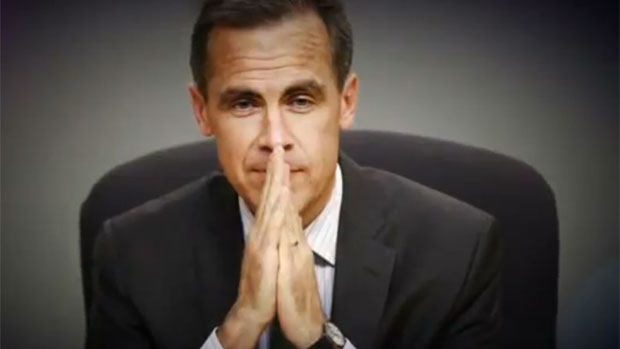

Five suggestions for Mark Carney on first day at BoE

Can the 'rock star' Canadian overcome bank's 'stodgy' culture and revitalise the UK economy?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

MARK CARNEY begins his new job as Bank of England governor today and there's no shortage of people offering advice to the 'rock star banker'. But what challenges will the 48-year-old Canadian face as he settles in behind his new desk in Threadneedle Street? He has to get used to the BoE's way of doing things. Carney would have realised he has entered a different world the moment he was ushered past the bank's doormen, who wear top hats and pink jackets. The BoE can appear to outsiders a "rather stuffy, old-school institution", says the BBC. David Blanchflower, a former member of the bank's Monetary Policy Committee (MPC), describes the atmosphere as "stodgy" and says unwritten rules such as not removing your jacket at meetings unless the governor does so will be alien to Carney. "Whether he adapts to the Bank's culture or it adapts to him will be important. No doubt a balance will be struck, but Blanchflower believes the new governor will have to draft in his own people and 'start cracking heads'," the BBC adds.

- See The Business for The Week's daily news round-up

He has to hit the ground running. The former Bank of Canada governor will be "thrust straight into the policy maelstrom", says The Independent. This morning he'll attend a pre-briefing for the MPC – the body that sets interest rates – before chairing a full meeting on Wednesday. He'll have to overcome some opposition. Carney is believed to favour more quantitative easing to help the UK economy reach the "escape velocity" that will allow it to shake off the financial crisis for good. In his old job, that would have been his call alone. But as head of the BoE he has to persuade the nine-member MPC to follow his lead. Six of them are currently blocking more QE because they fear it will cause inflation to rise, so Carney's "powers of persuasion will be put to the test", Patricia Croft, former chief economist at the Royal Bank of Canada, told The Guardian. He'll have to filter the deluge of advice. Everyone has an opinion on what the new governor should do. Yesterday the British Chamber of Commerce urged him to support an investment bank with central bank funds. The New Economics Foundation wants him to set up an offshoot of the MPC to consider direct investment in housebuilding through the bond market. Croft believes he'll make his own decisions, adding: "I have no doubt Carney will succeed if the UK lets him." He'll need to get results sooner rather than later. When chancellor George Osborne called Carney the "outstanding central banker of his generation" he cast the Canadian as the saviour of the UK economy. The big question is: can he deliver? Opinion is divided on this issue. No one doubts Carney's abilities, but the size, complexity and unbalanced state of the British economy presents a far greater challenge than the new governor faced in his homeland. Writing in The Guardian, Philip Inman asks: "Will Carney match his undoubted finance skills with a magician's ability to turn rabbits into doves, or will the former Goldman Sachs banker find himself, like the Wizard of Oz, furiously pulling levers to no great effect?"

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

-

The world’s most romantic hotels

The world’s most romantic hotelsThe Week Recommends Treetop hideaways, secluded villas and a woodland cabin – perfect settings for Valentine’s Day

-

Democrats push for ICE accountability

Democrats push for ICE accountabilityFeature U.S. citizens shot and violently detained by immigration agents testify at Capitol Hill hearing

-

The price of sporting glory

The price of sporting gloryFeature The Milan-Cortina Winter Olympics kicked off this week. Will Italy regret playing host?

-

The end for central bank independence?

The end for central bank independence?The Explainer Trump’s war on the US Federal Reserve comes at a moment of global weakening in central bank authority

-

Should Labour break manifesto pledge and raise taxes?

Should Labour break manifesto pledge and raise taxes?Today's Big Question There are ‘powerful’ fiscal arguments for an income tax rise but it could mean ‘game over’ for the government

-

What are stablecoins, and why is the government so interested in them?

What are stablecoins, and why is the government so interested in them?The Explainer With the government backing calls for the regulation of certain cryptocurrencies, are stablecoins the future?

-

Will the UK economy bounce back in 2024?

Will the UK economy bounce back in 2024?Today's Big Question Fears of recession follow warning that the West is 'sleepwalking into economic catastrophe'

-

Interest rates rise to 5.25% for first time in 15 years

Interest rates rise to 5.25% for first time in 15 yearsSpeed Read Inflation is slowing but at 7.9% it remains well above the Bank of England’s 2% target

-

Five options to get the UK back to 2% inflation

Five options to get the UK back to 2% inflationfeature Some economists believe alternatives to raising interest rates are in the country’s best interests

-

Why aren’t soaring interest rates bringing down inflation?

Why aren’t soaring interest rates bringing down inflation?Today's Big Question PM pins blame for stubborn inflation on fixed-rate mortgages, but economists say the picture is more nuanced

-

Sticky inflation and sluggish growth: why does UK economy continue to struggle?

Sticky inflation and sluggish growth: why does UK economy continue to struggle?Today's Big Question Food prices, Brexit and the Bank of England have been blamed for poor economic performance