The daily business briefing: October 7, 2022

Biden says U.S. considering alternatives to OPEC oil after production cut, a judge postpones the Musk-Twitter trial as the two sides discuss deal, and more

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

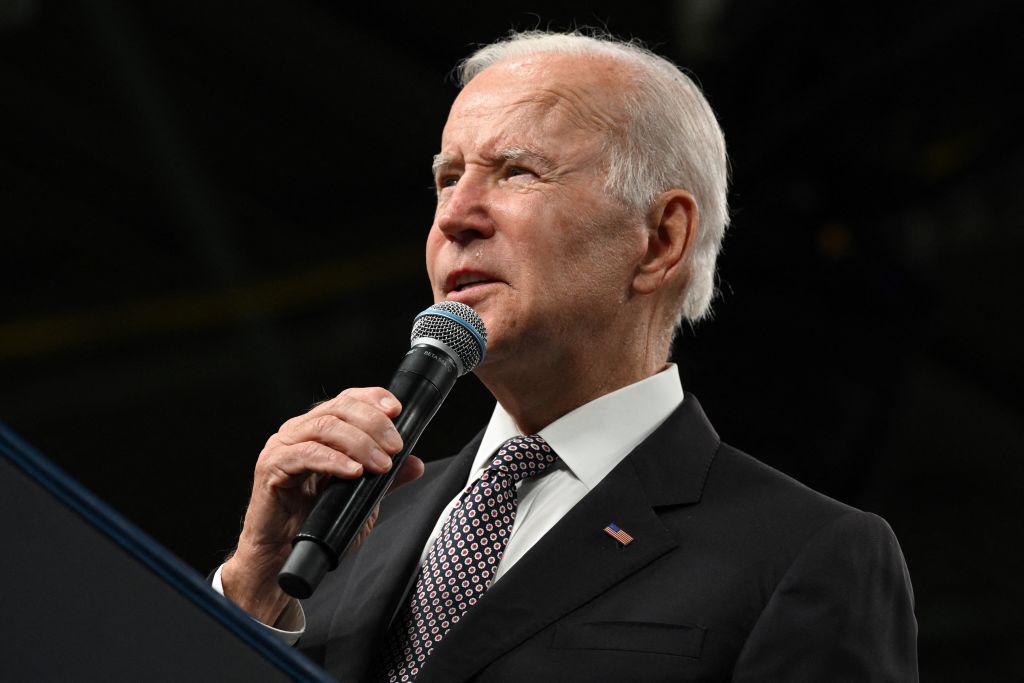

1. Biden seeks alternatives to OPEC oil after production cut

President Biden said Thursday his administration is looking for alternatives to oil from OPEC+ countries to keep gasoline prices from rising significantly after the alliance's decision to cut production by two million barrels a day. "We are looking at alternatives — we haven't made our minds up yet," Biden said. The president defended his decision to visit Saudi Arabia in July, saying it was about diplomacy in the Middle East and Israel, not oil, as many believed. Still, he said he was disappointed by the production cut by the Organization of Petroleum Exporting Countries, led by Saudi Arabia, and other oil producers led by Russia. Pump prices were already rising in recent weeks, a potential problem for Democrats in the November midterm elections.

USA Today The Wall Street Journal

2. Judge postpones trial over Musk-Twitter deal after talks resume

A Delaware judge, Chancellor Kathaleen McCormick, on Thursday postponed the trial over Tesla CEO Elon Musk's deal to buy Twitter. Musk tried to back out of the $44 billion deal, and Twitter took him to court to compel him to go through with the purchase. Musk recently told the company he was willing to close the deal at the original price of $54.20 per share, with some caveats. The two sides are still haggling over the terms, however, and McCormick gave Musk until Oct. 28 to wrap up negotiations. Musk had asked McCormick to call off the trial, but Twitter argued the case should continue because Musk might try to back out again.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. Stock futures mixed ahead of jobs report

U.S. stock futures were mixed early Friday ahead of the release of the September jobs report. Futures tied to the Dow Jones Industrial Average were up less than 0.1 percent at 6:30 a.m. ET. S&P 500 and Nasdaq futures were down 0.1 percent and 0.4 percent, respectively. The Dow and the S&P 500 fell 1.2 percent and 1 percent, respectively, on Thursday. The tech-heavy Nasdaq dropped 0.7 percent. Economists expect the Labor Department to report that U.S. employers added 275,000 nonfarm jobs in September, with unemployment remaining at 3.7 percent. If the report indicates the labor market is stronger than expected, it could fuel concerns that the Federal Reserve will raise interest rates so aggressively to fight inflation that it will tip the economy into a recession.

4. Cannabis stocks jump as Biden pushes marijuana policy reform

Cannabis stocks surged Thursday after President Biden announced he was pardoning thousands of people convicted on federal charges of simple marijuana possession as part of a push to ease criminalization of the drug. Biden said he is asking federal officials to review marijuana's classification under federal law, which is currently the same as heroin and LSD and higher than the classification of fentanyl and methamphetamine. U.S.-listed shares of well-known marijuana sellers Tilray Brands and Canopy Growth Corp. surged 22 percent and 31 percent, respectively. The ETFMG Alternative Harvest ETF, which includes several cannabis stocks, jumped nearly 20 percent. Cannabis stocks soared in 2018 when Canada legalized marijuana, but they have dropped since then as the industry's expansion fell short of expectations.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. Peloton to cut another 500 jobs

Peloton is cutting 500 jobs, or about 12 percent of its workforce, in its ongoing effort to reduce costs as sales slow. It will be the high-end exercise equipment maker's fourth round of layoffs this year. Peloton's shares jumped more than 400 percent in 2020 as coronavirus lockdowns kept gyms closed and the popularity of its bikes, treadmills, and subscriptions for its streaming exercise classes soared. But sales started slowing last year as COVID-19 vaccines became widely available and coronavirus restrictions were lifted, allowing people to emerge from their homes and return to their gyms. A Peloton spokesperson said the company hopes the cost cutting will help it "achieve break-even cash flow by the end of our fiscal year."

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

The daily business briefing: January 24, 2024

The daily business briefing: January 24, 2024Business Briefing The S&P 500 sets a third straight record, Netflix adds more subscribers than expected, and more

-

The daily business briefing: January 23, 2024

The daily business briefing: January 23, 2024Business Briefing The Dow and S&P 500 set fresh records, Bitcoin falls as ETF enthusiasm fades, and more

-

The daily business briefing: January 22, 2024

The daily business briefing: January 22, 2024Business Briefing FAA recommends inspections of a second Boeing 737 model, Macy's rejects Arkhouse bid, and more

-

The daily business briefing: January 19, 2024

The daily business briefing: January 19, 2024Business Briefing Macy's to cut 2,350 jobs, Congress averts a government shutdown, and more

-

The daily business briefing: January 18, 2024

The daily business briefing: January 18, 2024Business Briefing Shell suspends shipments in the Red Sea, December retail sales beat expectations, and more

-

The daily business briefing: January 17, 2024

The daily business briefing: January 17, 2024Business Briefing Judge blocks JetBlue-Spirit merger plan, Goldman Sachs beats expectations with wealth-management boost, and more

-

The daily business briefing: January 16, 2024

The daily business briefing: January 16, 2024Business Briefing Boeing steps up inspections on 737 Max 9 jets, Zelenskyy fights for world leaders' attention at Davos, and more

-

The daily business briefing: January 12, 2024

The daily business briefing: January 12, 2024Business Briefing Inflation was slightly hotter than expected in December, Hertz is selling a third of its EVs to buy more gas cars, and more