Why you should consider switching savings accounts

Savers who remain loyal to their banks are rarely rewarded

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

While banks and building societies are being urged to offer better savings rates, customers can take steps now to boost the returns on their cash.

Interest rates have been rising since December 2021, yet nine of the biggest savings providers only passed through 28% of the base rate rise, on average, to their easy access accounts up to May 2023, according to the Financial Conduct Authority (FCA).

The City watchdog has given these firms until the end of August to explain how their rates offer “fair value” under its new Consumer Duty rules.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But rather than waiting, customers could benefit immediately by taking control of their cash and switching bank accounts.

Get a higher return

While not all providers are passing on rate rises to their savings customers, banks are now offering “the best interest rates” in years, said This is Money. Yet many consumers are still “sticking with the bank they know and trust” even if their rate is poor.

MoneyWeek blamed inertia for causing “far too many people” to leave their cash in accounts paying “little or no interest”. But opening an account “can take a matter of minutes”, and switching is also “simple” using the government-backed Current Account Switching Service.

Average one- and two-year fixed rate savings products are now at around 5% for the first time since 2008. And savers can get easy access accounts with rates of around 4.6%, according to data from Moneyfactscompare.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Meanwhile, many other providers “continue to rip off savers”, said savings expert Sylvia Morris on This is Money, with “derisory” interest rates as low as 0.1%. So shop around and take action if “loyalty is costing you”, she advised.

Earn cashback

As well as getting better interest rates, savers could earn free money just by switching savings account.

Banks such as TSB, First Direct and NatWest have offered up to £200 “free cash for your custom”, said MoneySavingExpert. All you have to do is move your savings or current account to them.

Check the eligibility criteria though, advised The Times Money Mentor, as cash incentives are “often” reserved for new customers. Most are time-limited too, “so get your skates on for the best deals”.

Gain account perks

Some current accounts, such as Santander’s 123 product, offer long-term rewards including cashback on bills. However, these accounts often come with a fee, warned MoneySavingExpert, “so work out whether the cashback will outweigh this”.

There are also packaged accounts that offer extras such as travel insurance or breakdown cover for a monthly fee. But bear in mind that these accounts “are only worth having if you make the most of the benefits and services you’re paying for”, said Yahoo! Finance.

Other factors to consider

Cash and extra interest are enticing incentives to switch savings accounts, but other factors to consider include the standard of service offered by different providers.

Also factor in the personal savings allowance.

Basic rate taxpayers can earn £1,000 without paying any tax on their savings, dropping to £500 for higher earners. But as savings rates rise, savers could get “caught off guard” and earn interest above the allowance, warned the Financial Times, especially if they are holding large sums in cash.

An alternative option is to make use of premium bonds offered by government-backed bank National Savings & Investments (NS&I). These don’t pay interest but offer savers tax-free cash prizes ranging from £25 to £1m.

The choice, said Investors' Chronicle, may come down to getting “higher guaranteed interest” but seeing these returns taxed, or having tax-free and decent “hypothetical returns” from NS&I while risking the possibility of receiving “nothing whatsoever”.

Marc Shoffman is an NCTJ-qualified award-winning freelance journalist, specialising in business, property and personal finance. He has a BA in multimedia journalism from Bournemouth University and a master’s in financial journalism from City University, London. His career began at FT Business trade publication Financial Adviser, during the 2008 banking crash. In 2013, he moved to MailOnline’s personal finance section This is Money, where he covered topics ranging from mortgages and pensions to investments and even a bit of Bitcoin. Since going freelance in 2016, his work has appeared in MoneyWeek, The Times, The Mail on Sunday and on the i news site.

-

Bad Bunny’s Super Bowl: A win for unity

Bad Bunny’s Super Bowl: A win for unityFeature The global superstar's halftime show was a celebration for everyone to enjoy

-

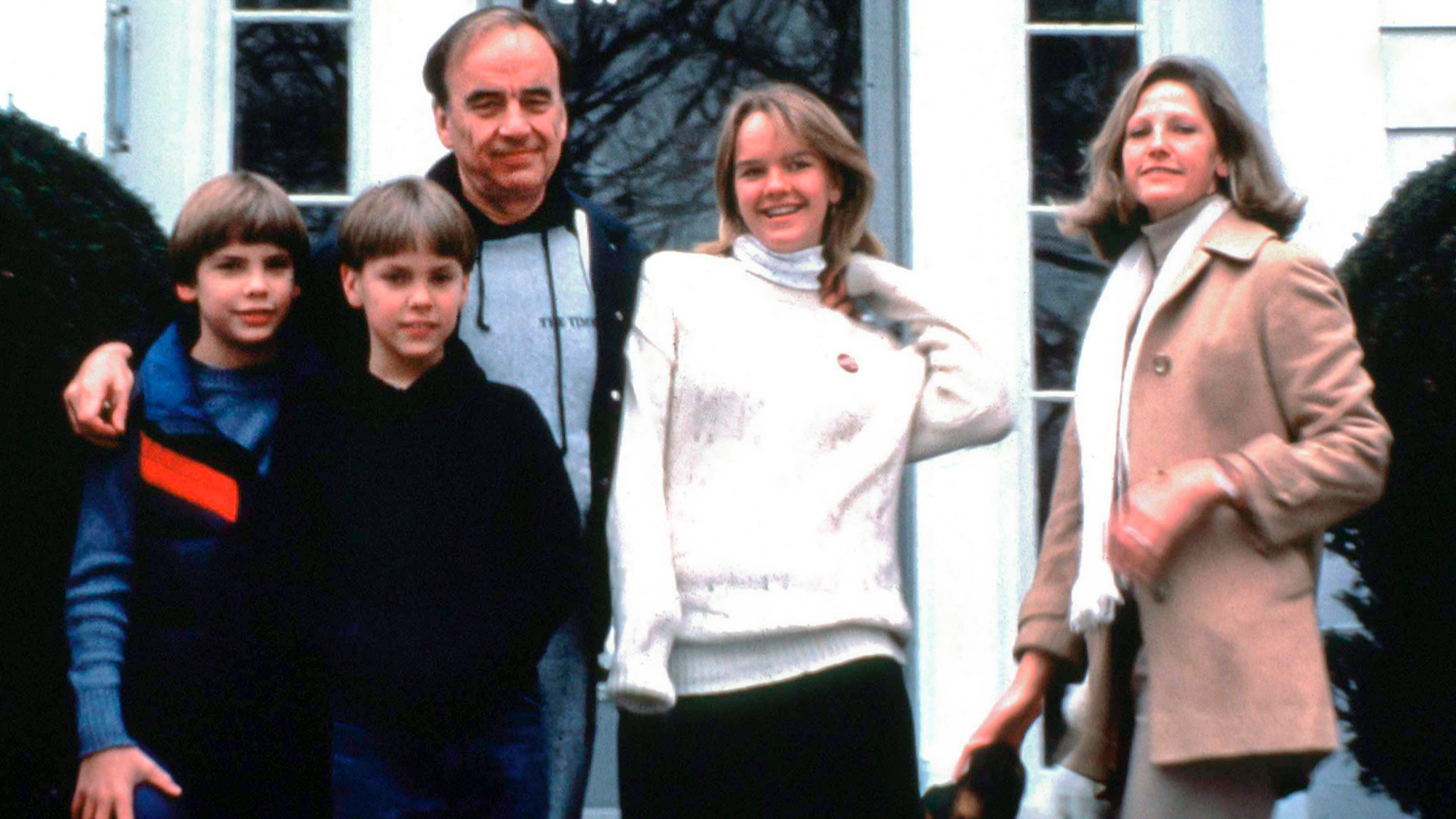

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’Feature New insights into the Murdoch family’s turmoil and a renowned journalist’s time in pre-World War II Paris

-

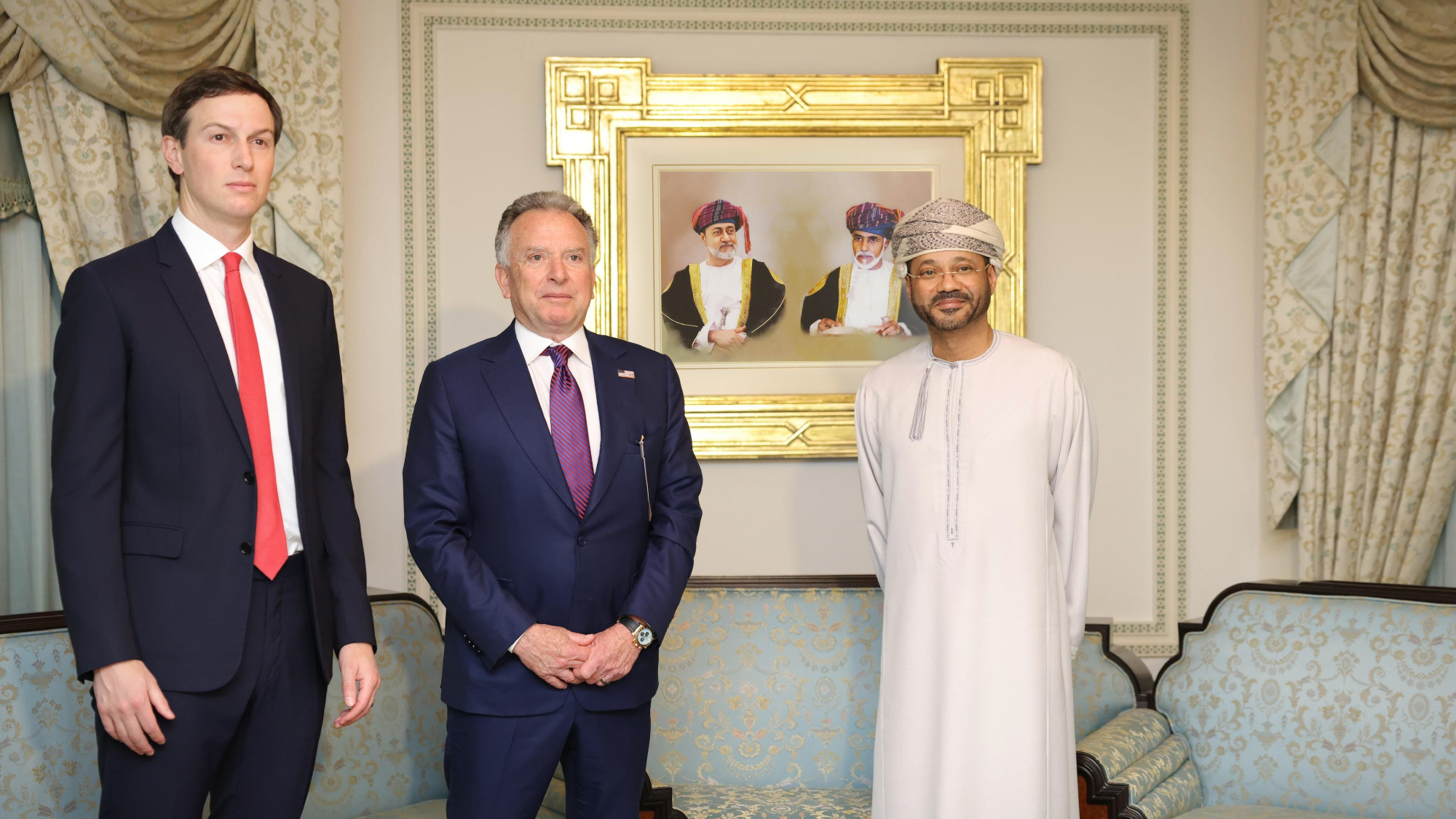

Witkoff and Kushner tackle Ukraine, Iran in Geneva

Witkoff and Kushner tackle Ukraine, Iran in GenevaSpeed Read Steve Witkoff and Jared Kushner held negotiations aimed at securing a nuclear deal with Iran and an end to Russia’s war in Ukraine

-

What to expect financially before getting a pet

What to expect financially before getting a petthe explainer Be responsible for both your furry friend and your wallet

-

How to juggle saving and paying off debt

How to juggle saving and paying off debtthe explainer Putting money aside while also considering what you owe to others can be a tricky balancing act

-

The pros and cons of tapping your 401(k) for a down payment

The pros and cons of tapping your 401(k) for a down paymentpros and cons Does it make good financial sense to raid your retirement for a home purchase?

-

Saving for a down payment on a house? Here is how and where to save.

Saving for a down payment on a house? Here is how and where to save.the explainer The first step of the homebuying process can be one of the hardest

-

What to look for in a reliable budgeting app

What to look for in a reliable budgeting appThe Explainer Choose an app that will earn its place in your financial toolkit

-

Planning a move? Here are the steps to take next.

Planning a move? Here are the steps to take next.the explainer Stay organized and on budget

-

What should you look out for when buying a house?

What should you look out for when buying a house?The Explainer Avoid a case of buyer’s remorse

-

3 smart financial habits to incorporate in 2026

3 smart financial habits to incorporate in 2026the explainer Make your money work for you, instead of the other way around