The daily business briefing: May 11, 2022

Biden says fighting inflation is his top domestic priority, gasoline prices hit a nominal all-time high, and more

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

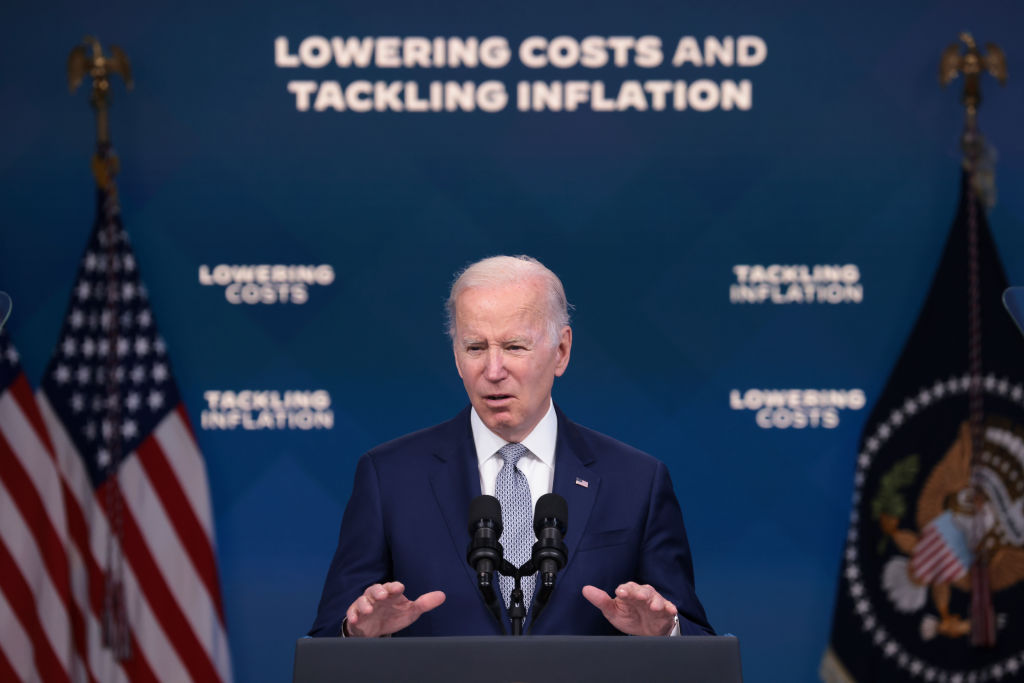

1. Biden calls fighting inflation his top domestic priority

President Biden on Tuesday defended his administration's efforts to fight high inflation, telling Americans that reining in rising prices is his top domestic priority. "I know families across America are hurting because of inflation," Biden said. "I understand what it feels like." The White House has said inflation is being fueled by pandemic-caused supply-chain bottlenecks and Russia's invasion of Ukraine, which disrupted oil markets and drove up costs. Biden also accused "ultra-MAGA" Republicans of exploiting frustration over inflation to push their "extreme agenda." Ronna McDaniel, chair of the Republican National Committee, said Biden appears to be "living in an alternate reality," blaming him and his fellow Democrats for rising prices.

The New York Times The Washington Post

2. Gas prices reach an all-time high

Gasoline prices hit an all-time high in the U.S. on Tuesday, not adjusted for inflation. The average U.S. price for a gallon of regular gas hit $4.37. But oil prices were down about 10 percent since the weekend and 20 percent since March as COVID-19 lockdowns slowed China's economy. Many traders expect slowing global economic activity to bring some relief at the pump, unless high demand in the summer driving season keeps prices high as Russian oil bans over the Ukraine war tighten supply. "I think the consumer will get a bit of a break here," said Tom Kloza, global head of energy analysis at Oil Price Information Service. "Just watch out for July and August."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The New York Times The Columbus Dispatch

3. Peloton shares fall on biggest quarterly loss as a public company

Peloton shares dropped 9 percent on Tuesday after the interactive-exercise equipment maker reported its biggest quarterly loss yet as a public company. Peloton said it had raised $750 million to help keep the business going as losses mount and demand weakens. Chief Executive Barry McCarthy, who took over in February, said the company was short on capital partly because it was stuck with unsold bikes and treadmills. Peloton is among the companies that thrived early in the pandemic, as people worked and played more online, but are struggling now that the coronavirus crisis has eased and people are resuming normal activities.

4. E.U. lifts mask mandate in airports and on planes

European Union authorities announced Wednesday they will no longer require masks at airports and on planes, the latest easing of coronavirus restrictions in the trading bloc. The European Union Aviation Safety Agency said the move is "a big step forward in the normalization of air travel." The aviation regulator made the decision jointly with the European Centre for Disease Prevention and Control. The updated guideline reflects the latest pandemic developments, "in particular the levels of vaccination and naturally acquired immunity, and the accompanying lifting of restrictions in a growing number of European countries," the agencies said in a joint statement.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. Stock futures rise ahead of inflation data

U.S. stock futures rose early Wednesday ahead of inflation data that could affect how fast the Federal Reserve raises interest rates to fight inflation. Futures tied to the Dow Jones Industrial Average and the S&P 500 were up 0.8 percent and 0.9 percent, respectively, at 6:30 a.m. ET. Nasdaq futures were up 1.1 percent. On Tuesday, the Dow fell 0.3 percent, while the S&P 500 and the tech-heavy Nasdaq rose 0.3 percent and 1 percent, respectively. Federal data due to be published at 8:30 a.m. ET is expected to show that the consumer price index rose at an annual rate of 8.1 percent in April, down from a 40-year high of 8.5 percent in March, which would be the first monthly decrease since August 2021.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

The daily business briefing: January 24, 2024

The daily business briefing: January 24, 2024Business Briefing The S&P 500 sets a third straight record, Netflix adds more subscribers than expected, and more

-

The daily business briefing: January 23, 2024

The daily business briefing: January 23, 2024Business Briefing The Dow and S&P 500 set fresh records, Bitcoin falls as ETF enthusiasm fades, and more

-

The daily business briefing: January 22, 2024

The daily business briefing: January 22, 2024Business Briefing FAA recommends inspections of a second Boeing 737 model, Macy's rejects Arkhouse bid, and more

-

The daily business briefing: January 19, 2024

The daily business briefing: January 19, 2024Business Briefing Macy's to cut 2,350 jobs, Congress averts a government shutdown, and more

-

The daily business briefing: January 18, 2024

The daily business briefing: January 18, 2024Business Briefing Shell suspends shipments in the Red Sea, December retail sales beat expectations, and more

-

The daily business briefing: January 17, 2024

The daily business briefing: January 17, 2024Business Briefing Judge blocks JetBlue-Spirit merger plan, Goldman Sachs beats expectations with wealth-management boost, and more

-

The daily business briefing: January 16, 2024

The daily business briefing: January 16, 2024Business Briefing Boeing steps up inspections on 737 Max 9 jets, Zelenskyy fights for world leaders' attention at Davos, and more

-

The daily business briefing: January 12, 2024

The daily business briefing: January 12, 2024Business Briefing Inflation was slightly hotter than expected in December, Hertz is selling a third of its EVs to buy more gas cars, and more