The daily business briefing: September 26, 2022

The British pound falls to a record low against the dollar, OECD estimates Russia's war in Ukraine to cost global economy $2.8 trillion, and more

- 1. British pound falls to record low against dollar

- 2. Russia's Ukraine invasion costing global economy trillions, OECD says

- 3. Fed official says central bank can tame inflation with limited job losses

- 4. Stock futures fall after Dow's drop to lowest level of 2022

- 5. Apple shifts some iPhone 14 production to India

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

1. British pound falls to record low against dollar

The British pound fell more than 4 percent on Monday to a record low of $1.035 against the U.S. dollar. The plunge in early trading in Asia came after a 2.6 percent fall on Friday as British Chancellor of the Exchequer Kwasi Kwarteng announced that the United Kingdom would increase spending while imposing the biggest tax cuts in 50 years. Former Tory chancellor Lord Ken Clarke warned Sunday the tax cuts could trigger a collapse of the currency. The previous record low for the pound was $1.054 in 1985. The euro also hit a 20-year low of 0.965 per dollar. Weak economic data and concerns about Russia's war in Ukraine have boosted the dollar, a safe haven in uncertain times.

2. Russia's Ukraine invasion costing global economy trillions, OECD says

Russia's invasion of Ukraine will have reduced global economic output by $2.8 trillion by the end of 2023, the Organization for Economic Cooperation and Development said Monday. The cost will be even higher if Europe is hit by a severe winter and governments in the region are forced to ration energy as Russia squeezes supplies of natural gas, the Paris-based club of advanced economies said. The invasion, which Russia launched in late February, has driven up energy prices, leaving households with less to spend on everything else. It also has chipped away at the confidence of businesses and investors, rattling markets. The OECD forecasts the global economy will grow 3 percent this year, down from pre-war predictions of 4.5 percent.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. Fed official says central bank can tame inflation with limited job losses

Atlanta Federal Reserve President Raphael Bostic said Sunday there is "a really good chance" that the central bank can bring high inflation under control with fewer job losses than in previous slowdowns. "There is some ability for the economy to absorb our actions and slow in a relatively orderly way," Bostic said on CBS's Face the Nation. Fed officials are aggressively raising interest rates to bring down borrowing and spending. Fed officials believe that even as the economy slows, businesses that have had trouble finding enough workers during the coronavirus pandemic will try hard to avoid layoffs. "We need to have a slowdown," Bostic said. "We are going to do all that we can at the Federal Reserve to avoid deep, deep pain."

4. Stock futures fall after Dow's drop to lowest level of 2022

U.S. stock futures dipped early Monday as the British pound plunged against the dollar and after concerns about rising interest rates and high inflation dragged the Dow Jones Industrial Average to its lowest point of the year on Friday. Futures for the Dow and the S&P 500 were down 0.6 percent at 7 a.m. ET. Nasdaq futures were down 0.5 percent. The Dow and the S&P 500 fell 1.6 percent and 1.7 percent on Friday. The tech-heavy Nasdaq dropped 1.8 percent. Last week's losses were fueled by Federal Reserve Chair Jerome Powell's comments after the central bank's policy meeting. Powell said the Fed would continue aggressively raising rates, going as high as 4.6 percent next year before pulling back.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. Apple shifts some iPhone 14 production to India

Apple said on Monday it had started assembling its latest flagship smartphone, the iPhone 14, in India as it shifts some production away from China. The locally produced smartphones will be sold in India later this year. The tech giant unveiled the iPhone 14 earlier this month. "The new iPhone 14 lineup introduces groundbreaking new technologies and important safety capabilities. We're excited to be manufacturing iPhone 14 in India," Apple said in a statement. Apple started manufacturing older generation iPhones in India five years ago. J.P.Morgan analysts said they expected Apple to be producing about 5 percent of the latest iPhone handsets in India by the end of the year, and up to a quarter of them by 2025.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

El Paso airspace closure tied to FAA-Pentagon standoff

El Paso airspace closure tied to FAA-Pentagon standoffSpeed Read The closure in the Texas border city stemmed from disagreements between the Federal Aviation Administration and Pentagon officials over drone-related tests

-

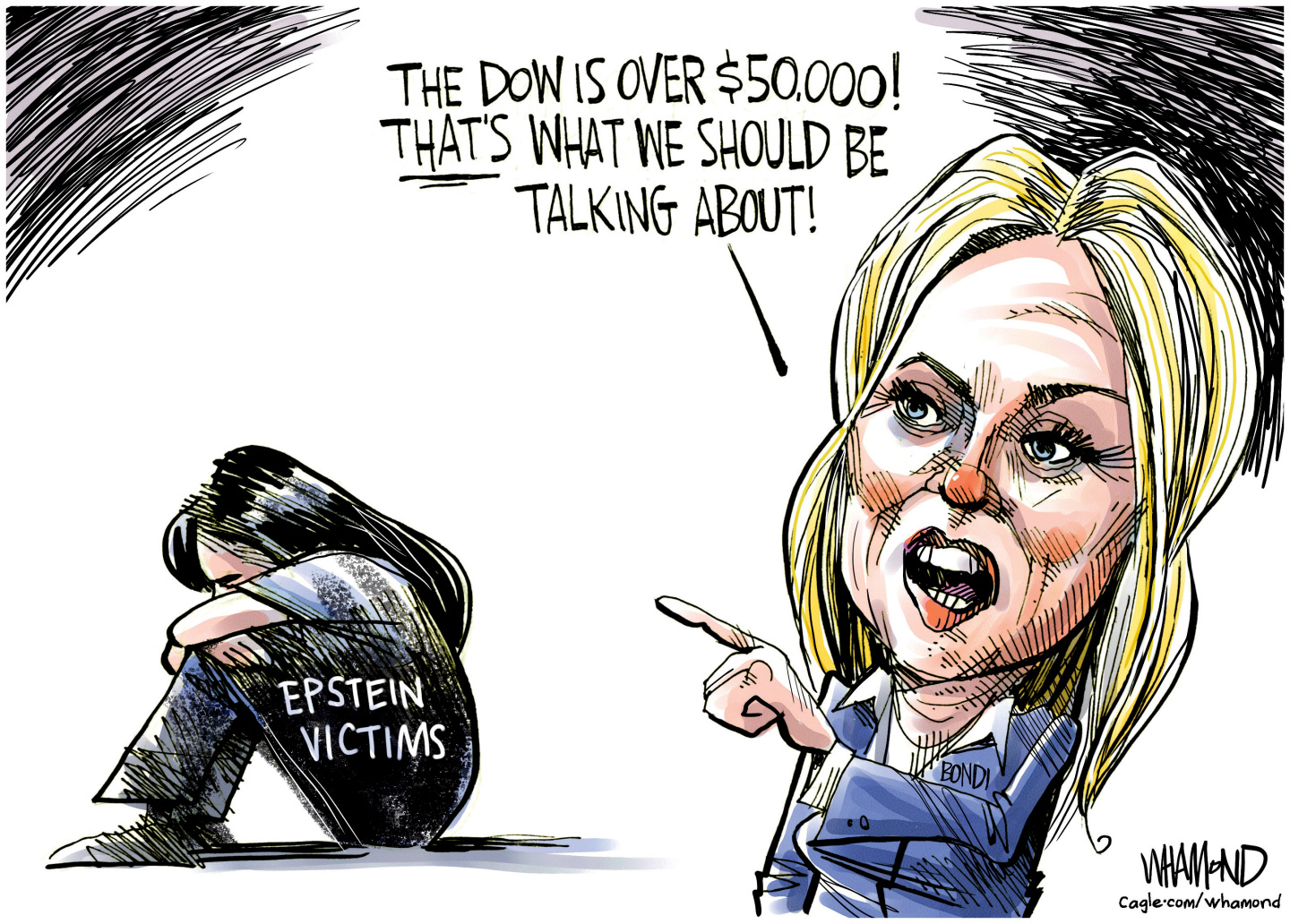

Political cartoons for February 12

Political cartoons for February 12Cartoons Thursday's political cartoons include a Pam Bondi performance, Ghislaine Maxwell on tour, and ICE detention facilities

-

Arcadia: Tom Stoppard’s ‘masterpiece’ makes a ‘triumphant’ return

Arcadia: Tom Stoppard’s ‘masterpiece’ makes a ‘triumphant’ returnThe Week Recommends Carrie Cracknell’s revival at the Old Vic ‘grips like a thriller’

-

Buffett: The end of a golden era for Berkshire Hathaway

Buffett: The end of a golden era for Berkshire HathawayFeature After 60 years, the Oracle of Omaha retires

-

Tariffs have American whiskey distillers on the rocks

Tariffs have American whiskey distillers on the rocksIn the Spotlight Jim Beam is the latest brand to feel the pain

-

TikTok secures deal to remain in US

TikTok secures deal to remain in USSpeed Read ByteDance will form a US version of the popular video-sharing platform

-

SiriusXM hopes a new Howard Stern deal can turn its fortunes around

SiriusXM hopes a new Howard Stern deal can turn its fortunes aroundThe Explainer The company has been steadily losing subscribers

-

How will the Warner Bros. bidding war affect the entertainment industry?

How will the Warner Bros. bidding war affect the entertainment industry?Today’s Big Question Both Netflix and Paramount are trying to purchase the company

-

Texas is trying to become America’s next financial hub

Texas is trying to become America’s next financial hubIn the Spotlight The Lone Star State could soon have three major stock exchanges

-

US mints final penny after 232-year run

US mints final penny after 232-year runSpeed Read Production of the one-cent coin has ended

-

How could worsening consumer sentiment affect the economy?

How could worsening consumer sentiment affect the economy?Today’s Big Question Sentiment dropped this month to a near-record low