Rouble rebounds as Russia sells foreign exchange

Analysts fear effect will be temporary after a wild ride for the rouble forces Apple to halt Russian sales

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Russian attempts to stabilise the rouble have brought some relief after a turbulent 24 hours in which the currency hit record lows against the dollar.

The finance ministry announced this morning that it would start selling off foreign currency reserves in order to boost the value of the rouble. The immediate effect was a 5 per cent rise against the dollar, but some of those early gains have since slipped away.

The decision to raise interest rates from 10.5 per cent to 17 per cent yesterday led to wild fluctuations in the value of the rouble. At one point it was trading at 58 to the dollar, before plunging in value to 80 to the dollar and then coming back to 72.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

After the finance ministry's intervention this morning, the rouble reached 66.12, a gain of 8 per cent. By 10.30am GMT it had lost about a third of those gains.

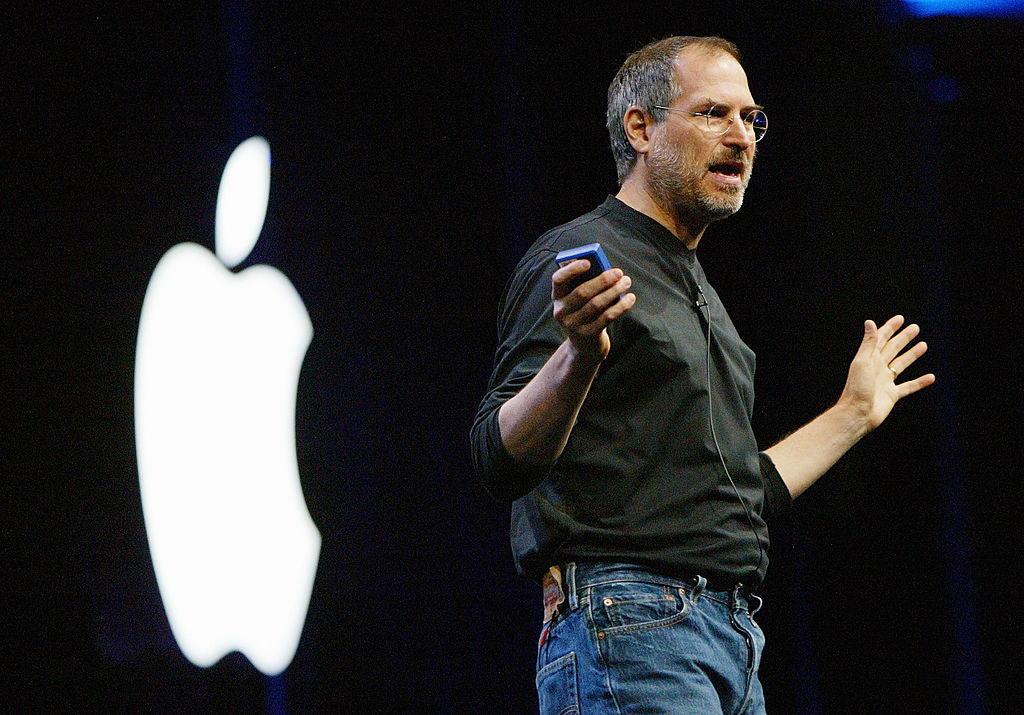

Apple has stopped selling goods in Russia, saying that currency fluctuations were preventing it from setting a price in roubles, the BBC reports.

Commentators have said that Russia may be forced to make further economic interventions if the interest rate hike and currency sale does not have the desired effect.

"Traders and analysts fear the Kremlin may respond to the rouble’s collapse by implementing some form of capital controls — an option that policy makers in Moscow have been discussing, albeit theoretically, for some time," the Financial Times reports.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The Russian prime minister, Dmitri Medvedev, said this morning that the rouble must be brought under control. But he insisted that "tough regulation of currency markets" would not be needed, according to the Russian Interfax news agency.

Rouble nears all-time low despite surprise rate hike

16 December

The rouble fell dramatically this morning in early trading, despite a surprise announcement from the Russian central bank that it had raised interest rates to 17 per cent to try to resuscitate the country's ailing economy.

The Russian currency slipped close to an all-time low against the dollar today after the central bank hiked interest rates by 6.5 percentage points – the biggest rise since 1998, when interest rates rocketed and the government defaulted on its debts.

Falling oil prices and Western sanctions have caused the rouble to lose 50 per cent of its value against the dollar this year, the BBC reports.

As the rouble began to fall again, some economists expressed doubt over whether the Russian economy will be able to sustain the newly raised interest rates for long.

"This move symbolises the surrender of economic growth for the sake of preserving the financial system," Ian Hague, a founding partner at New York-based equity investment firm Firebird Management LLC told Bloomberg. But he added: "it's the right move to make, and it wasn't easy to make it."

The Russian central bank's previous attempt to stabilise the rouble by raising its base rate by one per cent were "like a doctor giving a seriously ill patient a headache tablet", the BBC's Moscow correspondent Steve Rosenberg said. But with today's interest rates rise, the bank has "reached for the defibrillator".

In the short term the measure may cause some discomfort, but it is better than the alternative, says Piotr Matys, a currency strategist at Rabobank International in London.

"While such drastic tightening measures will inflict more pain on the economy, we have been arguing for a while that it is not about preventing recession, but full-scale financial turmoil caused by the precipitous rouble fall," Matys said.

But with oil prices at their lowest levels in five and a half years, the outlook for the Russian economy remains bleak. Last week, the World Bank predicted that Russia's economy would contract by at least 0.7 per cent next year if oil prices did not rebound significantly.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

Apple in first union contract with retail employees

Apple in first union contract with retail employeesSpeed Read The deal with employees at the Towson, Maryland, store marks the first labor agreement for any US Apple employees

-

How might the Israel-Hamas war affect the global economy?

How might the Israel-Hamas war affect the global economy?Today's Big Question Regional escalation could send oil prices and inflation sky-high, sparking a worldwide recession

-

Recent mega-mergers could signal a turning point for the US oil industry

Recent mega-mergers could signal a turning point for the US oil industryTalking Point Both Chevron and Exxon have recently spent billions to acquire smaller oil companies

-

Has Saudi Arabia lost control of oil prices?

Has Saudi Arabia lost control of oil prices?Today's Big Question Kingdom goes it alone to cut production, risking tension with US and reigniting cooling inflation in Europe

-

Surviving mid-career job loss

Surviving mid-career job lossfeature And more of the week's best financial insight

-

Troubled union: Apple's China problem

Troubled union: Apple's China problemfeature How will Apple branch away from building products in China?

-

Elon Musk claims Apple threatened to remove Twitter from the App Store

Elon Musk claims Apple threatened to remove Twitter from the App StoreSpeed Read

-

Steve Jobs' used Birkenstocks sell at auction for $218,000

Steve Jobs' used Birkenstocks sell at auction for $218,000Speed Read