economy's most reliable warning lights started flashing more frantically last week. Returns on three-month Treasuries pulled even with returns on 10-year Treasuries: the arrival of the dreaded inverted yield curve. For the last half century, recessions come a year-and-a-half or so after a yield curve inversion, basically like clockwork.

But will this indicator always be reliable? Or could the warning system break down?

An inverted yield curve doesn't actually cause a recession. It's just a distillation of the market's crowd wisdom, i.e. how investors weigh various risks in the economy. Under normal economic conditions, long-term investments are riskier than short-term ones. To compensate for that risk, investors demand higher returns on long-term assets (like 10-year Treasuries) than on short-term ones (like three-month Treasuries).

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But occasionally, for whatever myriad reasons, the markets decide that short-term risks are greater than long-term ones. The returns change accordingly, and now short-term returns are higher. The yield curve has inverted. And presumably, if short-term risks are greater than long-term risks, that means a recession is imminent.

The 10-year and three-month Treasuries inverted last week — the first time that's happened since 2007. Of course, there are lots of bonds and yield curves to choose from. And the popular 10-year versus two-year curve hasn't inverted yet. (Though it's close.) On the other hand, the yield curves for five-year and two-year Treasuries, and for five-year and three-year Treasuries, inverted late last year.

But like I said, the yield curve is ultimately circumstantial evidence. Investors' behavior exists within a certain context, looks back on a certain history, and makes a certain set of assumptions accordingly. For instance, outside of the United States, an inverted yield curve has never been an especially reliable indicator of incoming recessions. It's a product of its circumstances, and circumstances can change. In fact, even just here in America, they have changed already.

Growth rates for economic output and productivity were significantly stronger in the midcentury than they've been for the last 15 years or so. Back then, investors had faith that long-term economic prospects were good. If a sudden crisis spooked them in the near term, the difference in risk premiums they'd demand would be pronounced. But now the long-term "normal" for the economy is weaker and less impressive, so the difference between it and suddenly dismal short-term investment prospects is less pronounced.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

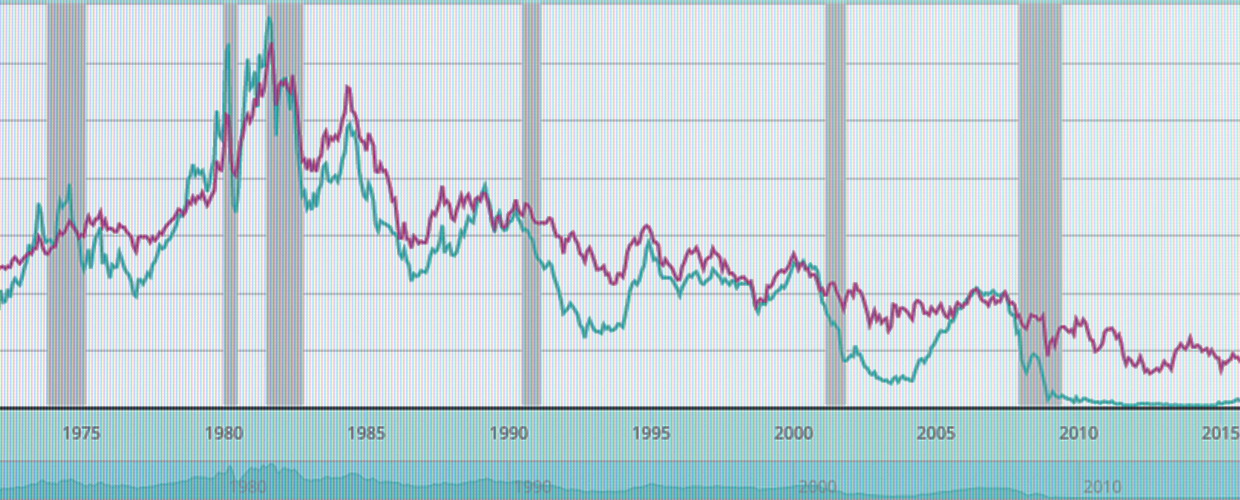

In fact, you can see this ongoing decay just by plotting short-term bond yields (one-year Treasuries in blue below) and long-term yields (10-year Treasuries in red).

You can see how, over and over, the short-term yields fall below the long-term yields, then rise to meet them as recessions (the gray patches) approach.

Yet this cycle sits within a larger trend of both returns falling over time. Off to the right, you can see how short-term yields flatlined at zero after 2008, even as long-term rates continued to fall. That squeezed the gap between the two. Short-term rates are finally rising again, but now they have to cover much less ground to hit inversion.

Another thing to consider is the role of the Federal Reserve itself. Adjusting short-term rates is one of its key monetary policy tools. When the economy is weak, the Fed tries to keep those rates low to boost growth. When the economy is strong, the central bank pushes those rates up, both to head off inflation and to give itself room to cut for the next recession. In fact, in decades past, recessions often happened because the Fed hiked too much too fast. An inverted yield curve could be seen as a sign the central bank had overshot its mark. But then, as soon as the Fed corrected, the economy would bounce back.

These days, more recessions are more often caused by bubbles and financial panics. And those bounce backs have become weaker and slower. In response, the highest point to which the Fed will raise its target rate during booms has fallen lower and lower. Now, we're just about at the point where they can't go any lower. Last week, the Fed announced it was done hiking rates for the immediate future, despite its interest rate target being at a remarkably low 2.25-to-2.5 percent.

The other thing the Fed did after 2008 was it tried to push long-term interest rates down, as a more unconventional form of stimulus. Some of those efforts are slowly unwinding. But the asset portfolio the Fed accumulated to achieve that end remains quite large.

In sum, the movements of bond yields are partially driven by investors bets and partially by the Fed's monetary policy choices. And it's increasingly hard to tell if inverted yield curves are signaling a change in economic risks or are just the residue of the Fed's judgment calls. But more broadly, all these changes ultimately point back to the same source: The economy is just chronically weaker now than it was in the past. That's changed the overall course of interest rates, and it's forced the Fed to change its policy strategy.

Sure, the inverted yield curve was a reliable indicator from roughly 1960 until now. But a little over half a century is not a long amount of time in the grand scheme of things. The economy had a particular structure for a number of decades and a particular set of pretty predictable behaviors. But a lot has changed since, and we've really started to feel those changes since the Great Recession.

Going forward, it's entirely possible the economy could keep shuffling along for awhile, keeping both interest rates and inflation low, without quite tipping over into recession. In such a world, is an inverted yield curve even a meaningful event anymore? It's difficult to say.

But in the next few years, we're going to find out.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

The pros and cons of noncompete agreements

The pros and cons of noncompete agreementsThe Explainer The FTC wants to ban companies from binding their employees with noncompete agreements. Who would this benefit, and who would it hurt?

-

What experts are saying about the economy's surprise contraction

What experts are saying about the economy's surprise contractionThe Explainer The sharpest opinions on the debate from around the web

-

The death of cities was greatly exaggerated

The death of cities was greatly exaggeratedThe Explainer Why the pandemic predictions about urban flight were wrong

-

The housing crisis is here

The housing crisis is hereThe Explainer As the pandemic takes its toll, renters face eviction even as buyers are bidding higher

-

How to be an ally to marginalized coworkers

How to be an ally to marginalized coworkersThe Explainer Show up for your colleagues by showing that you see them and their struggles

-

What the stock market knows

What the stock market knowsThe Explainer Publicly traded companies are going to wallop small businesses

-

Can the government save small businesses?

Can the government save small businesses?The Explainer Many are fighting for a fair share of the coronavirus rescue package

-

How the oil crash could turn into a much bigger economic shock

How the oil crash could turn into a much bigger economic shockThe Explainer This could be a huge problem for the entire economy