Cybertruck: A rough road ahead for Tesla's big bet

Elon Musk worries high interest rates will affect sales

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The smartest insight and analysis, from all perspectives, rounded up from around the web:

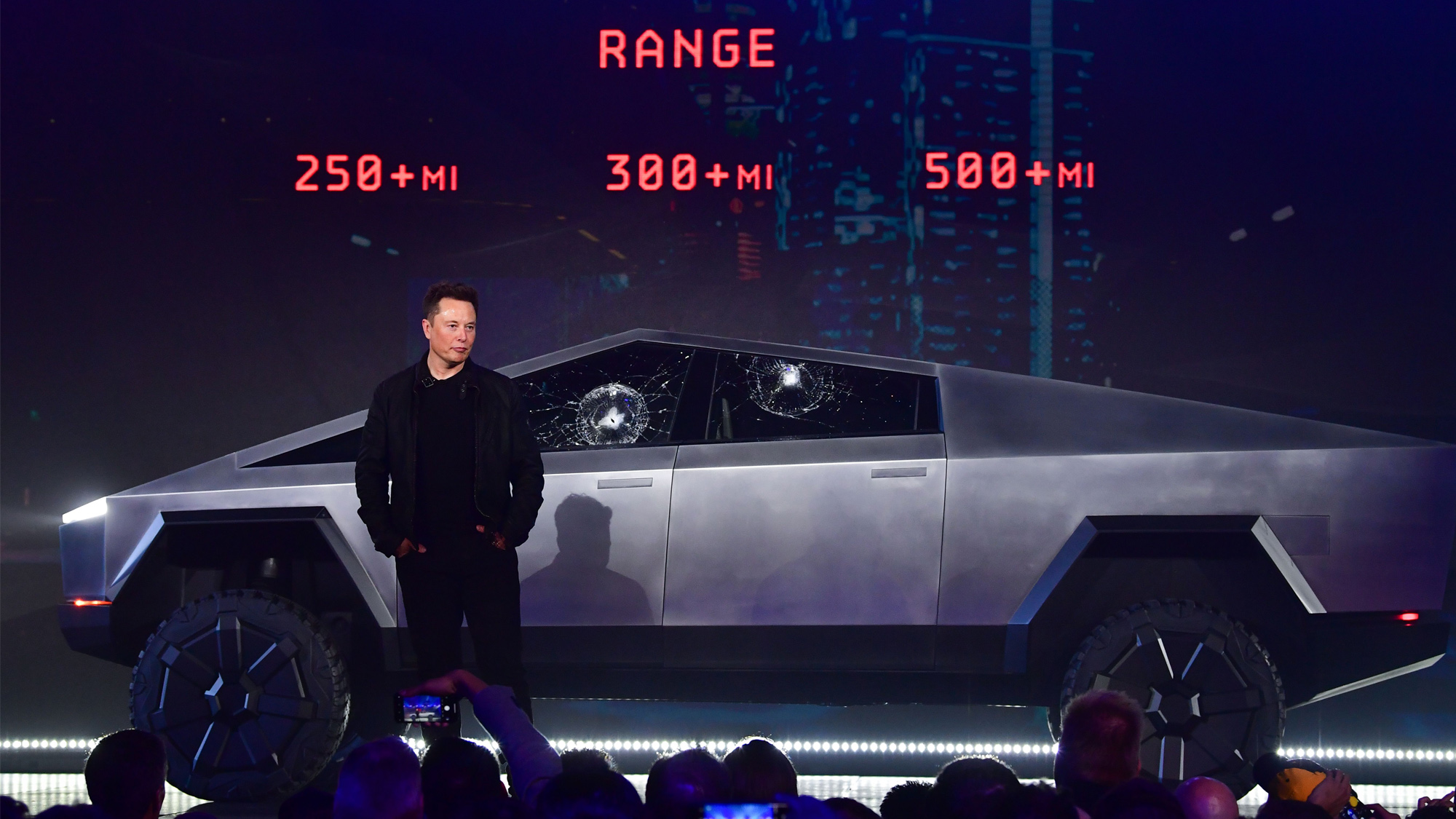

For once, America's most outspoken mogul is trying to lower expectations, said Therese Poletti in MarketWatch. On a Tesla conference call with investors last week, Elon Musk, the usually bombastic chief, brooded about high interest rates, Tesla's earnings slide, and production snags for the company's long-awaited Cybertruck. Musk said the inaugural deliveries for the odd-looking electric pickup are scheduled for Nov. 30, but warned that scale production wouldn't come until 2025. "We dug our own grave for Cybertruck," Musk griped, referring to the setbacks that have haunted the concept since it was unveiled in 2019. "Not only was Musk cautious about the Cybertruck's timing, he also said he was worried about the effect higher interest rates" would have on sales. Maybe Musk, for once, was heeding advice to avoid making overzealous predictions to Wall Street, but his worries about the economy appeared real.

Musk can't help but be worried after Tesla's "stunningly bad" quarterly numbers, said Shawn Tully in Fortune. After the electric-vehicle maker "posted its lowest quarterly earnings per share in two years," the company is now "only modestly profitable and getting less so." Musk always hyped the idea that Tesla would "achieve the profitability not of a heavy manufacturer, but of an Apple or Oracle." But Tesla is now looking more like an ordinary carmaker. Tesla's price cuts this year have not produced a corresponding jump in sales, said Liam Denning in Bloomberg. Ford and General Motors are also extending their timelines on electrifying trucks; after a loud rollout of the electric F-150 Lightning, Ford is now pushing hybrids. It's time to ask if "electrification’s momentum has stalled." Tesla is no ordinary stock and investors usually buy "the promise of whatever's next." However, "if the growth story is in doubt, the stock will need a lot more than a new truck."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

There's no need to panic, said Jonathan Guilford at Reuters. Let's not forget that "Tesla's competitors keep losing money on every electric car they sell," while Tesla still holds nearly half the market share in the U.S. for EVs and most of the country's charging stations. Musk's revised car designs for cheaper production should also preserve Tesla's sizable lead. And Musk may have more cards up his sleeve, said Stephen Wilmot in The Wall Street Journal. Tesla's expenses for AI and other R&D projects are way up, suggesting something is afoot. "In a flash of his old optimism, Musk said driverless cars and humanoid robots" still held the potential to make Tesla "the most valuable company in the world by far."

The economy still has to cooperate, said Theron Mohamed in Business Insider. "Like a car mechanic," Musk "ticked off a long list of concerns," noting that many American households appear to be "just scraping by as higher prices and steeper interest rates on credit cards, mortgages and car loans squeeze their monthly budgets." The anxiety caused by the Russia-Ukraine and Israel-Hamas conflicts is a global headwind, too. "If the macroeconomic conditions are stormy," Musk said, "even the best ship is going to have tough times."

This article was first published in the latest issue of The Week magazine. If you want to read more like it, you can try six risk-free issues of the magazine here.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Local elections 2026: where are they and who is expected to win?

Local elections 2026: where are they and who is expected to win?The Explainer Labour is braced for heavy losses and U-turn on postponing some council elections hasn’t helped the party’s prospects

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

Currencies: Why Trump wants a weak dollar

Currencies: Why Trump wants a weak dollarFeature The dollar has fallen 12% since Trump took office

-

Elon Musk’s starry mega-merger

Elon Musk’s starry mega-mergerTalking Point SpaceX founder is promising investors a rocket trip to the future – and a sprawling conglomerate to boot

-

TikTok: New owners, same risks

TikTok: New owners, same risksFeature What are Larry Ellison’s plans for TikTok US?

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history

-

Leadership: A conspicuous silence from CEOs

Leadership: A conspicuous silence from CEOsFeature CEOs were more vocal during Trump’s first term

-

Ryanair/SpaceX: could Musk really buy the airline?

Ryanair/SpaceX: could Musk really buy the airline?Talking Point Irish budget carrier has become embroiled in unlikely feud with the world’s wealthiest man

-

Powell: The Fed’s last hope?

Powell: The Fed’s last hope?Feature Federal Reserve Chairman Jerome Powell fights back against President Trump's claims

-

Taxes: It’s California vs. the billionaires

Taxes: It’s California vs. the billionairesFeature Larry Page and Peter Thiel may take their wealth elsewhere