How to make money in 2023: top tips for keeping financial resolutions

From pension improvements to portfolio advice, experts share insights on how to have a prosperous 2023

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

As we enter a new year, money is front of mind for many: more than a third of us will make a financial resolution in 2023, according to Hargreaves Lansdown.

“In the wake of horrendous price hikes and the subsequent financial carnage of 2022, unsurprisingly an awful lot of us are keen to get back on track financially in the new year,” Sarah Coles, a personal finance analyst for the investment platform, told ThisIsMoney.co.uk.

Whether you’re hoping to save more, spend less, put money aside to help loved ones, or all of the above, here are some ways to make it a happy new year for your wallet.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Set a savings goal

Naming your money targets, “such as a new home, a specific trip, or big purchase”, will help you reach those goals faster, Annabelle Williams, personal finance specialist for investment firm Nutmeg, told The Guardian.

Next, you want to make a habit of saving money. One way to do this is with a standing order from your current account into a savings account, the newspaper said. “These accounts offer some of the best interest rates out there, although the maximum you can tuck away often isn’t that high.”

For medium- to long-term savings goals, “consider investments such as shares, bonds, or funds that tend to provide protection from inflation”, said MoneyHelper.

It may even be worth trying a savings challenge such as the 50/30/20 budgeting rule to kickstart your habit.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

As your savings stack up, pay off any expensive debts such as credit cards first, as the interest charged will likely be more than what you can earn in a savings account, said The Times.

Savings offers from our financial partners

- İşbank, 4.75% AER on up to £85,000, fixed for one year. No withdrawals allowed during fixed term. Interest paid after 12 months

- Starling Bank, 3.25% AER on £2,000 to £1m, fixed for one year. No withdrawals allowed during fixed term. Interest paid after 12 months

- Brown Shipley, 3.5% AER on £1,000 to £85,000, easy access. Withdrawals and deposits allowed (minimum transaction £500 and balance must remain between £1,000 to £85,000)

- First Direct, 7% on up to £300 per month, fixed for one year, paid after one year. Making a withdrawal will result in less interest being paid. Must also open a First Direct current account (new customers qualify for £175 switching bonus).

Interest rates retrieved on 17 May 2023. When you apply via links on our site, we may earn an affiliate commission

Reassess your investment portfolio

The continuing pressures of higher inflation, rising interest rates, and political and economic tensions will affect investors’ portfolios this year, said IFA Magazine.

It may be worth investing in companies whose products will continue to sell even in a deep recession. “Think toiletries, pharmaceuticals and energy”, said The Telegraph.

Companies that regularly make payments to investors, known as dividends, can provide a welcome source of passive income during a cost-of-living crisis, “particularly for those in retirement who are no longer working and are able to tolerate less volatility than younger investors”, the newspaper added.

Consider companies with an international slant, Jason Hollands, managing director of wealth manager Bestinvest, told Forbes. Avoid investing in sectors “sensitive to UK domestic consumption”, including stocks “in the retail, hospitality and travel sectors”, added Hollands.

The golden rule is to not panic and sell your investments, said MoneyWeek. “There’s a good chance that any falls [in 2023] will just be a blip in your portfolio’s history,” the financial website said.

It advises staying cool if your investing horizon is more than five years, and ensuring your portfolio is diversified.

Sort your pensions

Employees over 22 years old are automatically enrolled into a pension when joining a company. If you have had many jobs over your career, you may have lots of pension pots. Now is a good time to take stock of what is in them.

“Knowing how much you have saved in total will help you work out how much you might need to save in the future to enjoy the retirement you want”, Laura Suter, head of personal finance for AJ Bell, told the Daily Express.

You may be able to find details of your previous pensions by contacting your old employers or using the government’s free Pension Tracing Service.

Once you have located any old funds, consider combining them with your current workplace pension or moving them to a self-invested personal pension you can manage online.

“This will make your pension easier to monitor and manage, but also means you could benefit from lower charges, greater investment choice and more flexibility when you decide to access your fund,” said Suter.

Get ready for tax changes

From April 2023 the earning threshold at which people pay the 45% additional rate of income tax will be lowered from £150,000 to £125,140. This means 250,000 more workers will pay tax at the highest rate, explained Which?.

Capital gains tax and dividend allowances are also being reduced to £6,000 and £1,000, respectively. One way taxpayers can reduce their income tax is to pay more into a pension, said the Financial Times.

Make sure you also take advantage of tax-free allowances on your savings and investments. Keep in mind you can earn up to £1,000 from interest on savings each year – dropping to £500 for higher-rate taxpayers – using the personal savings allowance.

You can also put up to £20,000 into an ISA to earn returns on cash or savings tax-free.

“If you haven’t used your full ISA allowance, and have some spare cash in the days running up to 5 April, it may be sensible to pay it into your ISA, before the 2023/24 tax year begins with a brand-new £20,000 allowance,” said The Money Edit.

Be honest about debt

You can try many tips and tricks for improving your finances, but at the end of the day, “waving a magic money-saving wand” isn’t enough, said MoneySavingExpert. You ultimately need to be honest about whether you’re spending more than you earn.

The “big danger signal” to watch out for is debt that you can’t explain, and that’s got out of control.

“Debt is fine if it is planned, rational, budgeted for, and as cheap as possible,” the financial planning website said. “But if you consistently need to use the credit cards to supplement your monthly spend, you have a problem.”

You should assess your income and expenses using a budget calculator to see if you are spending more than you earn, where you are wasting money, and how you can make changes.

Marc Shoffman is an award-winning freelance journalist, specialising in business, property and personal finance. He has a master’s degree in financial journalism from City University and has previously worked for the FT’s Financial Adviser, the financial podcast In For a Penny and MoneyWeek.

Marc Shoffman is an NCTJ-qualified award-winning freelance journalist, specialising in business, property and personal finance. He has a BA in multimedia journalism from Bournemouth University and a master’s in financial journalism from City University, London. His career began at FT Business trade publication Financial Adviser, during the 2008 banking crash. In 2013, he moved to MailOnline’s personal finance section This is Money, where he covered topics ranging from mortgages and pensions to investments and even a bit of Bitcoin. Since going freelance in 2016, his work has appeared in MoneyWeek, The Times, The Mail on Sunday and on the i news site.

-

Ex-South Korean leader gets life sentence for insurrection

Ex-South Korean leader gets life sentence for insurrectionSpeed Read South Korean President Yoon Suk Yeol was sentenced to life in prison over his declaration of martial law in 2024

-

At least 8 dead in California’s deadliest avalanche

At least 8 dead in California’s deadliest avalancheSpeed Read The avalanche near Lake Tahoe was the deadliest in modern California history and the worst in the US since 1981

-

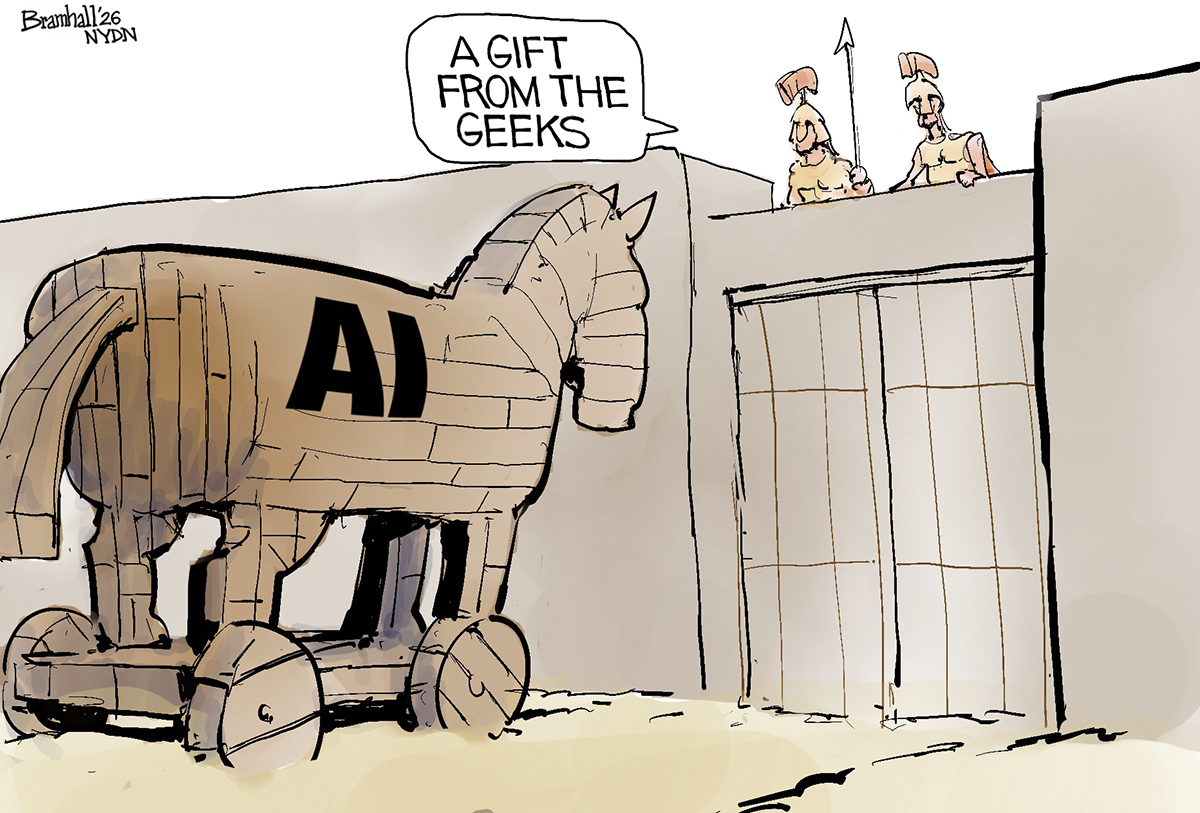

Political cartoons for February 19

Political cartoons for February 19Cartoons Thursday’s political cartoons include a suspicious package, a piece of the cake, and more

-

What to expect financially before getting a pet

What to expect financially before getting a petthe explainer Be responsible for both your furry friend and your wallet

-

What to know before filing your own taxes for the first time

What to know before filing your own taxes for the first timethe explainer Tackle this financial milestone with confidence

-

What are the best investments for beginners?

What are the best investments for beginners?The Explainer Stocks and ETFs and bonds, oh my

-

What’s a good credit card APR?

What’s a good credit card APR?The Explainer They have gotten even steeper in recent years

-

How to juggle saving and paying off debt

How to juggle saving and paying off debtthe explainer Putting money aside while also considering what you owe to others can be a tricky balancing act

-

Filing statuses: What they are and how to choose one for your taxes

Filing statuses: What they are and how to choose one for your taxesThe Explainer Your status will determine how much you pay, plus the tax credits and deductions you can claim

-

The pros and cons of tapping your 401(k) for a down payment

The pros and cons of tapping your 401(k) for a down paymentpros and cons Does it make good financial sense to raid your retirement for a home purchase?

-

3 tips to help protect older family members from financial scams

3 tips to help protect older family members from financial scamsthe explainer Prevent your aging relatives from losing their hard-earned money