The daily business briefing: September 8, 2022

Regal Cinemas parent company Cineworld files for bankruptcy protection, Kim Kardashian launches a private equity firm, and more

- 1. Cineworld, owner of Regal Cinemas, files for bankruptcy protection

- 2. Kim Kardashian launches private equity firm with former Carlyle executive

- 3. E.U. proposes Russia gas price cap, Putin threatens cutoff

- 4. Judge says Musk can add whistleblower claims to Twitter countersuit

- 5. Stock futures flat after Wednesday's surge

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

1. Cineworld, owner of Regal Cinemas, files for bankruptcy protection

Regal Cinemas owner Cineworld Group on Wednesday filed for bankruptcy protection in federal court in Houston, blaming weak ticket sales. Movie theater admissions rebounded somewhat as COVID-19 restrictions were lifted, but they haven't returned to pre-pandemic levels. Cineworld is the world's second-largest movie theater chain behind AMC Entertainment Holdings. It operates 751 movie theaters, more than 500 of them in the United States. Its stock has fallen since early this year as audiences were slow to return. "Traveling to a movie theater to watch a movie for two to three hours, and spending $20 to $25, is just not attractive anymore for a lot of people, especially young people," said Eric Snyder, a bankruptcy expert at Wilk Auslander.

The Guardian The Wall Street Journal

2. Kim Kardashian launches private equity firm with former Carlyle executive

Kim Kardashian is partnering with longtime Carlyle Group executive Jay Sammons to form a private equity firm, SKKY Partners. Kardashian's mother, Kris Jenner, will participate in the firm as a partner. Kardashian, a reality TV star, is the latest in a string of celebrities to get into private equity investing. SKKY said in a statement that it "will make both control and minority investments in growth-oriented, market-leading consumer and media companies," tapping into Sammons' financial experience and Kardashian's "global reach and unrivaled social influence" to identify investment opportunities. Sammons' past deals include Beats by Dre and streetwear brand Supreme. Kardashian has launched an underwear company, Skims, which has a $3.2 billion valuation.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The Hollywood Reporter MarketWatch

3. E.U. proposes Russia gas price cap, Putin threatens cutoff

The European Union on Wednesday proposed capping Russian gas prices, escalating a fight with Moscow over energy supplies. Russian President Vladimir Putin has threatened to cut off all Russian energy supplies to Europe in response to any price cap. The clash threatened to drive up already high European gas prices, and increased the potential for rationing in European countries this winter. Europe has accused Russia of using energy shipments to punish Western nations for imposing sanctions over Russia's invasion of Ukraine. Russia claims the sanctions created the energy crisis by preventing adequate maintenance of the Nord Stream 1 natural gas pipeline, a key conduit to Europe. E.U. energy ministers have scheduled an emergency meeting for Friday.

Reuters The Wall Street Journal

4. Judge says Musk can add whistleblower claims to Twitter countersuit

Chancellor Kathaleen St. Jude McCormick, head judge of Delaware's Court of Chancery, said Wednesday that Tesla CEO Elon Musk can amend his countersuit against Twitter to include recent whistleblower allegations by the social media company's former security chief. Ex-head of security Peter Zatko, who was fired by Twitter earlier this year, filed a whistleblower complaint saying the company has failed to protect sensitive user data and prevent fake accounts. Musk is trying to back out of a $44 billion deal to buy Twitter. He says the company has not satisfied his demand to know how many of Twitters users are bots. Twitter is suing to force him to go through with the acquisition. McCormick denied Musk's request to delay the trial to November from Oct. 17.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The Associated Press The Wall Street Journal

5. Stock futures flat after Wednesday's surge

U.S. stock futures were little changed early Thursday after Wednesday's big gains. Futures tied to the Dow Jones Industrial Average, the S&P 500, and the Nasdaq were up 0.1 percent at 7 a.m. ET. The Dow and the S&P 500 rose 1.4 percent and 1.8 percent, respectively, on Wednesday. The tech-heavy Nasdaq jumped 2.1 percent, snapping a seven-day losing streak. It was the best day since Aug. 10 for all three of the main U.S. indexes. On Thursday, investors will be watching a question-and-answer session with Federal Reserve Chair Jerome Powell for indications about the central bank's views on the state of the economy and its plans for continuing aggressive rate hikes to fight inflation.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

Tourangelle-style pork with prunes recipe

Tourangelle-style pork with prunes recipeThe Week Recommends This traditional, rustic dish is a French classic

-

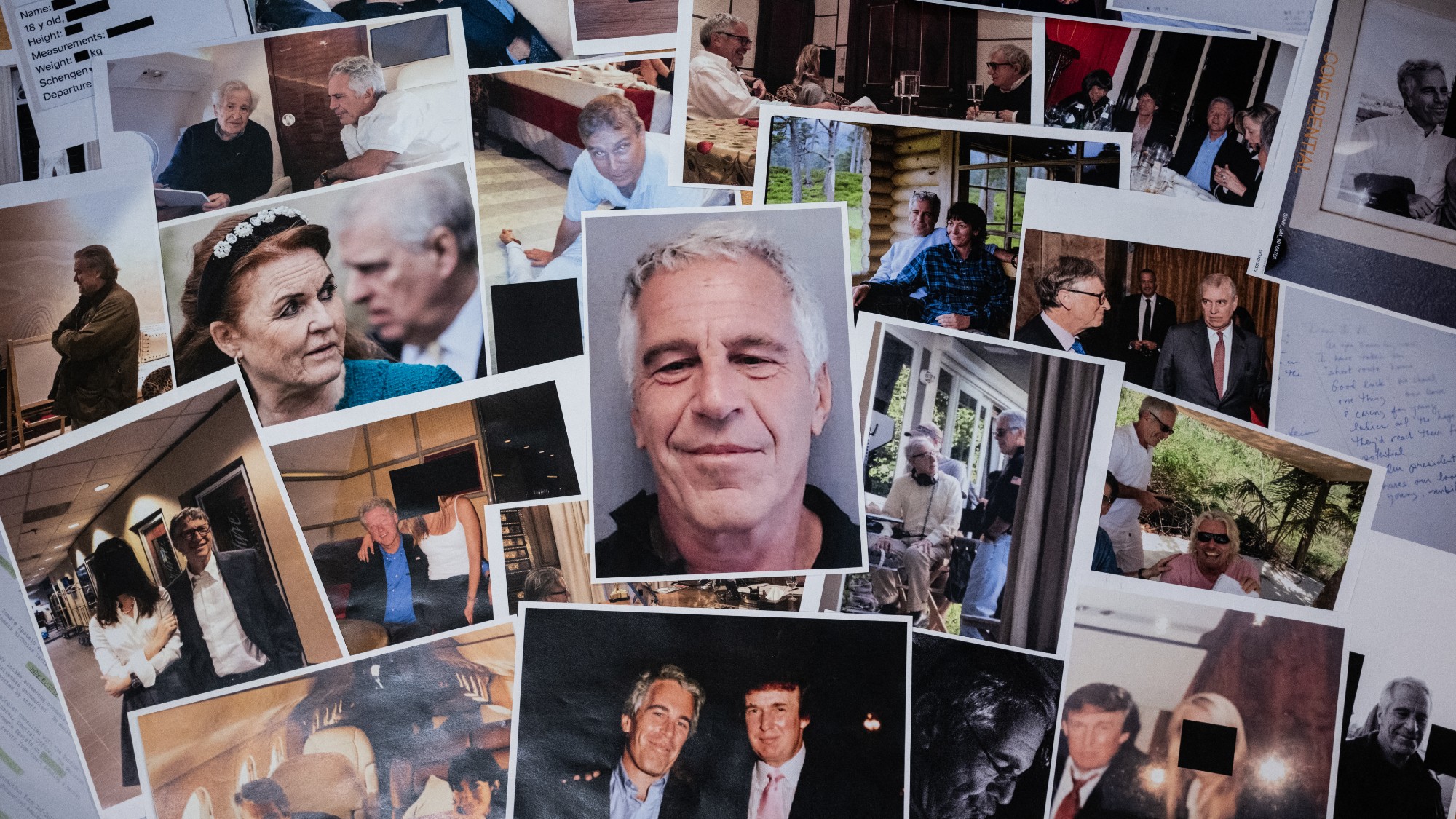

The Epstein files: glimpses of a deeply disturbing world

The Epstein files: glimpses of a deeply disturbing worldIn the Spotlight Trove of released documents paint a picture of depravity and privilege in which men hold the cards, and women are powerless or peripheral

-

Jeff Bezos: cutting the legs off The Washington Post

Jeff Bezos: cutting the legs off The Washington PostIn the Spotlight A stalwart of American journalism is a shadow of itself after swingeing cuts by its billionaire owner

-

The daily business briefing: January 24, 2024

The daily business briefing: January 24, 2024Business Briefing The S&P 500 sets a third straight record, Netflix adds more subscribers than expected, and more

-

The daily business briefing: January 23, 2024

The daily business briefing: January 23, 2024Business Briefing The Dow and S&P 500 set fresh records, Bitcoin falls as ETF enthusiasm fades, and more

-

The daily business briefing: January 22, 2024

The daily business briefing: January 22, 2024Business Briefing FAA recommends inspections of a second Boeing 737 model, Macy's rejects Arkhouse bid, and more

-

The daily business briefing: January 19, 2024

The daily business briefing: January 19, 2024Business Briefing Macy's to cut 2,350 jobs, Congress averts a government shutdown, and more

-

The daily business briefing: January 18, 2024

The daily business briefing: January 18, 2024Business Briefing Shell suspends shipments in the Red Sea, December retail sales beat expectations, and more

-

The daily business briefing: January 17, 2024

The daily business briefing: January 17, 2024Business Briefing Judge blocks JetBlue-Spirit merger plan, Goldman Sachs beats expectations with wealth-management boost, and more

-

The daily business briefing: January 16, 2024

The daily business briefing: January 16, 2024Business Briefing Boeing steps up inspections on 737 Max 9 jets, Zelenskyy fights for world leaders' attention at Davos, and more

-

The daily business briefing: January 12, 2024

The daily business briefing: January 12, 2024Business Briefing Inflation was slightly hotter than expected in December, Hertz is selling a third of its EVs to buy more gas cars, and more