Global economy: The coming wave of lockdowns

How this round of lockdowns will impact the global economy

The smartest insight and analysis, from all perspectives, rounded up from around the web:

The latest economic numbers showed record growth last week, but nobody is celebrating, said Courtenay Brown and Felix Salmon at Axios. The emergence of much of the country from lockdown led to a startling economic growth of 33.1 percent in the last quarter. But that number is deceptive. The economy is slowing again, and it's still "as far below its peak as in the darkest days of the last recession." The good number on economic growth also hides a lot of variation — and suffering. "Dense blue states are doing worse than open red states; women are doing worse than men; blacks are doing worse than whites; the poor are doing worse than the rich."

Corporations, too, posted excellent results in their latest earnings reports, but these were overshadowed by the "one word investors didn't want to hear," said Bob Pisani at CNBC: lockdown. As of last week, "85 percent of companies had beaten expectations by an astounding 19 percent on average" in the third quarter, a great sign of economic strengthening. Then soaring coronavirus case numbers in France and Germany prompted both countries to close bars, restaurants, and theaters for a month; more countries are considering similar measures. Wall Street was betting on the global economy to keep improving as reopening proceeded, while a new stimulus package would "be the bridge to a vaccine" sometime in the second quarter of 2021. Congress failed to deliver on the stimulus before the election, and the potential for a resurgence of lockdowns undermines the reopening narrative. That's an "explosive combination."

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

More lockdowns would be a mistake, said The Wall Street Journal in an editorial. Europe was "supposed to have done everything right to prevent another infection surge," with mask mandates and closures. It didn't last. "As before, the shutdowns are a blunderbuss response that won't eliminate the virus, but they will do considerable economic and public-health damage." Europe's recovery is about to go in reverse, sending a "ripple throughout the global economy." Fears of a market collapse were already at "their highest levels in many years," said economist Robert Shiller at The New York Times. According to my surveys, "an overwhelming majority of investors said there was a greater than 10 percent probability of an imminent market crash." The combination of high stock prices and investor fears makes this "a high-risk moment."

One positive sign for the world economy is that Europe's lockdowns aren't as draconian as before, said Neil Unmack at BreakingViews. Germany, for instance, is shutting bars but not stores, while France intends to keep schools open. So "the economic shock should be milder" than the contraction caused by the first wave. "The key question is how long lockdowns last, or how frequently they happen." What we do know, said Mohamed El-Erian at Bloomberg, is that what's happening in Europe is "a leading indicator for the United States." The U.S. will see more hospitalizations and deaths, and its own wave of closures. In response, the Fed will do its best to keep markets from collapsing — and in the process make the "disconnect between a profitable Wall Street and a struggling Main Street" even greater.

This article was first published in the latest issue of The Week magazine. If you want to read more like it, you can try six risk-free issues of the magazine here.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

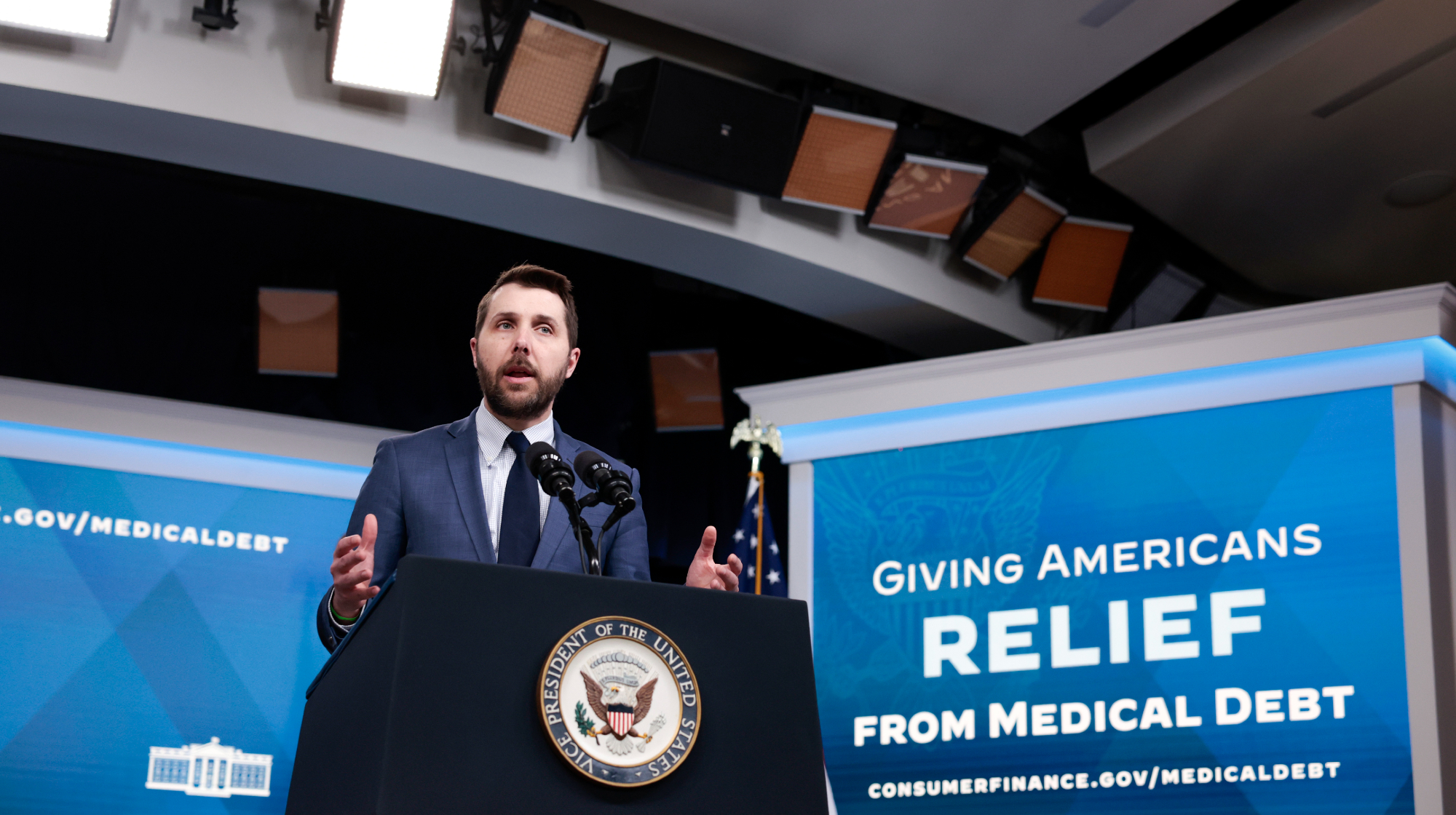

Judge nixes wiping medical debt from credit checks

Judge nixes wiping medical debt from credit checksSpeed Read Medical debt can now be included in credit reports

-

Grijalva wins Democratic special primary for Arizona

Grijalva wins Democratic special primary for ArizonaSpeed Read She will go up against Republican nominee Daniel Butierez to fill the US House seat her father held until his death earlier this year

-

18 slang words and phrases we can thank (or blame) Gen Z for

18 slang words and phrases we can thank (or blame) Gen Z forIn Depth Younger Americans have put their stamp on our language with these neologisms