UK growth to surge in spite of global turmoil

Consumer spending will help country remain insulated from global trade headwinds, says forecaster

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Doom and gloom surrounding the UK economy in the face of global upheaval is misplaced as expansion is set to surge in the coming 12 months, according to one respected forecaster.

Accountancy firm Ernst and Young's Item Club said growth would come in ahead of expectations as a result of increased exports and higher consumer spending, which will be boosted further by rising wages and low inflation. It is predicting growth of 2.6 per cent this year, above a recently-downgraded official forecast of 2.4 per cent.

Consumer spending was up last year and accelerated through the final three months as low oil price-led weak inflation and improved wage rises boosted real disposable incomes. E&Y said this trend would gather pace this year due to the introduction of the first phase of the national living wage, which is no longer being offset by the removal of working tax credits.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The analyst added that a weak pound, which last week fell to a five-year low against the dollar and could go lower if the Federal Reserve pushes ahead with rates rises, will boost overseas trade. It reckons exports will surge four per cent in 2016, after disappointing growth in the past couple of years.

"While growth in world trade remains disappointing, as a result of the slowdown in emerging markets, the UK is relatively well protected," Peter Spencer, Item's chief economic advisor, told the Daily Mail. "Our traditional trading markets such as the EU and US have performed better lately and should continue to do so."

The more positive outlook coincides with an upbeat survey in the UK's important financial services sector, the Daily Telegraph adds. Almost half of 100 financial services firms polled by the Confederation of British Industry and accountancy firm PwC said business volumes had increased in the three months to December, while a third expected growth to continue in 2016.

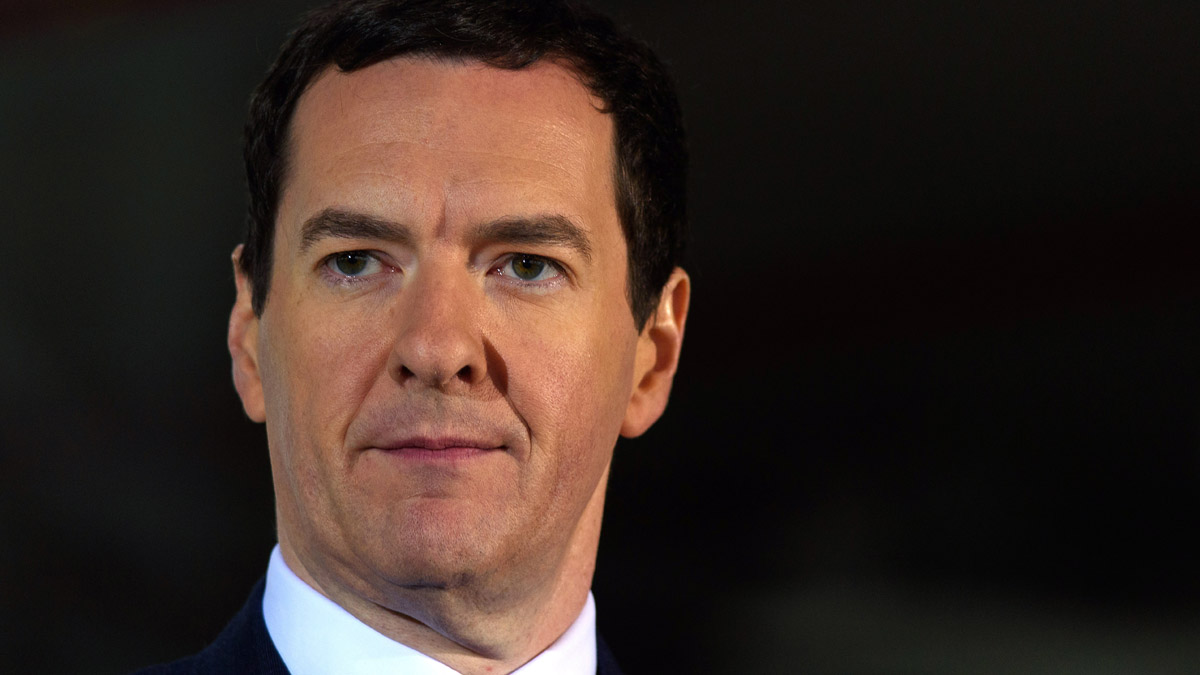

It does, though, follow a spate of warnings from, among others, the Chancellor George Osborne on a "cocktail" of risks, which is prompting turmoil on global stock markets. E&Y says these factors and the impact of austerity will take a toll by the end of the year, with growth slowing to 2.3 per cent in 2017 and 2.2 per cent in 2018.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Local elections 2026: where are they and who is expected to win?

Local elections 2026: where are they and who is expected to win?The Explainer Labour is braced for heavy losses and U-turn on postponing some council elections hasn’t helped the party’s prospects

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

French finances: what’s behind country’s debt problem?

French finances: what’s behind country’s debt problem?The Explainer Political paralysis has led to higher borrowing costs and blocked urgent deficit-reducing reforms to social protection

-

New austerity: can public services take any more cuts?

New austerity: can public services take any more cuts?Today's Big Question Some government departments already 'in last chance saloon', say unions, as Conservative tax-cutting plans 'hang in the balance'

-

Liz Truss and Kwasi Kwarteng’s supply-side reforms

Liz Truss and Kwasi Kwarteng’s supply-side reformsfeature PM and chancellor are banking on cuts to regulations and tax in bid to stimulate growth

-

Do Tory tax cuts herald return of austerity?

Do Tory tax cuts herald return of austerity?Today's Big Question Chancellor U-turns on scrapping top rate tax but urges ministers to make public spending cuts

-

Labour shortages: the ‘most urgent problem’ facing the UK economy right now

Labour shortages: the ‘most urgent problem’ facing the UK economy right nowSpeed Read Britain is currently in the grip of an ‘employment crisis’

-

Will the energy war hurt Europe more than Russia?

Will the energy war hurt Europe more than Russia?Speed Read European Commission proposes a total ban on Russian oil

-

Will Elon Musk manage to take over Twitter?

Will Elon Musk manage to take over Twitter?Speed Read The world’s richest man has launched a hostile takeover bid worth $43bn

-

Shoppers urged not to buy into dodgy Black Friday deals

Shoppers urged not to buy into dodgy Black Friday dealsSpeed Read Consumer watchdog says better prices can be had on most of the so-called bargain offers