The daily business briefing: March 16, 2021

The S&P 500 and Dow hit record highs, Purdue Pharma unveils a $10 billion plan to emerge from bankruptcy, and more

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

1. S&P 500, Dow hit record highs

The S&P 500 and the Dow Jones Industrial Average continued their record-setting surge on Monday, both gaining to close at all-time highs. The S&P 500 rose by nearly 0.7 percent. The Dow gained 0.5 percent to post its sixth straight record high. The tech-heavy Nasdaq, which has seen big swings lately, rose by nearly 1.1 percent. The market has been boosted in recent days from the increasing pace of COVID-19 vaccinations and the approval of the new $1.9 trillion coronavirus relief bill. "With the vaccine positive news and the stimulus, we think there will continue to be a fair amount of rotation out of the stay-at-home stocks," said Greg Bassuk, CEO of AXS Investments. "We are bullish on financial services and energy coming out of the pandemic." U.S. stock index futures were mixed early Tuesday.

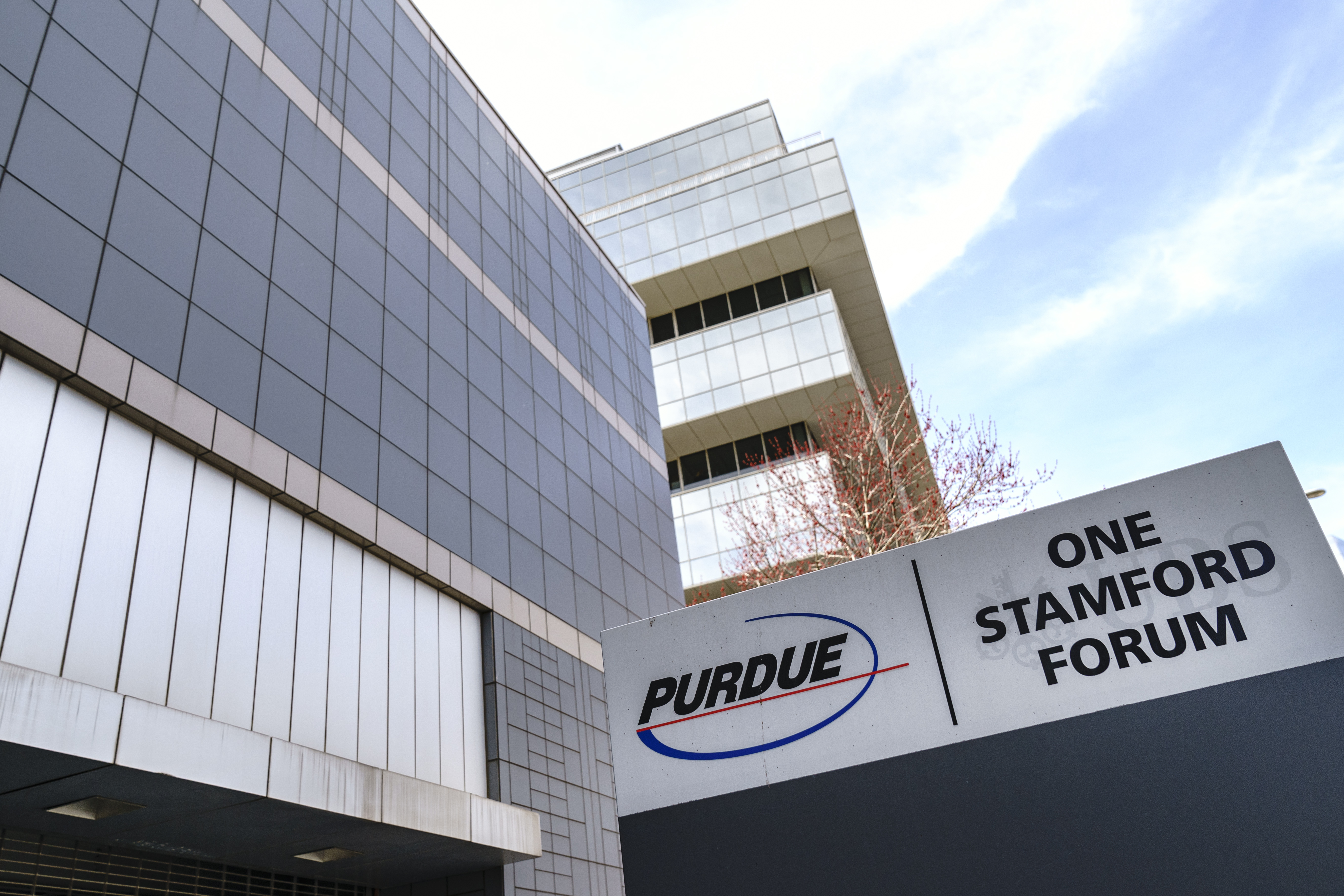

2. Purdue Pharma unveils $10 billion settlement plan

OxyContin maker Purdue Pharma on Monday proposed a $10 billion plan to emerge from bankruptcy and settle lawsuits over its role in the opioid crisis. Steve Miller, chairman of Purdue's Board of Directors, said in a statement that the "historic plan" would have a "profoundly positive impact" on public health by funneling profits to people and communities affected by the crisis. The proposal seeks to settle more than 2,900 lawsuits from state and local governments, Native American tribes, and hospitals. Most of the parties are on board, but attorneys general representing 23 states and the District of Columbia issued a statement saying the offer "falls short." They say the Sackler family that owns the company became billionaires by fueling the epidemic and should cough up more than the $4 billion it would pay under the proposal.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. Germany, Italy, France, Spain suspend use of AstraZeneca vaccine

Germany, Italy, France, and Spain on Monday became the latest European countries to suspend the use of AstraZeneca's coronavirus vaccine over concerns that it could be tied to recent deaths from blood clots. Denmark last week became the first country in the region to halt the shots. It was followed by Ireland, Norway, the Netherlands, and Iceland. The governments announcing the precautions said they were awaiting a determination by Europe's drug regulator on whether the blood-clotting problems were connected to the vaccine. The pauses marked the latest setback for Europe's vaccination campaign. AstraZeneca said the handful of severe clotting issues among the 17 million people inoculated with its COVID-19 vaccine was lower than would be expected in the general population.

4. Fed expected to keep policies firm as economy picks up

Federal Reserve policy makers start a two-day meeting on Tuesday that is expected to conclude it's too soon to change their plans to keep interest rates near zero and continue purchasing bonds to help the economy recover from the damage of the coronavirus pandemic. Fed Chair Jerome Powell has said recently that "substantial further progress" is needed before the recovery is solid enough to change policies. The Fed doesn't plan to raise its target short-term interest rates until the economy has reached its goals of maximum employment and 2 percent inflation. Most Fed officials in December favored keeping interest rates near zero through 2023, but with economists raising growth forecasts for this year and next, investors will be looking for signs the Fed might raise rates sooner.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. News Corp. reaches Australia content deal with Facebook

Rupert Murdoch's News Corp. and Facebook announced a content deal covering Australia on Tuesday, signaling progress toward settling a dispute that forced Facebook to shut down pages with media content in the country for a week. News Corp. is the first major news outlet to reach a deal with Facebook since Australia adopted laws requiring social media companies to agree to payments to news companies for content posted to their sites, or pay fees set by a government-appointed arbitrator. News Corp. owns two-thirds of Australia's metropolitan newspapers, and it was one of the media companies that called for Facebook and Alphabet's Google to pay for media links that bring them users and ad money. News Corp. CEO Robert Thomson called the agreement "a landmark in transforming the terms of trade for journalism."

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

Earth is rapidly approaching a ‘hothouse’ trajectory of warming

Earth is rapidly approaching a ‘hothouse’ trajectory of warmingThe explainer It may become impossible to fix

-

Epstein files topple law CEO, roil UK government

Epstein files topple law CEO, roil UK governmentSpeed Read Peter Mandelson, Britain’s former ambassador to the US, is caught up in the scandal

-

Iran and US prepare to meet after skirmishes

Iran and US prepare to meet after skirmishesSpeed Read The incident comes amid heightened tensions in the Middle East

-

Israel retrieves final hostage’s body from Gaza

Israel retrieves final hostage’s body from GazaSpeed Read The 24-year-old police officer was killed during the initial Hamas attack

-

China’s Xi targets top general in growing purge

China’s Xi targets top general in growing purgeSpeed Read Zhang Youxia is being investigated over ‘grave violations’ of the law

-

Panama and Canada are negotiating over a crucial copper mine

Panama and Canada are negotiating over a crucial copper mineIn the Spotlight Panama is set to make a final decision on the mine this summer

-

Why Greenland’s natural resources are nearly impossible to mine

Why Greenland’s natural resources are nearly impossible to mineThe Explainer The country’s natural landscape makes the task extremely difficult

-

Iran cuts internet as protests escalate

Iran cuts internet as protests escalateSpeed Reada Government buildings across the country have been set on fire

-

US nabs ‘shadow’ tanker claimed by Russia

US nabs ‘shadow’ tanker claimed by RussiaSpeed Read The ship was one of two vessels seized by the US military