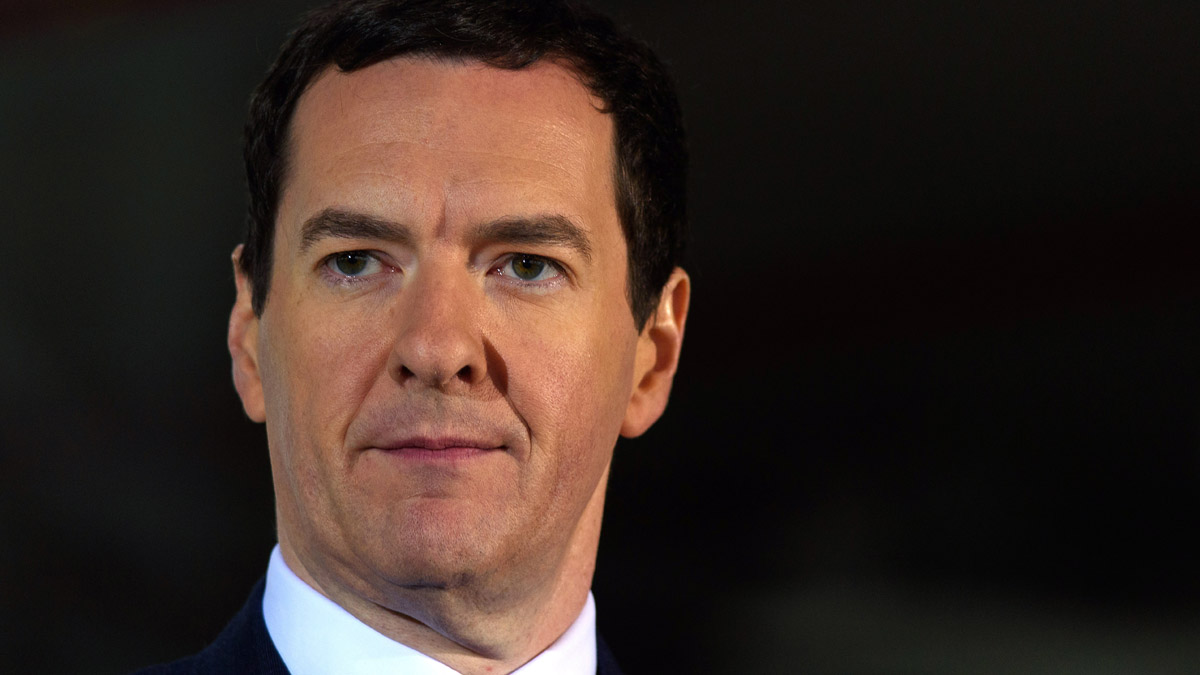

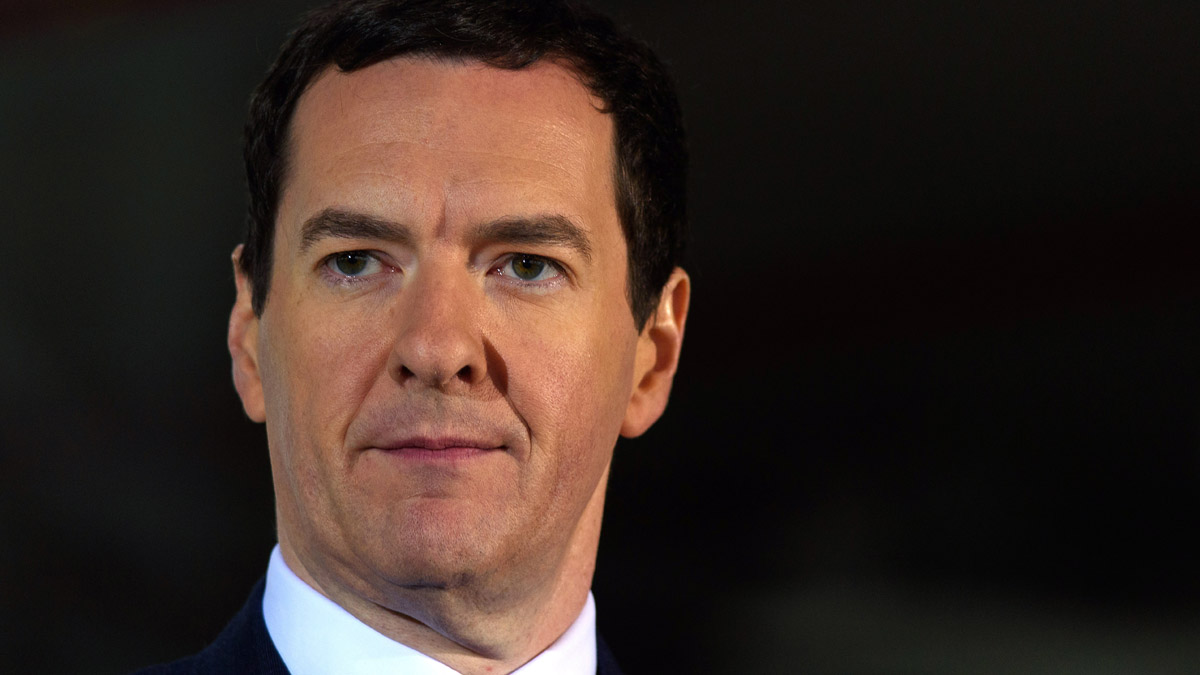

Budget 2014: what we want vs what we'll get from Osborne

The Chancellor might have a surprise up his sleeve but this won't be a Budget full of tax giveaways

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

WESTMINSTER is abuzz with speculation that George Osborne is plotting a “big surprise” in today’s Budget. The Treasury has already revealed a new £1 coin, a hike in childcare subsidies and an extension of the Help to Buy scheme. But with the Chancellor focused on supporting a “resilient” economy, analysts say it is unlikely to be a Budget full of tax giveaways. So what can we expect?

What time is the Budget?

The Chancellor will unveil the government's financial plans for the coming year to Parliament at 12.30pm on 19 March 2014.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

What demands does George Osborne face?

Individuals and organisations have been busy writing their wish lists for this year's announcement. The British Bankers Association wants more measures to encourage saving, while retailers want to see a reform of business rates, reports the BBC. Manufacturers have called for a reduction in energy costs, while the Confederation of British Industry has called for the annual investment allowance, which provides tax relief on new equipment and currently stands at £250,000, to be extended beyond 2015.

Allister Heath, editor of City AM, tells the Daily Telegraph that Osborne should cut air passenger duty and fuel duty, and freeze alcohol taxes. "Stamp duty on shares should be abolished, boosting returns to investors and cutting the cost of capital," he adds. Meanwhile, Londoners are calling for a freeze on utility bills, a cut in VAT and cheaper public transport, according to a survey published in the Evening Standard. Other responses included freezing council tax, introducing a minimum level of interest on savings accounts and capping rent prices.

What has the Treasury said so far?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

In the run-up to the Budget, the Treasury has announced plans to offer up to £2,000 in subsidised childcare to working families after the next general election, a proposed rise in the hourly minimum wage to £6.50 and an extension of the Help to Buy scheme for aspiring homebuyers. Osborne will use his Budget to announce a new 12-sided £1 coin based on the old threepenny bit. He is also expected to pledge £20m for renovations of Britain’s cathedrals ahead of the World War I commemorations.

According to the Daily Telegraph, the corridors of Westminster are “buzzing with speculation that Osborne is plotting a big surprise to fire the starting gun on the Tory election campaign”. Last year, he announced a surprise “penny off a pint” policy. This year, the Telegraph suggests he might reduce the tax rates on bingo halls. “Either way, Osborne will be looking to score another popular hit – as long as its fiscally neutral, of course.”

What is Osborne likely to deliver?

The Chancellor will focus on the country's strengthening growth, say analysts, but this is unlikely to mean a Budget full of tax giveaways, as cutting the budget deficit is still his primary goal.

With just over a year until the next general election, ministers will be aiming to appeal to the "grey vote" by helping pensioners get better value from their savings and retirement funds, predicts City Wire. Economic consultant Capital Economics forecasts a rise in the three per cent stamp duty threshold to £300,000 to help house buyers, as well as further measures to prevent tax avoidance and improve support for unemployed young people.

David Cameron has so far rejected calls from Conservative MPs to cut taxes for the additional 1.1 million middle-income earners who have been dragged into the 40p tax bracket since the threshold was lowered in 2010. The Prime Minister has suggested that any money for tax cuts would instead be focused on raising the 20p basic rate threshold. Osborne has already committed to raising the tax-free personal allowance to at least £10,000 for 2014/15 and to £10,500 from 2015. But, for middle-income earners, the threshold at which the 40p tax is taken will rise by less than the rate of inflation for the second year in a row.

How does government spend our money?

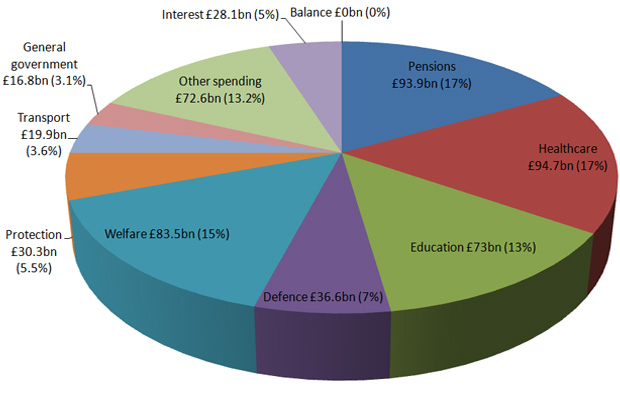

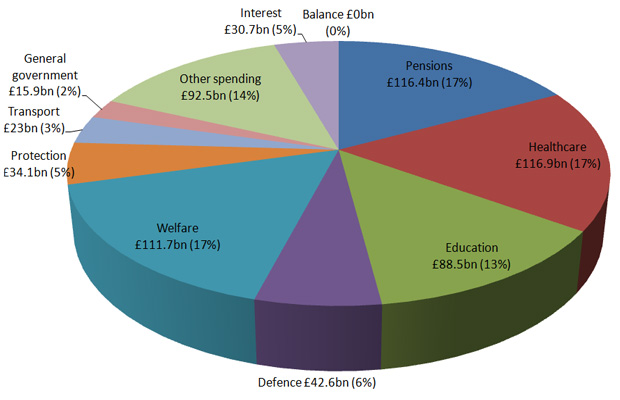

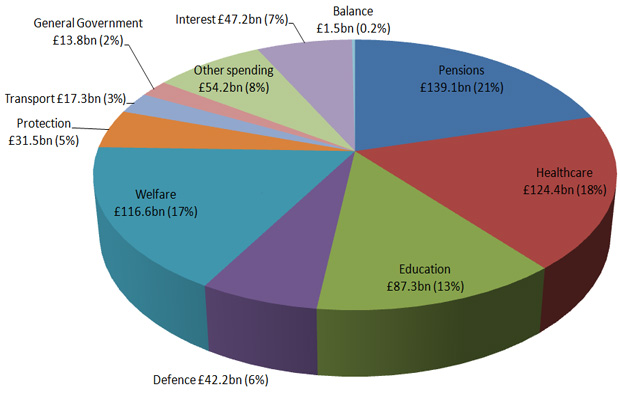

Every year, the government calculates where cuts need to be made within its own departments. Here is how money has been spent in the past few years, according to UK Public Spending. The ‘protection’ category includes police and fire services, prisons and courts, while ‘other spending’ includes areas such as agriculture, energy, environment, arts and housing development.

2006/07 (Total spending: £549.4bn)

2009/10 (Total spending: £672.3bn)

2012/13 (Total spending: £675.1bn)

-

Switzerland could vote to cap its population

Switzerland could vote to cap its populationUnder the Radar Swiss People’s Party proposes referendum on radical anti-immigration measure to limit residents to 10 million

-

Political cartoons for February 15

Political cartoons for February 15Cartoons Sunday's political cartoons include political ventriloquism, Europe in the middle, and more

-

The broken water companies failing England and Wales

The broken water companies failing England and WalesExplainer With rising bills, deteriorating river health and a lack of investment, regulators face an uphill battle to stabilise the industry

-

Do Tory tax cuts herald return of austerity?

Do Tory tax cuts herald return of austerity?Today's Big Question Chancellor U-turns on scrapping top rate tax but urges ministers to make public spending cuts

-

What is the Northern Powerhouse?

What is the Northern Powerhouse?In Depth George Osborne’s think tank was designed to devolve power and boost the North’s economic output

-

Hammond to announce departure from Osborne policies

Hammond to announce departure from Osborne policiesSpeed Read Chancellor to tell Tory conference 'we must change with the times' in move away from predecessor

-

Budget 2016: is George Osborne about to make more cuts?

Budget 2016: is George Osborne about to make more cuts?In Depth Chancellor hints at further austerity measures during interview at G20 meeting in China

-

Budget 2016: 'We should all be worried', warns IFS

Budget 2016: 'We should all be worried', warns IFSIn Depth Leading think-tank criticises economic policies that will 'lower wages and living standards'

-

Budget 2016: Osborne in line for another £20bn+ windfall

Budget 2016: Osborne in line for another £20bn+ windfallSpeed Read Lower debt servicing costs could offset weaker tax revenues as a result of market turmoil

-

UK growth to surge in spite of global turmoil

UK growth to surge in spite of global turmoilSpeed Read Consumer spending will help country remain insulated from global trade headwinds, says forecaster

-

Osborne makes fresh case for austerity in warning over 'cocktail' of risks

Osborne makes fresh case for austerity in warning over 'cocktail' of risksSpeed Read World Bank also sounds alarm over "perfect storm" of worldwide economic problems.